Zimbabwe and its approach to the AfCFTA can be described, from the outside looking in, as, at best, tepid.

Beyond the ratification of the Africa Continental Free Trade Area Agreement, there has been little movement inside Zimbabwe to seize whatever opportunities the AfCFTA has to offer.

What can Zimbabwe offer right now and quickly?

At the recently concluded conference hosted by the Zimbabwe Revenue Authority (ZIMRA) on the country’s AfCFTA participation, the following was revealed about what value proposition Zimbabwe could offer to the continental free trade area.

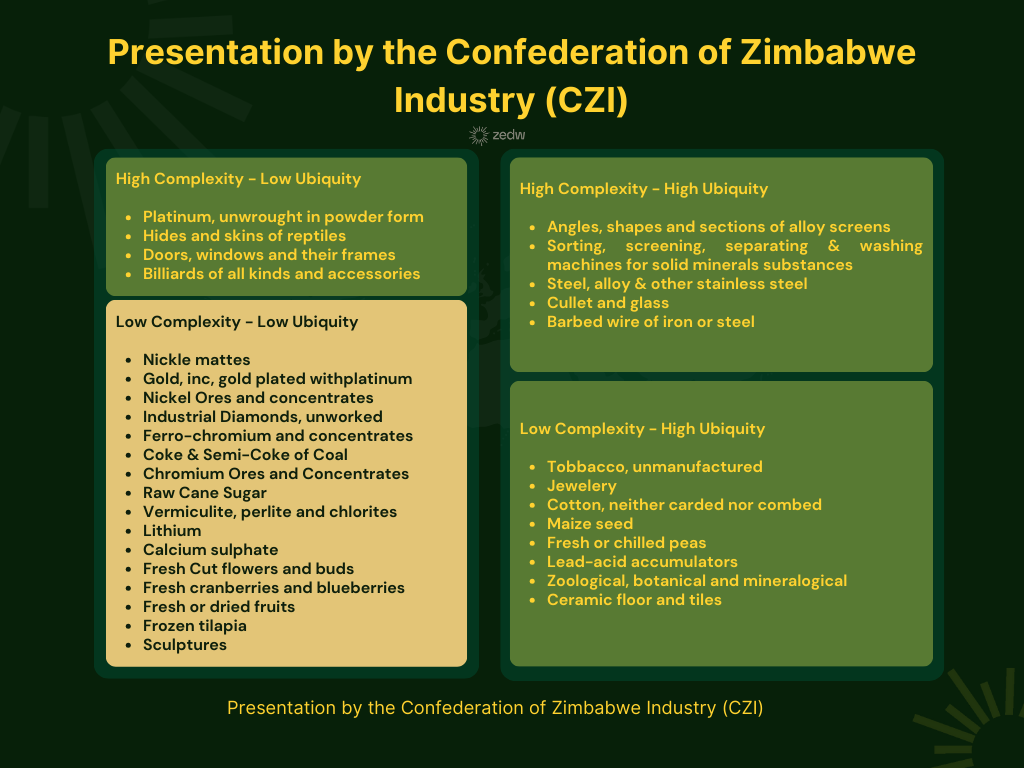

In the presentation by the Confederation of Zim Industries (CZI), the admission was made that there are too few low complexity, low ubiquity products that Zimbabwe can easily plug into the AfCFTA.

This category is important because it displays the products that the country can easily produce (low complexity) and have relatively little competition (low ubiquity)

Now, saying there are few products of Low Complexity-Low Ubiquity products while it has the most entries in the diagram above is relatively simple to explain.

All of the products mentioned above are in the primary sector. This means they have to be grown or extracted from the earth. The benefit of this is that it makes things easier because Zimbabwe has a considerable amount of arable land and mineral deposits (untapped or otherwise).

The downside is that Zimbabwe is dependent on a single sector as its only viable entrant into the AfCFTA. What this shows is a serious lack of diversity and could put the nation in a difficult position because all of these products rely on nature to act as expected. From a mineral extraction point of view, this might not necessarily be a problem, but for agricultural products, this is a serious concern. Particularly with the drought that has prevailed in 2023/24.

