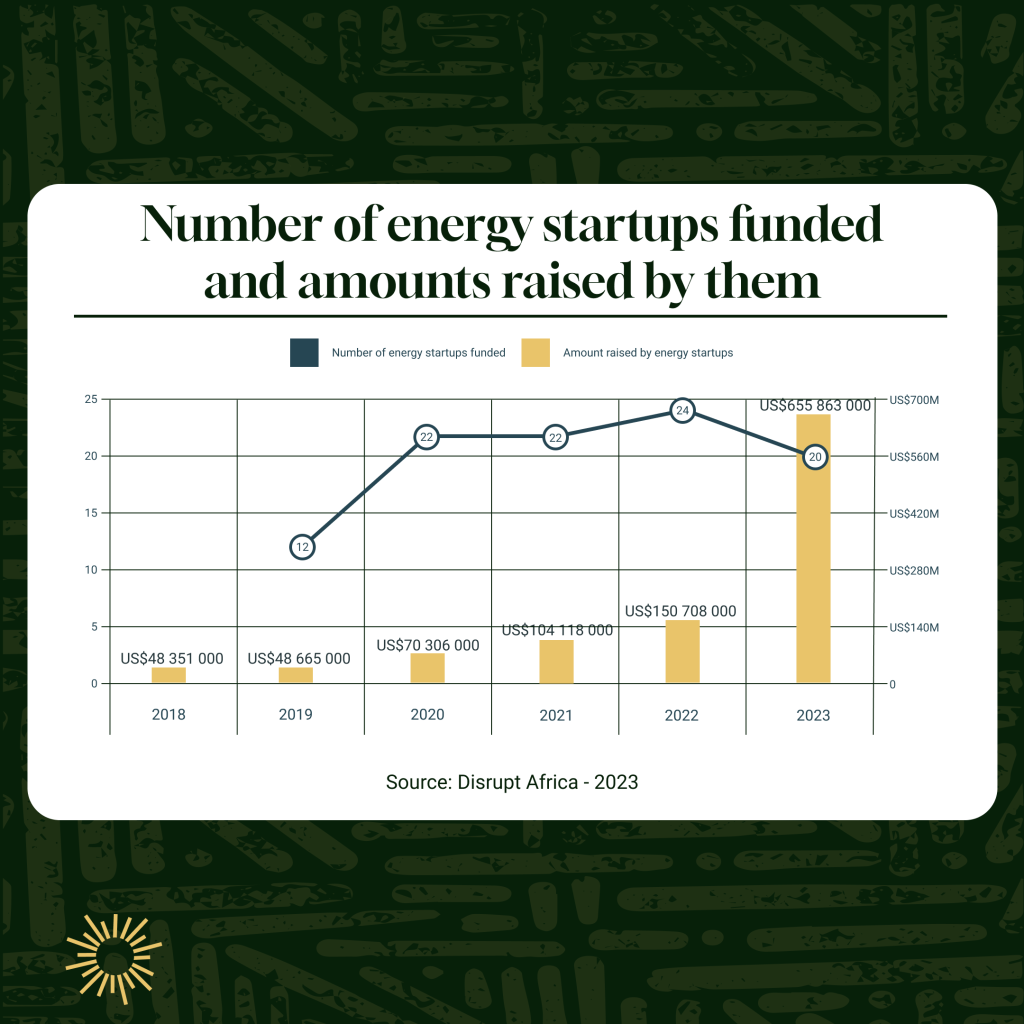

In 2020, Startups in Africa’s energy sector managed to raise US$70,306,000 in funding and all startups on the continent managed to raise US$700 million in what was described at the time as a “record year” by Disrupt Africa. At the time everyone was well aware that there was still room for growth in funding for African startups but few examples illustrate that growth quite as well as what has since happened in the energy sector.

In 2023, startups within this sector managed to raise an eye-watering US$656,863,000 in funding – quite close to what was raised by the entire startup industry just 4 years prior. This US$656.9mn is quite interesting as historically, African energy startups have only raised between 4%-10% of total startup funding but last year that number grew to nearly a third 27.2%.

