Back in 2013, McKinsey indicated that by 2025 Africa had the potential to make US$75bn in annual eCommerce sales. 11 years have passed and Statista noted that eCommerce was a US$28bn market in 2023 which begs the question – what’s going wrong? Why is the continent US$47bn dollars of the mark and why is eCommerce still largely an emerging industry in Africa? As is usually the case, we took a look at some stats to try and explain why it’s so difficult for eCommerce to make headway on the continent…

“If 10 percent of retail spending in Africa’s largest economies were to move online, e-commerce activity could result in revenue of $75 billion.”

Lions go digital: The Internet’s transformative potential in Africa | McKinsey

10 years from McKinsey’s projection Africa eCommerce field now resembles a graveyard more than fertile ground. In March 2023, Kenyan eCommerce player Zumi shut down after failing to raise capital. In 2017 VenturesAfrica reported only 30% of eCommerce startups in Africa were profitable.

In 2018, Nigerian eCommerce startup Konga was acquired by Zinox – for an undisclosed amount. What was clear though was that no one thought Konga’s initial investors had made money on that deal – if anything the sale was described by media as a fire sale – investors wanted out. One of the more alarming statistics that became public knowledge was that in 2016 Konga’s active customer base was less than 1% of Nigeria’s population at the time – estimated to be around 184,000 customers.

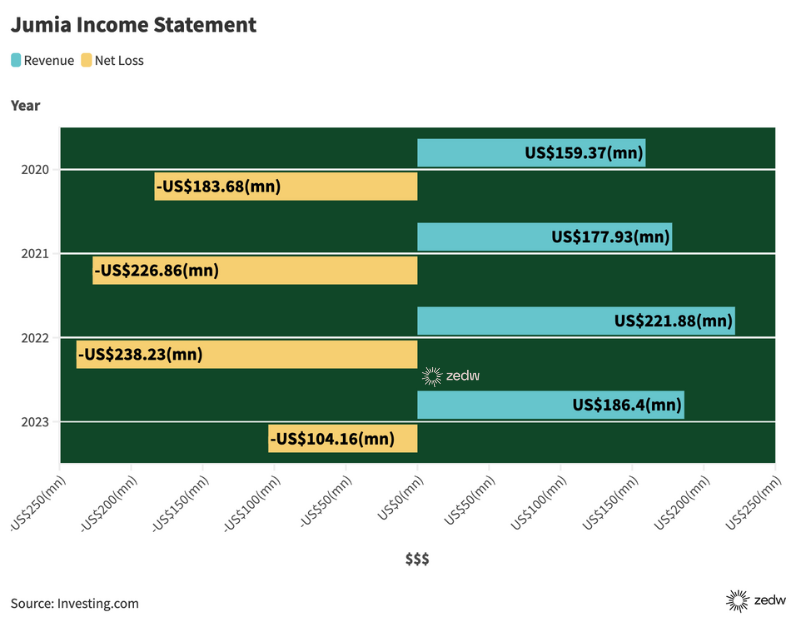

Jumia has been the longest lasting giant-B2C eCommerce player in Africa since its founding in 2012. The company has iterated to offer food deliveries, logistics services, payment tech and more in that decade but the startup has still had difficult times breaking even:

So that’s the general lay of the land – most are losing money and the market seems tiny. Let’s now take a look at the stats that explain what eCommerce ventures in Africa perilous leaps of faith.

A young continent, a “broke” continent…

TechCabal attributed the bloodbath in eCommerce to the following factors:

- the lack of functional addressing systems;

- poor road networks;

- a general preference for cash payments;

- worries about fake products, and escalating security concerns.