Where does Zimbabwe rank in exports for all the low-ubiquity low complexity AfCFTA products?

First off, the diagram presented by the CZI follows a clear line of logic and shows the areas that Zimbabwe can indeed attack in the AfCFTA that are low difficulty and “relatively” underserved.

| Low Complexity – Low Ubiquity Ranking as of 2022 | Description and Uses | Global Export Ranking 2022 (Source: World Integrated Trade Solution/WITS) |

| Nickel mattes | an intermediate product that is used to produce nickel sulphate, an integral component of the battery materials value chain | 1* (as of 2021) |

| Gold, inc, gold plated with platinum | – | |

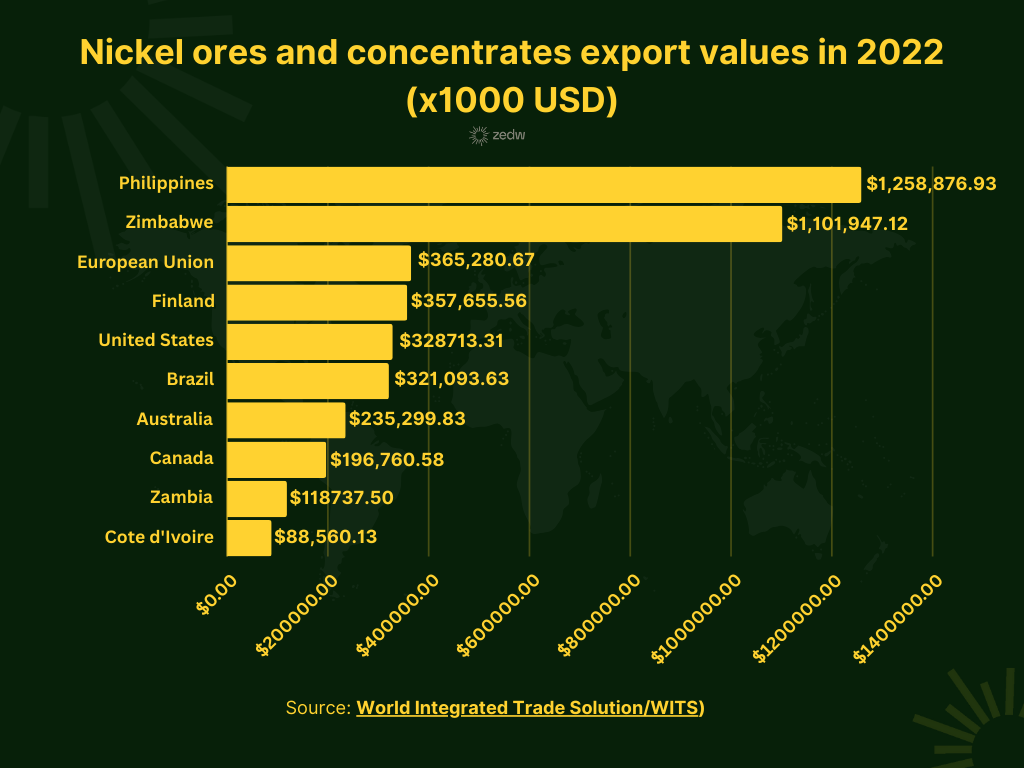

| Nickel Ores and concentrates | More than 80% of nickel is used to make alloys, as nickel adds toughness, strength, rust resistance and various other electrical, magnetic and heat-resistant properties. | 2 |