Energy startups funding trends

It will be interesting to see whether 2023’s high can be sustained in the long term but energy startups have progressively been raising more and more over the years;

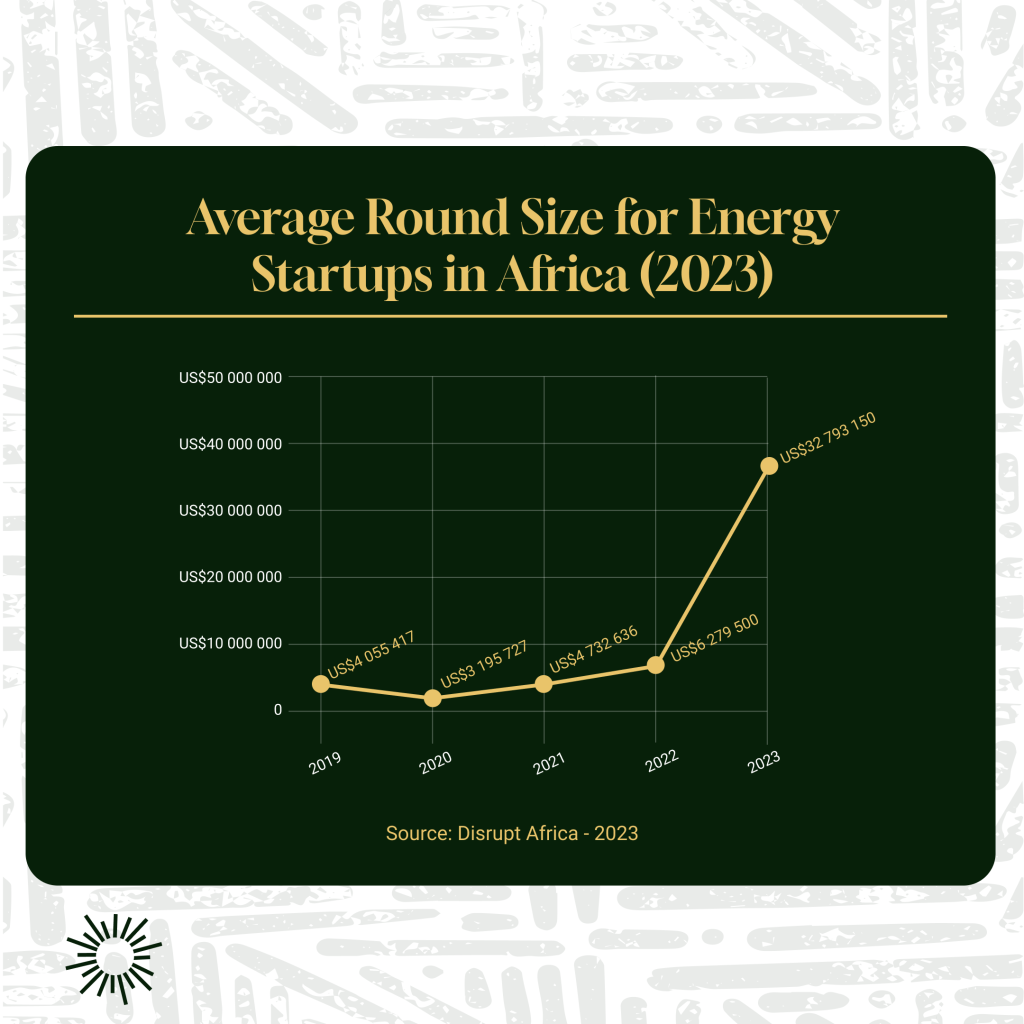

We know that generally – a low number of energy startups get funded but they tend to receive larger checks as they operate within a capital-intensive field that has slow profitability paths. Business models in the energy sector tend to have pay-as-you-go elements sometimes targeted towards low-income populations (as we’ll see in the case study section of the article) which means check sizes need to be heftier than usual.

Back in 2020 – this meant that the average round size for an energy startup was US$3.2mn – by 2023 this figure had shot up by 10x to US$32,8mn.

“Energy ventures do, in general, require larger amounts of capital, hence the consistent relative over-performance in the startup space and the higher average ticket size.”

Disrupt Africa | Startup Funding Report 2018

The only metric which has remained relatively steady is the amount of startups receiving the funding – hovering between 10 and 24 over the last half-decade.

The most interesting thing about the boom in funding for the energy sector for 2023 is that it comes at a time when the startup and venture capital scene is going through what has been described as a funding winter.

Globally, startup funding hit a 5-year low in 2023, so it is quite surprising that in that environment funding for energy startups would grow exponentially (335.2%). In Africa, only two sectors, ed-tech and, most notably, energy, raised larger amounts of funding in 2023 as opposed to 2022.

Based on data from Disrupt Africa, we also managed to discover that this increase in funding might be having a positive impact on the energy startup’s ability to employ people as that number has been steadily rising from 758 to 5,461.

What was happening in the SADC region during this period?