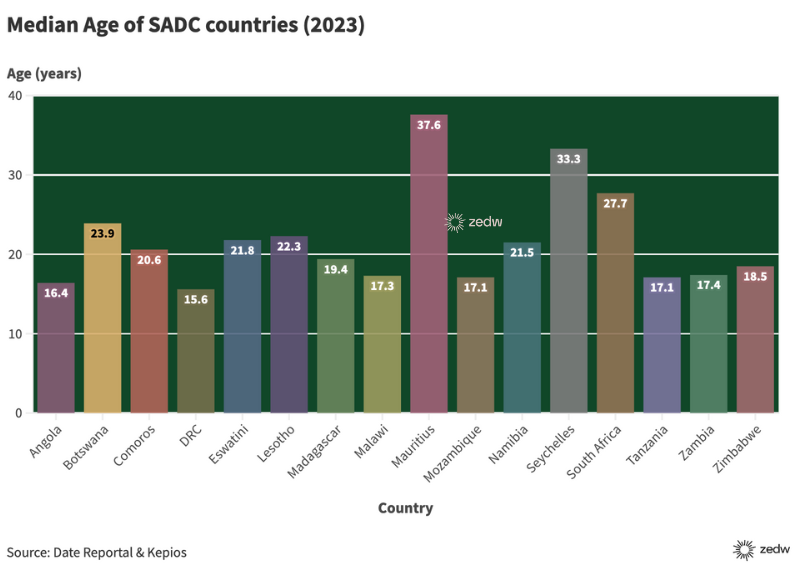

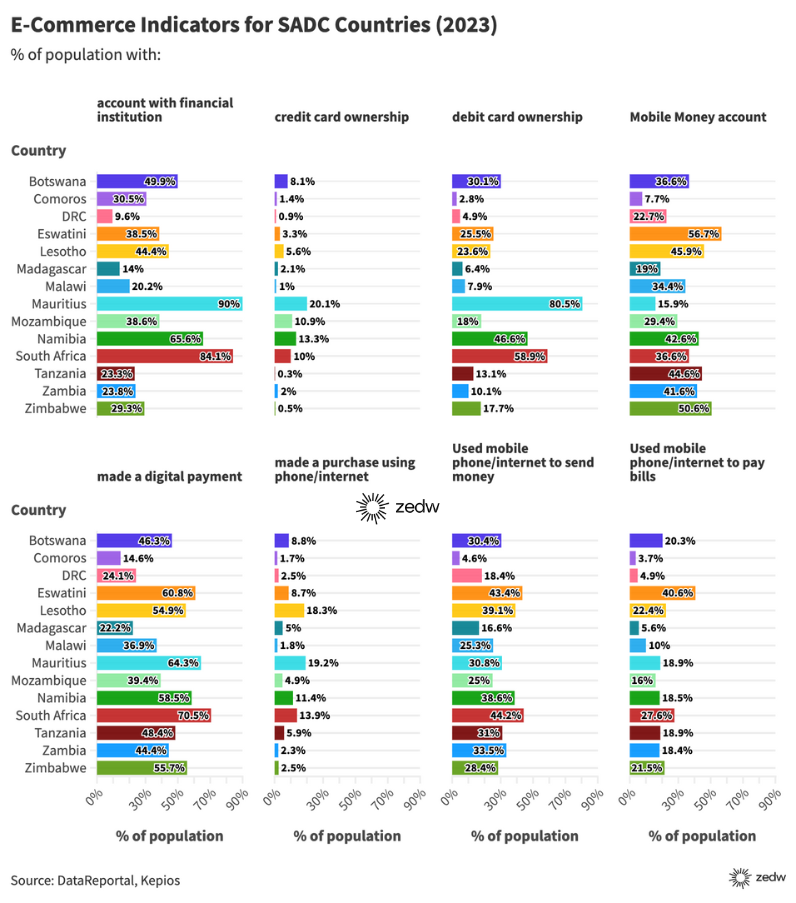

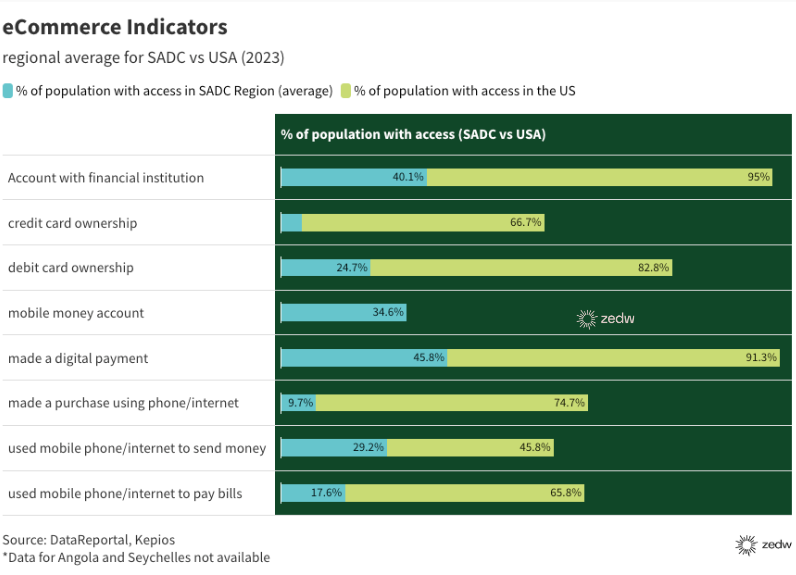

All of this is true and eCommerce indicators compiled by DataReportal indicate that the markets are not yet ready for digital commerce. We narrowed our focus to Southern Africa (SADC) and the first point to discuss here is that Africa (at least Southern Africa) might just be too young at present:

*For context the median age of the USA is 38.2 years

If half your population is younger than 25, as is the case in 13/16 SADC countries – how big are your markets? This low median age means most of the population is still being educated or just entering the job market which tends to mean limited disposable income for discretionary spending.