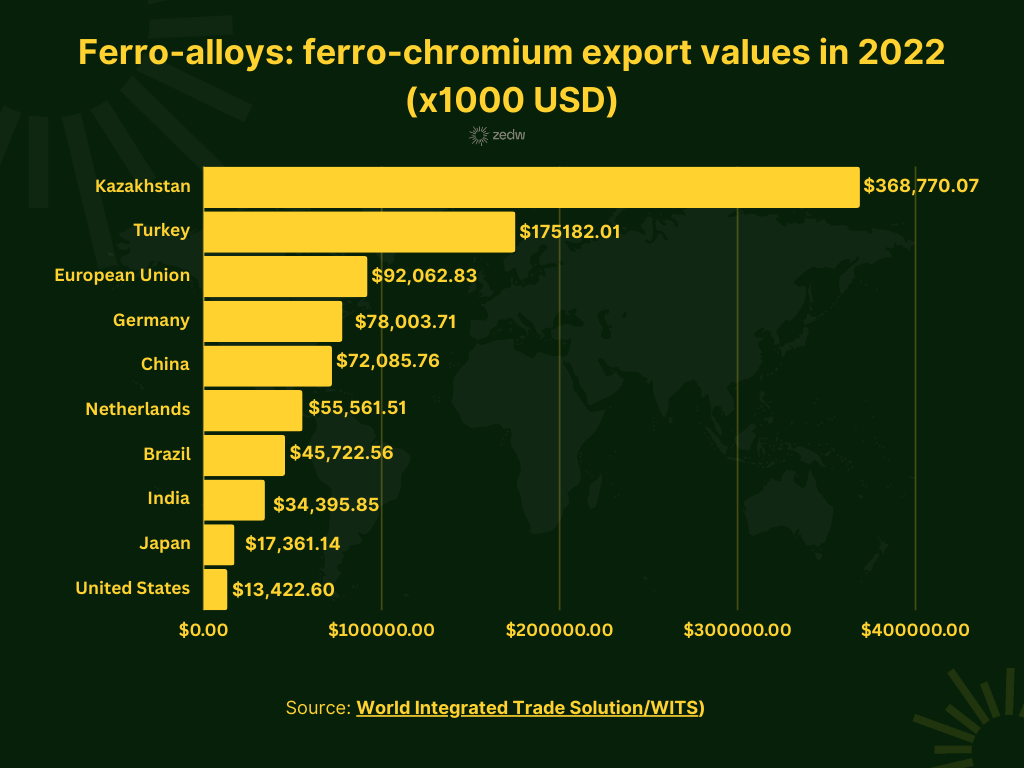

| Ferro-chromium and concentrates | ferrochrome is utilised in the production of stainless steel | 5 |

