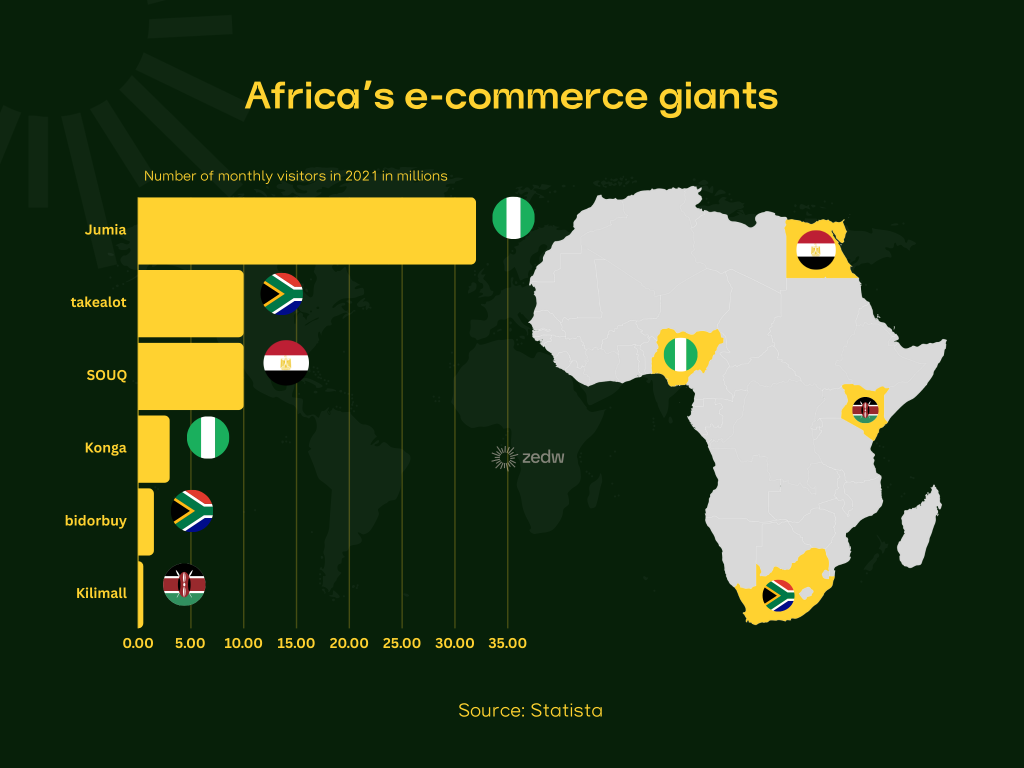

The blessing of the Africa Continental Free Trade Area (AfCFTA) Digital Trade Protocol is that it seeks to further push the growth of e-commerce on the continent. On the other hand, the curse with the move is that it effectively means that companies like Jumia and Takealot who were restricted to certain markets, for one reason or another, have the opportunity to spread their wings to be continent-wide entities.

It might sound like fear-mongering, but the assumption of safety in your local market is slowly eroding, at least on paper. It doesn’t only apply to startups in the e-commerce industry, but others like Agtech, Edutech, Fintech (to some extent) and many others, including SMEs.

What the AfCFTA’s Digital Trade Protocol has presented is an opportunity for better-funded, more mature and hardened operators to explore the opportunities in other markets.

Follow the money

For the sake of simplicity, and you may have already noticed, we will be focusing on e-commerce.