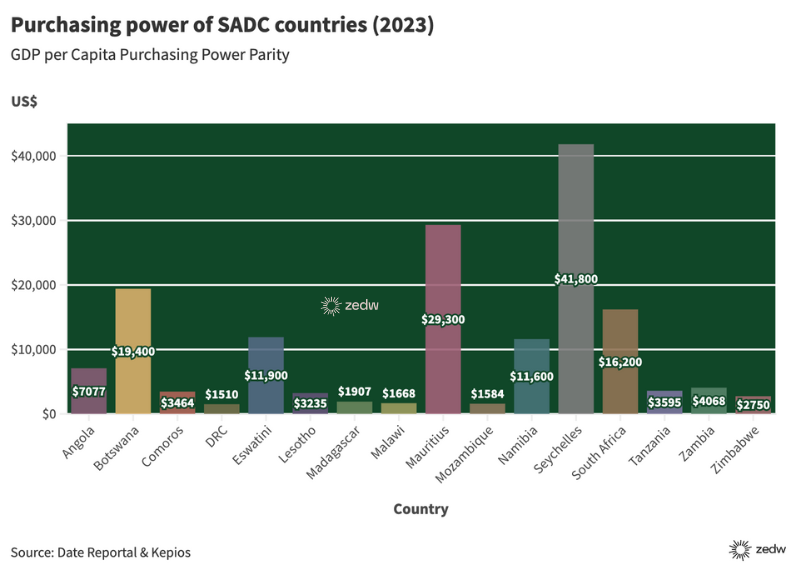

Beyond age we considered GDP per Capita Purchasing Power Parity an indicator which considers the following:

- GDP per Capita – The monetary value of all final goods and services produced within a country’s borders during a specific adjusted to the total number of people living in the country.

Purchasing power parity – An economic theory that compares different currencies based on a basket of goods. It essentially asks how much it would cost to buy the same amount of goods and services in different countries.

*For context the USA’s GDP per Capita Purchasing Power Parity is US$80,400

This metric basically indicates the following within the region

- Lower Average Economic Output per Person: Essentially, the total value of goods and services produced in the country, divided by its population, translates to a lower average amount per person. This suggests a limited capacity to produce goods and services that fulfil people’s needs and wants.

- Lower Purchasing Power: The PPP adjustment highlights that even if things appear cheap because of exchange rates, the reality might be different. A low GDP per capita (PPP) means that even though products/services might cost less, people on average still have little money to afford them.

- Indicators of a Lower Standard of Living: This metric is often used as a proxy for a country’s standard of living. A low GDP per capita (PPP) can suggest limitations in i) access to essential goods and services, ii) availability and quality of housing and infrastructure and iii) opportunities for employment and income generation

So, most of the population is young and has no money to buy things, are there other constraints?

Unfortunately, yes, the eCommerce indicators don’t look too great either…

Beyond consumers financial situations it also seems like infrastructure to facilitate commerce and its uptake by consumers is way behind eCommerce leaders such as the USA. Whilst it’s important to note that the averages above exclude Angola and Seychelles – it’s hard to see a scenario where they would make a world of difference.

Are there any redeeming positives?

When it comes to Africa it’s easy to fall into the trap of gloom and doom narratives – especially for those of us who live here. This negative outlook can sometimes overshadow progress and in the realm of eCommerce there is progress.