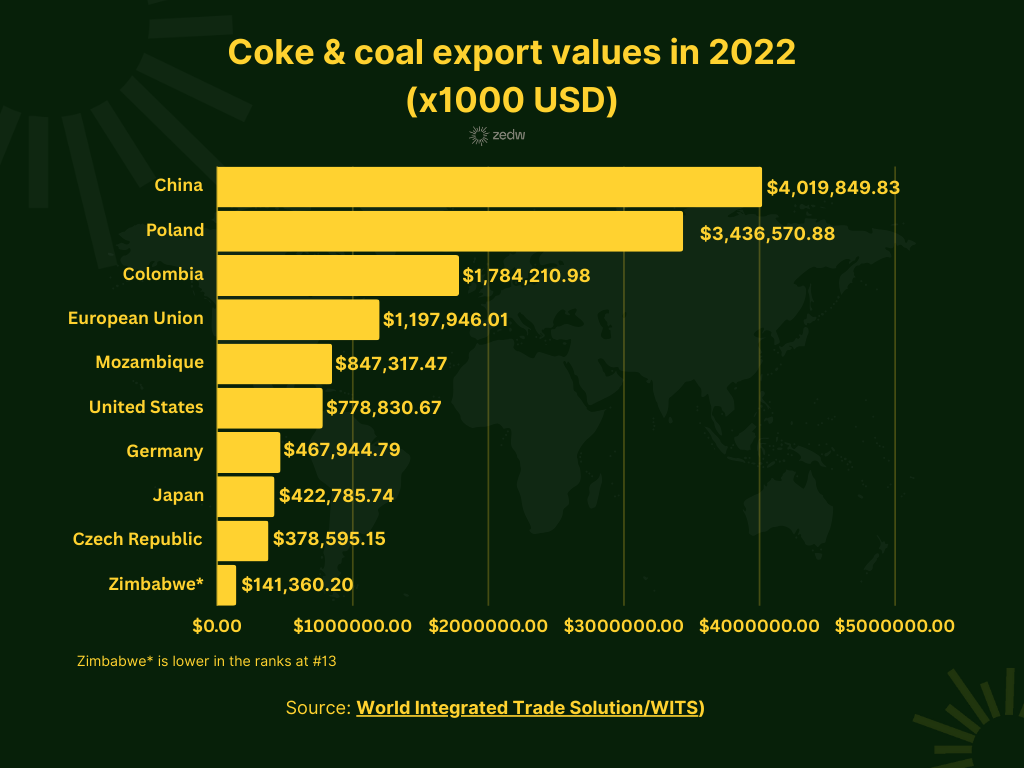

| Coke & Semi-Coke of Coal | Coke* used mainly in iron ore smelting, but also as a fuel in stoves and forges | 14 |

| Chromium Ores and Concentrates | manufacture of stainless steel, gray cast iron, iron-free high-temperature alloys, and chromium plating for surface protection | 6 |

| Raw Cane Sugar | Food sweetener | Unranked |

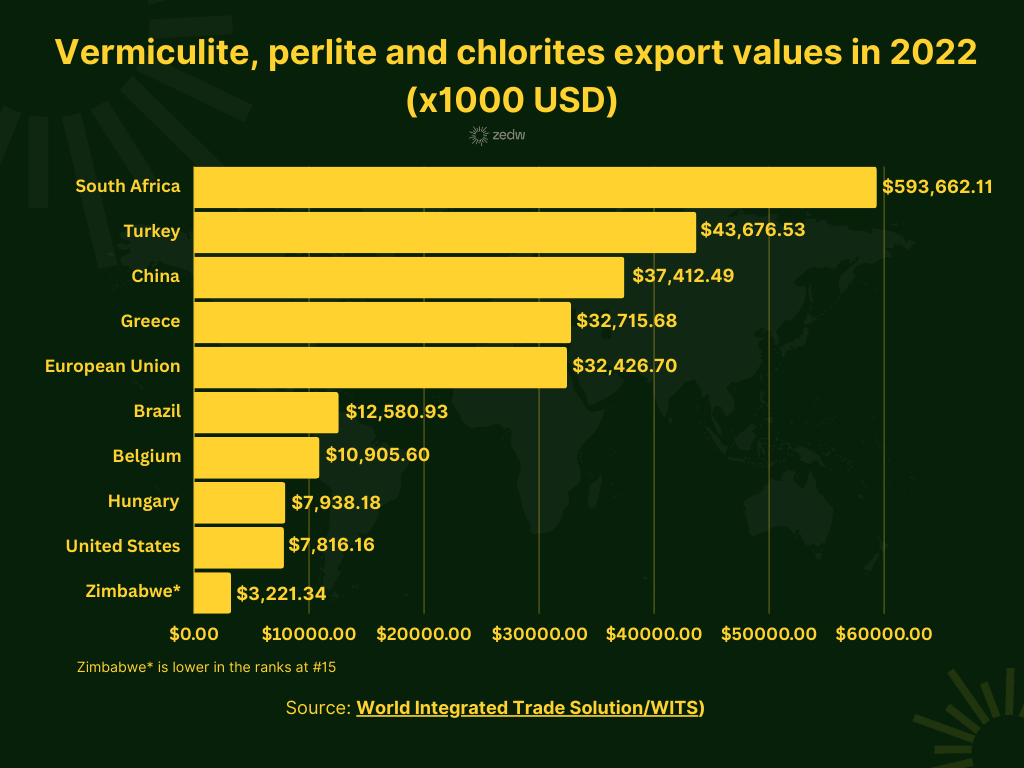

| Vermiculite, perlite and chlorites | Vermiculite – It is used as an insulator, a soil additive, and as a component in potting soils. Perlite -ceiling tiles, pipe insulation, roofing board and fire-rated door cores Chlorite – Used in water purification, to bleach wood pulp, textiles, fats, oils; and for many other uses | 16 |