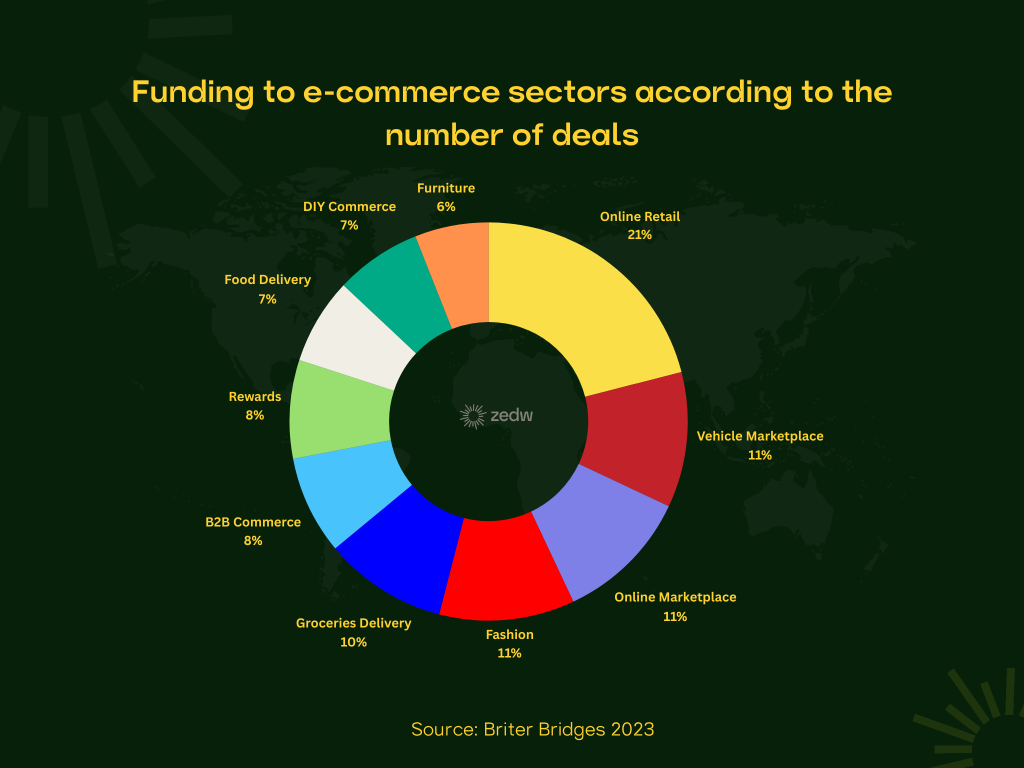

E-commerce in Africa is a heavily funded industry and mature industry (in some markets) as shown by the billions that have gone into the industry over the years…

Additionally, the dispersion of funding in the sub-industries of e-commerce/retail-tech shows that the appetite from investors is high for all its flavours.

On the continent, there are more than 330 startups in 34 sectors offering hundreds of products. Furthermore, the revenues of the sectors have been impressive according to projections, in 2023 it has been estimated that e-commerce revenues were in the region of US$42 billion which is a Compound Annual Growth Rate of 13.9%.

