Your cart is currently empty!

NetOne has nearly 2 million customers it is not chasing

Welcome to .zedw Roundup – where we bring you interesting insights from different industries condensed into a quick and informative read. Buckle up, because whether you’re a business leader, policy fanatic, or simply curious about the region, this newsletter has something for you. Stay informed, stay engaged, and have a good weekend!

The second half of the year is well and truly underway, and it seems as though startups within Southern Africa will have to pull their socks up if they are looking to attract investment. According to Africa: The Big Deal, the region attracted just US$87mn in funding, 97.7% of which went to South Africa (US$85mn). This lags behind East Africa (US$285mn), West Africa ($270mn) and North Africa (US$115mn) respectively. Central Africa was lagging behind the rest of the regions with only $4mn raised in startup funding during the first half of 2024.

Given that African startups raised an estimated US$2.4 billion in 2023, it seems as though 2024 will miss that mark significantly. What gives? Well loosely the decline has been attributed to “global macroeconomics.” Some have cited rising interest rates in the US as the reason capital is no longer being dished out loosely. Others have pointed to economic crises among the big African startup markets (e.g Egypt and Nigeria). Other still have apportioned the blame to a strengthening US$ which has weakened African currencies and had the domino effect of weakening household incomes on most of the income. All in all there’s plenty of blame to go around, it seems.

Within Southern Africa, below are some of the interesting investments that took place in the first half of the year:

| Startup | Sector | Investment (US$) | Country |

| Carry1st | Gaming | n/a | South Africa |

| OfferZen | Job marketplace | $4.3mn | South Africa |

| Cue | AI | $2mn | South Africa |

| Simera Sense | Manufacturing | $14.8mn | South Africa |

| Hohm Energy | Energy | $8mn | South Africa |

| Spatialedge | AI | $3.1mn | South Africa |

| Float | Fintech | $11mn | South Africa |

| Planet42 | Transport | $15.8mn | South Africa |

Some other interesting facts from the past 6 months of investment activity:

Sign up to our mailing list to get the weekly roundup straight in your inbox

Back in 2021 Tlou Energy, a Botswana Stock Exchange (BSE) listed company, focused on delivering power solutions to Botswana and Southern Africa announced the Lesedi Project after being awarded a 10MW Generation Licence by BERA (Botswana Energy Regulatory Authority). Once complete the project is set to become Botswana’s first project to derive electricity from gas.

In Tlou Energy’s most recent quarterly reporting the company indicated that the project had made “significant strides” towards completion;

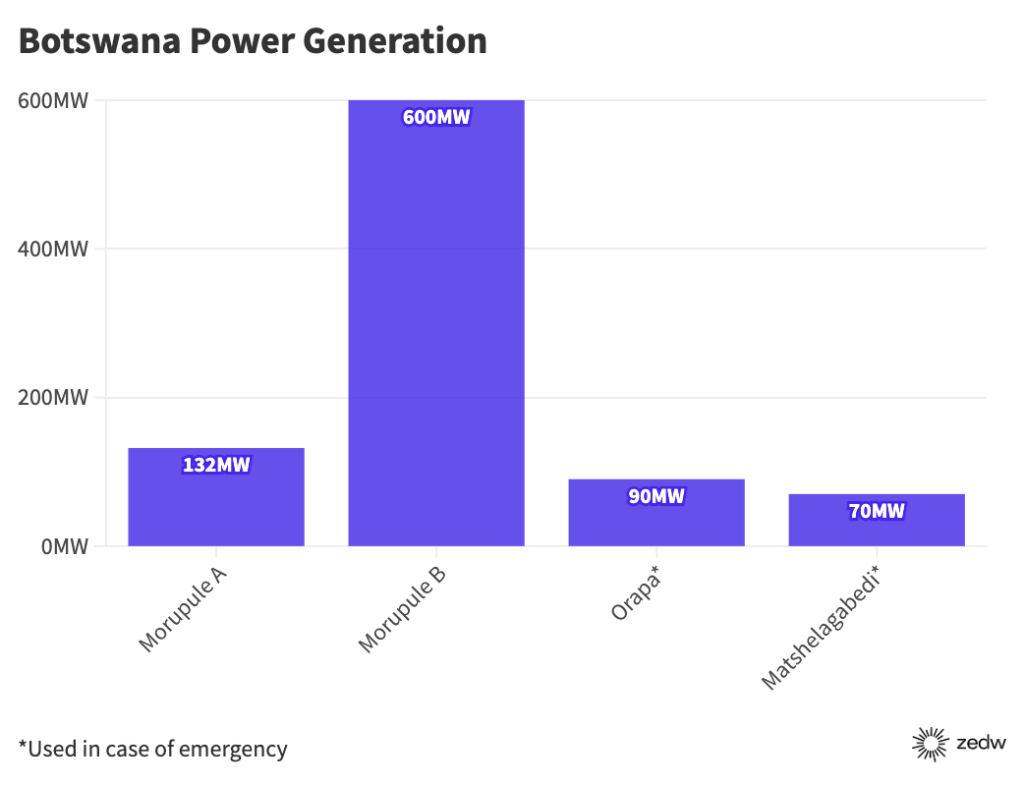

The initial electricity produced at Lesedi will be used to fulfil the 10 MW Power Purchase Agreement with Botswana Power Corporation. Botswana currently produces an estimated 732MW from Morupule Power A (132MW) and Power B (600MW) plants respectively but these have been criticised for facing “technical challenges and at times [has] been closed for repairs or operated at partial capacity.”

Botswana’s Integrated Resource Plan (IRP) continues to provide a roadmap and guidance to achieve a reliable, safe, and affordable electricity supply with a target of renewable energy contributing 30 percent to the energy mix by 2030. Whilst gas is not a renewable alternative projects such as the Lesedi Power project will be key in ensuring the power sources are more varied and less reliant on coal as is the current case.

For the better part of the last 10-15 years we’ve been hearing about how African governments are prioritising moving their citizens from transacting using cash to adopting digital channels. Back then you could have given them grace on the basis of internet penetration being alarmingly low but that whilst that metric has improved over time it still seems that most Africans still prefer using cash over the digital channels.

Backbase recently published its 2024 edition of The African Digital Banking Transformation Report and the report noted that “the vast majority of Africans currently rely on cash to complete transactions, with banknotes and coins used in about 90% of financial transactions, while there is limited use of cheques, debit cards, credit cards and point-of-sale networks.” That does not bode well for the long-awaited digital dawn (and I strongly suspect this is one of the many reasons why fintech’s momentum is dying down on the continent).

Away from Backbase, in 2022 McKinsey estimated that 20%-30% of Africa’s population are making use of digital banking services and worryingly only 5%-7% of payments are made by digital/electronic means. Whilst the popular narrative seems to suggest that cash is on the precipice of extinction in Africa – the data seems to suggest something entirely different…

Sign up to our mailing list to get the weekly roundup straight in your inbox

Featured

Gain access to premium content and stay up to date with the latest insights

Unlock potential and investment opportunities with precise market insights from .zedw newsletter.