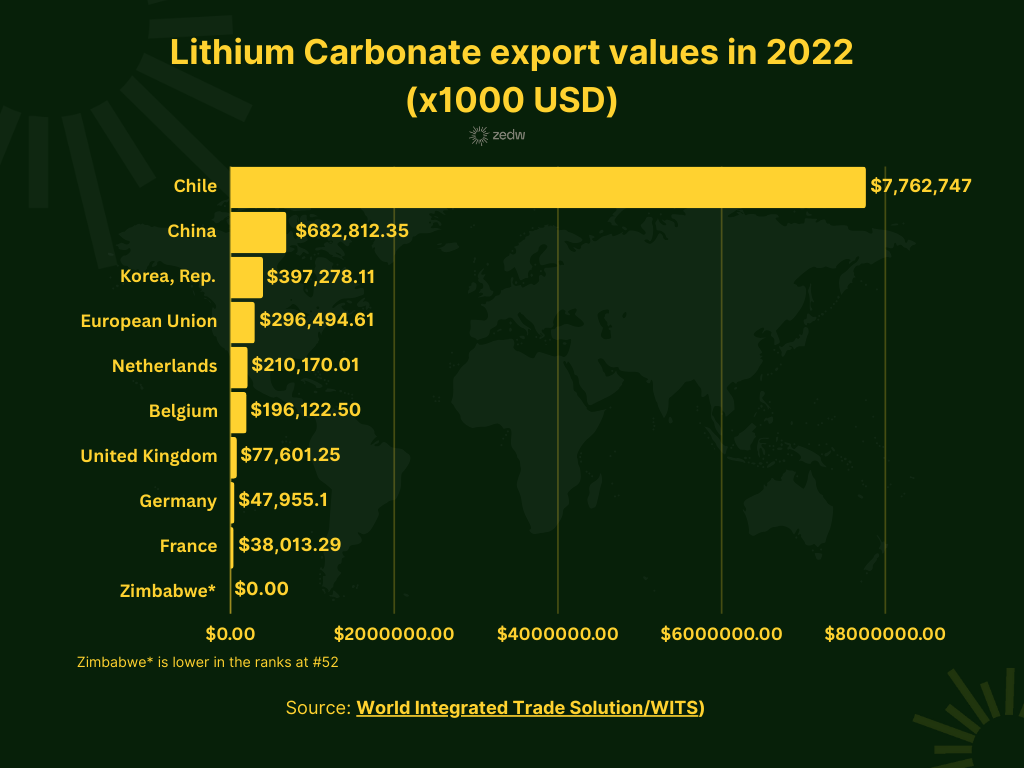

| Lithium | Batteries, ceramics, lubricants, steel and aluminium production among many others | No Data Available |