4 markets have a distinct advantage

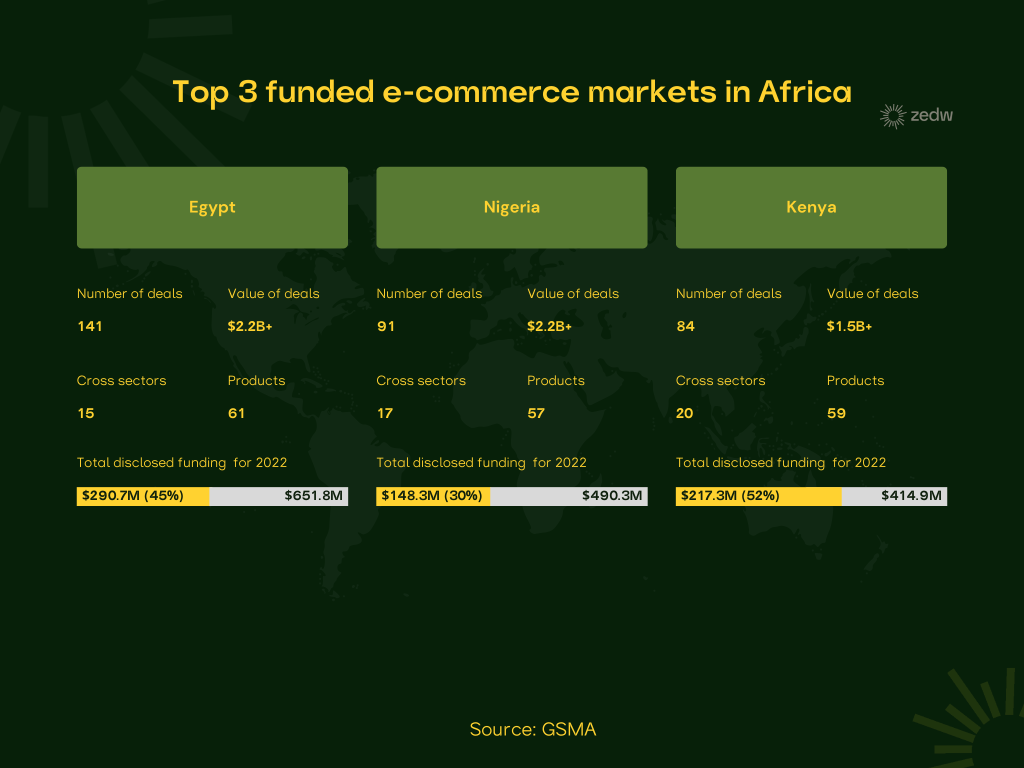

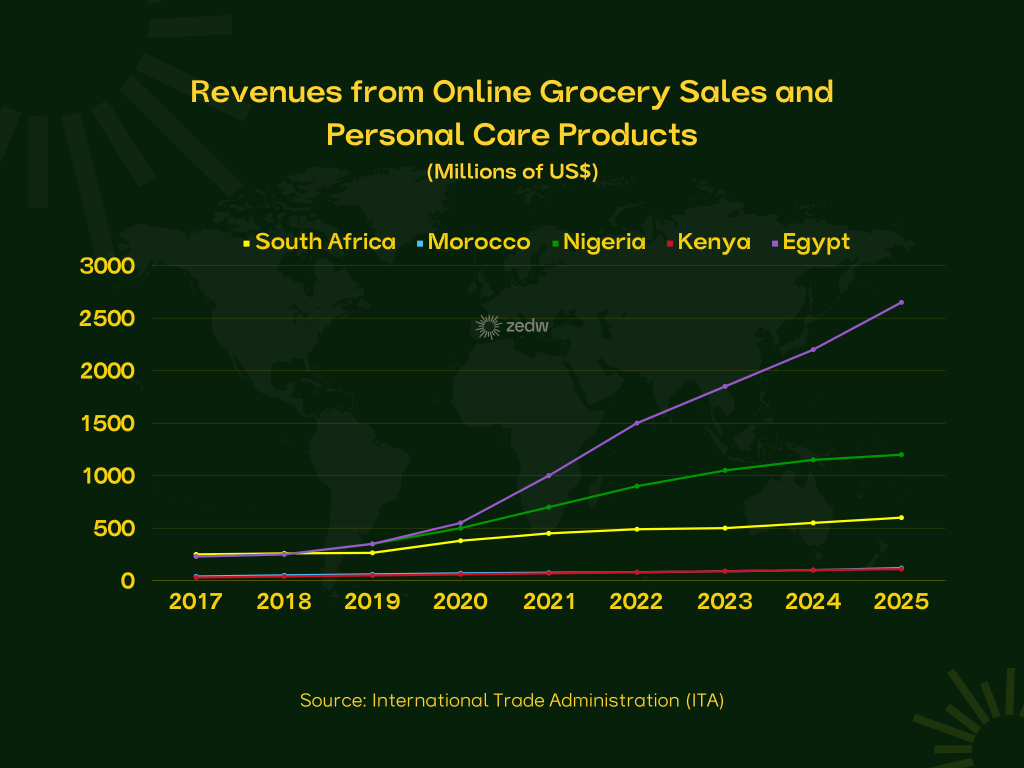

The Big Four, Kenya, South Africa, Egypt and Nigeria, have the upper hand not only when it comes to funding but also in the lessons learned in their respective markets and those their startups have branched off into.