As is usually the case South Africa was leading activity in regards to SADC startups receiving funding in the SADC region. Whilst the list below is not exhaustive – it does reflect some of the deals we are aware of that occurred in the region during 2023:

| Startup | Country | *Description | Funding raised in 2023 |

| Wetility | South Africa | Wetility’s flagship product is a comprehensive digital solar energy management system that allows users to regulate power usage remotely. | US$48,000,000 |

| Asoba | South Africa | Asoba provide control of power generation and management back to the companies and individuals that are constructing Africa’s future. | Undisclosed |

| GoSolr | South Africa | GoSolr is a residential solar energy company offering solar-as-a service with fixed monthly fees to households. | Undisclosed |

| Yellow | South Africa | an asset financier for solar energy and digital devices in Africa. | US$14,000,000 |

| Altech | DRC | Altech Group aims at expanding access to clean, renewable, and affordable energy both for poor-grid and off-grid households. | US$18,000,000 |

| Nuru | DRC | Nuru is a renewable and environment company that specializes in the fields of storage micro-grids and solar energy. | US$41,500,000 |

| NeedEnergy | Zimbabwe | NeedEnergy is there to provide sustainable and clean energy solutions based on energy data | Undisclosed |

| Skicc Tech | Zimbabwe | Skicc Tech is an artificial intelligence-powered technical innovation startup. | Undisclosed |

| Everlasting Technology | Zimbabwe | Everlasting Technology provides sustainable energy solutions for off-grid rural households in Africa. | US$125,000 |

The biggest raise from the region came from Wetility – who managed to secure US$48mn from investors like Sanlam along with undisclosed commercial and development banks in South Africa. One of the energy players we spoke to for this story – Leroy Nyangani, cofounder of NeedEnergy – a startup using data and machine learning to use smart meters to sell energy (gas and electricity). Leroy alluded to the fact that a lot of the funding being poured into energy startups in South Africa was among other things a reaction to the country’s ongoing energy crisis.

“Markets like South Africa are driving [the funding boom] because they are spending on average 8 hours without power on a daily basis. Solar has become an alternative and you’ll see private equity and investment banks pouring money to make sure that solar participates as one of the alternatives in the energy mix.”

Leroy Nyangani NeedEnergy co-Founder

Another big raise came from DRC startup Nuru who managed to secure $41 million in Series B funding. The raise was going to enable the startup to begin construction on a 13.7 MWp (MegaWatt peak) power project. In DRC the need for electricity is quite acute as only 20% of people in the country reportedly have access at the moment.

This gap was highlighted by all players we spoke to who are in the energy market. Tinaye Makoni – the cofounder of Skicc Tech – a startup supplying and providing access to electricity and one of the things he highlighted was the extent to which this gap exists within the continent:

“We have over 600 million people without access to electricity and most of them are in sub-Saharan Africa. In countries like Zimbabwe, over 50% of the population don’t have access but the ones that do – don’t have reliable access due to power cuts.”

Tinaye Makoni – Skicc Tech cofounder

That gaps like this have taken this long to address is quite frustrating but it seems there is now an influx of funds directed towards alternative energy sources.

What are still the limitations for African startups in this space?

We noted that the average round raised was around the $4 million mark in 2023, but this hasn’t been the case in many parts of the region – including Zimbabwe. We put forward the question of what’s standing in the way of some of the smaller startups and the bigger checks to Mr Makoni and Mr Nyangani to understand some of the gaps and challenges hindering industry entrants.

One of the issues highlighted was that access to capital was quickly falling into a chicken and egg scenario where investors tend to be looking to see what a startup has done – whether they have an MVP or proof-of-concept and sometimes an entrant in the market actually hasn’t had access to the capital to prove their solution. Unlike most software and tech solutions that are digital and have low-cost entry barriers – energy is capital intensive and developing prototypes often requires significant investment.

“It is hard to prove that a startup has a great investable initiative since many startups in Zimbabwe do not have the funding to deploy proof of concepts (MVPs) that produce notable traction and attract investors. In markets like South Africa and Nigeria for example – they have supportive structures like incubators, accelerators and partnerships which substantially fund startups to create minimum viable products and be investor ready.”

Tinaye Makoni – Skicc Tech co-founder

Nyangani in turn highlighted that the innovation in some parts of the region was still too low and some of the solutions being deployed were not scalable into other countries which made their effectiveness questionable but also limited the potential size of the market for the solution.

“Are you building something innovative enough that will force investors to back you because they feel in a year or two you can take that solution and start operating in countries like Zambia, Namibia or South Africa? If investors believe in your technology and team then they will back you.”

Leroy Nyangani – NeedEnergy co-Founder

Another thing highlighted by the founder was the talent gap. Given that energy solutions deal heavily in science and mathematics, if you don’t have the engineering and science talent to build out these solutions it’s hard to build out solutions that move the needle. Where this compounds for startups is that these skills are in demand globally and so what are the odds that they end up in a small startup?