| Calcium sulphate | to produce plaster of Paris and stucco | 23 |

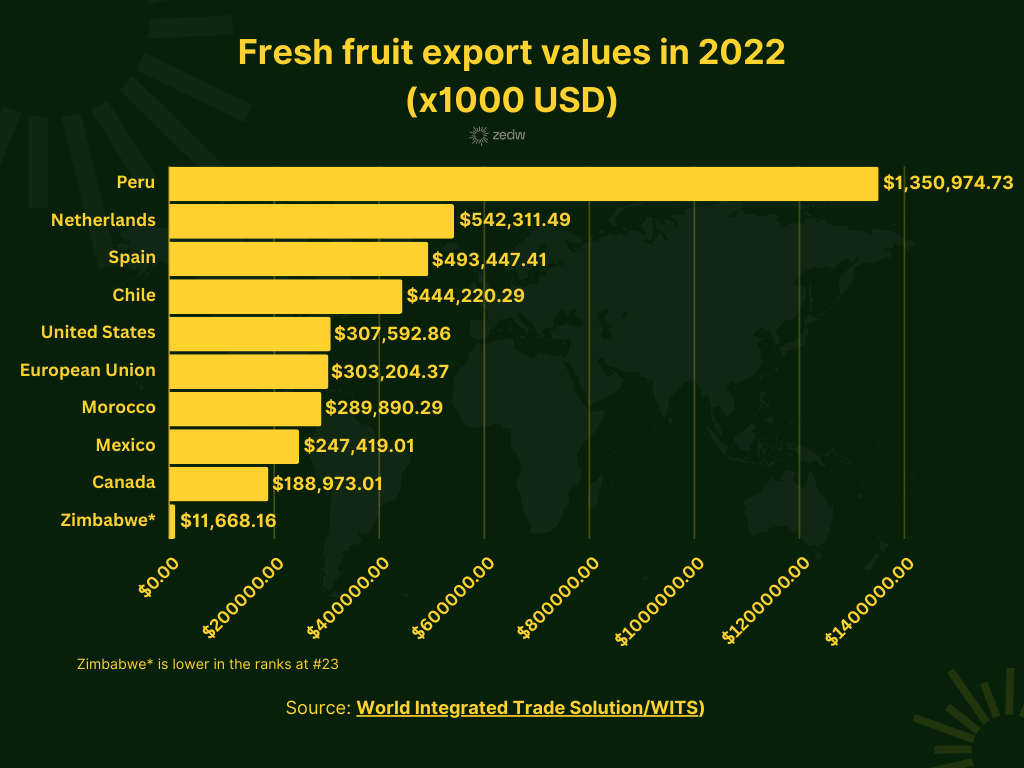

| Fresh Cut flowers and buds | Extracts, decorative and consumption | 45 |

| Fresh cranberries and blueberries | Consumption | 24 |

| Fresh or dried fruits | Consumption | Undefined |

| Frozen tilapia | Consumption | (No data Available) |

| Sculptures | Decorative | 39 |

African Threats Exist in the “Easy to Deploy” Export Products

Even though these products are a good starting point for Zimbabwe, there is some serious continental competition for the majority of them.

| Low Complexity – Low Ubiquity Ranking as of 2022 | Global Export Ranking 2022 | African countries that rank Higher than Zimbabwe |

| Nickel mattes | 1* (as of 2021) | – |

| Gold, inc, gold plated with platinum | No Data | No Data |

| Nickel Ores and concentrates | 2 | – |

| Ferro-chromium and concentrates (containing by weight more than 4% of carbon) | 4 | South Africa (1) |

| Coke & Semi-Coke of Coal | 13 | Mozambique (5) |

| Chromium Ores and Concentrates | 5 | South Africa (1) |

| Raw Cane Sugar | Unranked | South Africa (14) Egypt (19) Botswana (31) Rwanda (40) |

| Vermiculite, perlite and chlorites | 15 | South Africa (1) |

| Lithium | No Data Available | No Data |

| Calcium sulphate | 22 | Tunisia (7) South Africa (19) |

| Fresh Cut flowers and buds | 44 | Kenya (5) Ethiopia (6) South Africa (15) Morocco (35) Zambia (37) Tanzania (38) Rwanda (41) |

| Fresh cranberries and blueberries | 23 | Morocco (7) South Africa (10) |

| Fresh or dried fruits | Undefined | – |

| Frozen tilapia | (No Data Available) | – |

| Sculptures and Statuary | 38 | South Africa (22) |

The economies and markets that Zimbabwe is competing with are, in the case of South Africa, Morocco, Kenya, Tunisia, Rwanda, Botswana, Egypt and Tanzania significantly more developed than Zimbabwe with a greater capacity to either execute at a higher level or access more markets.

Now, Zimbabwe is ahead on at least two products (nickel mattes and Nickel Ores and concentrates) which gives the country some advantage and a viable entry-level product according to the data collected by the World Integrated Trade Solution (WITS).

What this shows, at least from our understanding, is that Zimbabwe has to diversify its economy significantly to compete properly in the AfCFTA. Without any manufactured/semi-manufactured/finished products, the nation might not be able to sustainably compete against the developed and further developing counterparts on the continent.