The opportunity of the AfCFTA Digital Trade Protocol offers them yet another advantage because they are best positioned to further branch out into other markets. This can and will cause tremors in those new markets, particularly for e-commerce startups coming up or nearing the point of maturity.

The resources that these companies have are considerably greater than those of those in nations that have not received backing from entities that are intent on disrupting the state of retail trade.

It won’t be without its challenges

Ease of doing business

Navigating other markets is not the easiest thing to do because they all have various requirements for businesses that want to operate in their territories. An example is that to operate in one country the local authorities may require local registration so that taxes can be properly administered.

Taxation itself can’t be ignored, authorities differ on how they tax goods and services. Moreover, the issue of taxation, particularly for digital services is still something that African countries don’t have a uniform baseline on.

Another point of contention may be the ease of doing business being vastly different from one market to another. Additionally, understanding consumers’ habits in other countries is a cost and resource-intensive exercise.

There are, of course, common Fast Moving Customer Goods but that might not be enough to justify establishing an enterprise in another region of the continent.

Payments

Payments are another concern, even if the Pan African Payments and Settlements System (PAPSS) is enacted today, a good number of Africans remain unbanked. Mobile money is the only noteworthy alternative to traditional finance, but there hasn’t yet been a clear understanding of how PAPSS will integrate with mobile money operators across the continent and the currency issues from market to market. For instance, someone living in a relatively stable economy with a strong currency might not want to gamble with the currency and the exchange rates of weaker markets.

The whole system may have to be backed on the United States Dollar to make it make sense for exchange rates across Africa. Payment gateways may simplify things considerably in this respect. However, the next spectre is the cash-based nature of many African economies. In late 2022 McKinsey reported that cash is still King in Africa. Even in the case of Mobile Money users, the Cash-In-Cash-Out (CICO) is still a fundamental use case for Mobile Money.

The small ray of hope is that online payments are on the rise and according to McKinsey, they expect Compound Annual Revenue from Online Payments to grow by 30%.

“as a proportion of overall sales, online is expected to grow at a faster pace, especially as small and medium-sized enterprises (SMEs) look to switch from cash to electronic payments and as offline merchants extend to online to capture growth.” – McKinsey

Their optimism might be a little exaggerated or skewed towards the more digitised markets, if we look at the proverbial edge case, Zimbabwe. We recently covered the entrance of Bolt into that market and from interactions with local it’s Zimbabwean drivers, the company is not yet asking them to remit money to the company.

The case is the same for InDrive and Rida, an approximation of what this phenomenon is can be “market acquisition or penetration”. Additionally, most of the payments being made are in cash, very few drivers reported that they were getting paid from customers via digital payments.

How many other markets or market segments in Africa are similar to Zimbabwe? It would be a stretch to say that any market in Africa bears an exact resemblance to Zimbabwe, some are far better and others worse. What they do share is market segments that do not see the need for digital or are not able to access that service for one reason or another.

If the opportunity is there and big enough the challenges might be worth overcoming

The sale of goods is, of course, far different from ride-hailing and other services. However, what InDrive, Rida and Bolt have shown in the Zimbabwean market is that they trying to fill the void left by the failed public transport operator.

It might be for a certain demographic who can afford their rates, however, their commitment to allowing locals to use their tech and platforms for free, as of the time of writing, means that they are either collecting valuable data, or this is a staging operation to find out the viability of for their services in Zimbabwean market and other similar markets.

Now, how much of a stretch is it to say that the giants of e-commerce in Africa can’t do the same?