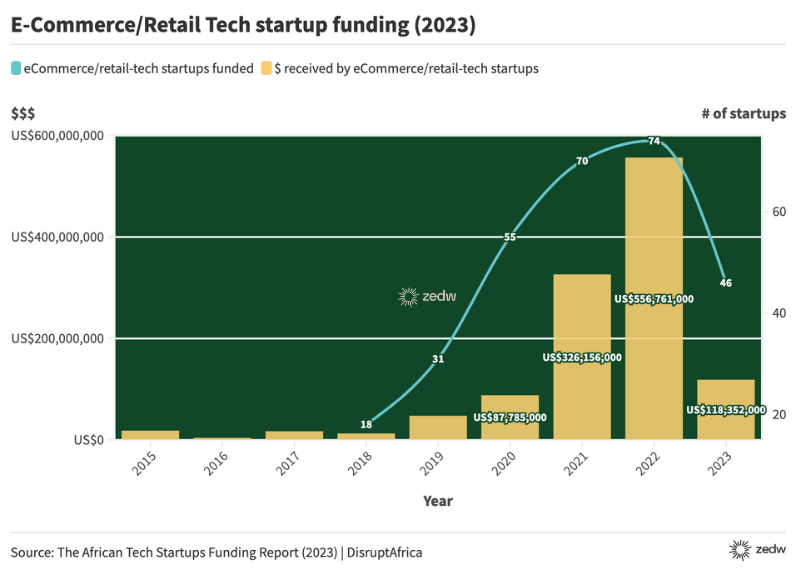

Investor appetite in eCommerce startups has not died down with the number of startups receiving investment and funding in the space ballooning over the years:

The number of startups funded and amounts received in Africa grew significantly between 2018 and 2022 but last year saw a massive regression and it will have to be seen if this is the new norm. A general disclaimer in this regard is that startup funding was at a 5-year low last year:

“Startups last year navigated a tough funding environment, tightened their belts and focused on unit economics. Layoffs across tech deepened in 2023. Investors deployed capital more sparingly, with a higher bar at each stage.”

CrunchBase

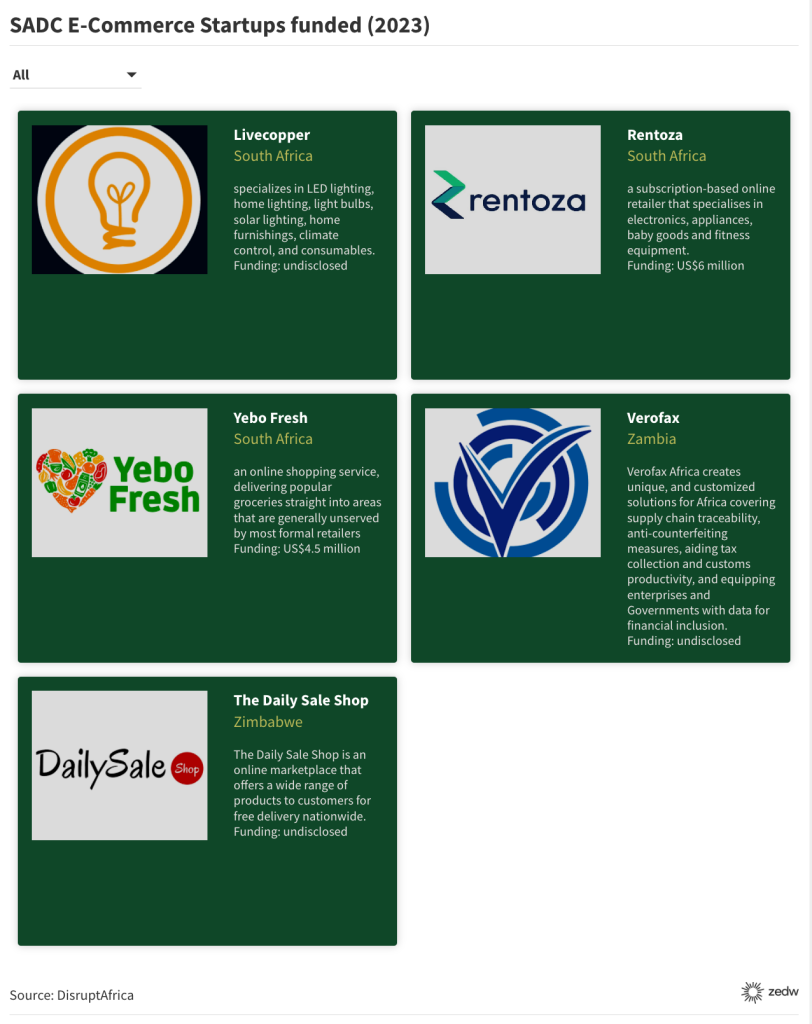

Within the region, 5 startups managed to get their hands on the sweet investor cheques:

Investor appetite is still strong and as long as that remains the case – we will continue to see startups come up with eCommerce solutions as there is a healthy pipeline of capital to be deployed towards solving the problem. Even without investor capital eCommerce solutions will continue to sprout up as eCommerce is ultimately just people transacting digitally. In the short term though, Africa’s infrastructural and the limitations of its consumers suggest that change won’t happen overnight;

“There is sustained interest in Africa’s e-commerce industry as the value proposition is evident and attractive; however, early attempts at building out the space have struggled to overcome infrastructure challenges, among others.”

DisruptAfrica