From the Zimbabwean context, air travel is a relatively rare form of travel. Looking at the border between Zimbabwe and South Africa, around 3 million road passengers cross the border versus just 400,000 Air Passengers. There is a 7.5X gap between the two when looking at traffic volumes. So it seems quite odd that given these pre-COVID numbers FlySafair, a relatively small airline by number of routes and number of passengers, would pick up the already airline-populated Harare Johannesburg route. Moreover, it came in with a strategy that aims to lowball every other airline servicing the route.

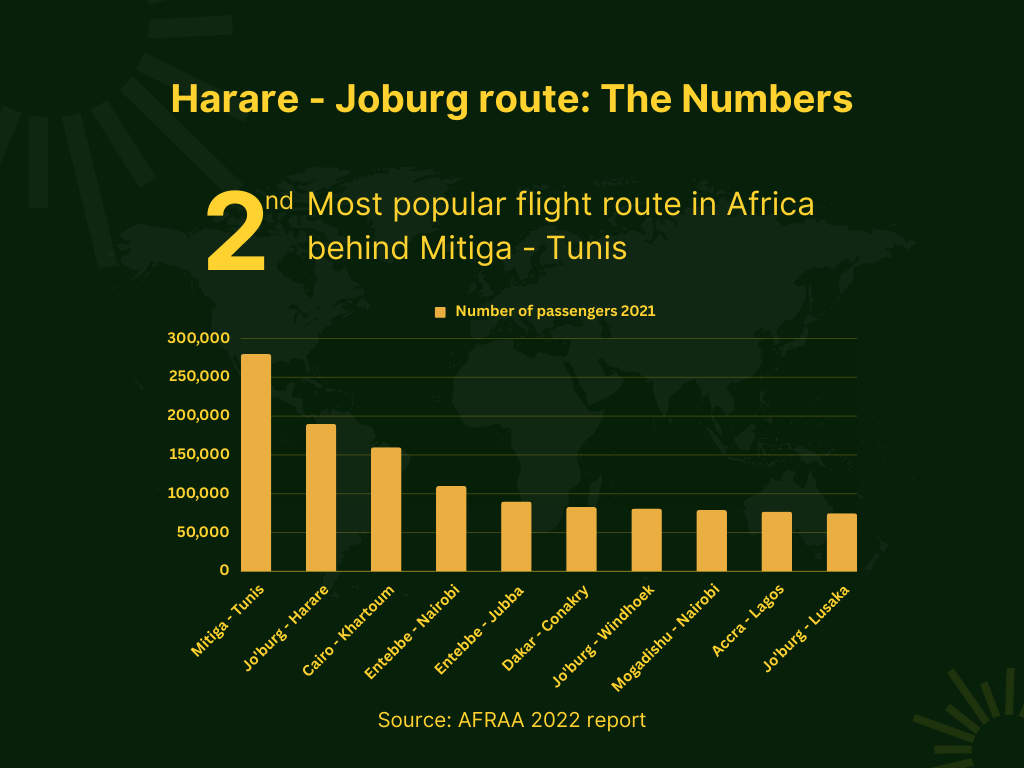

Harare – Joburg route. The Numbers

10 major airlines pass through the Robert Mugabe International Airport with 8 of them servicing the Harare-Johannesburg route. In 2021, this route was the second most popular Intra Africa route with around 180,000 passengers and 7 daily flights. With an average ticket price of US$150, it leads to this route having a market cap of US$27 million.

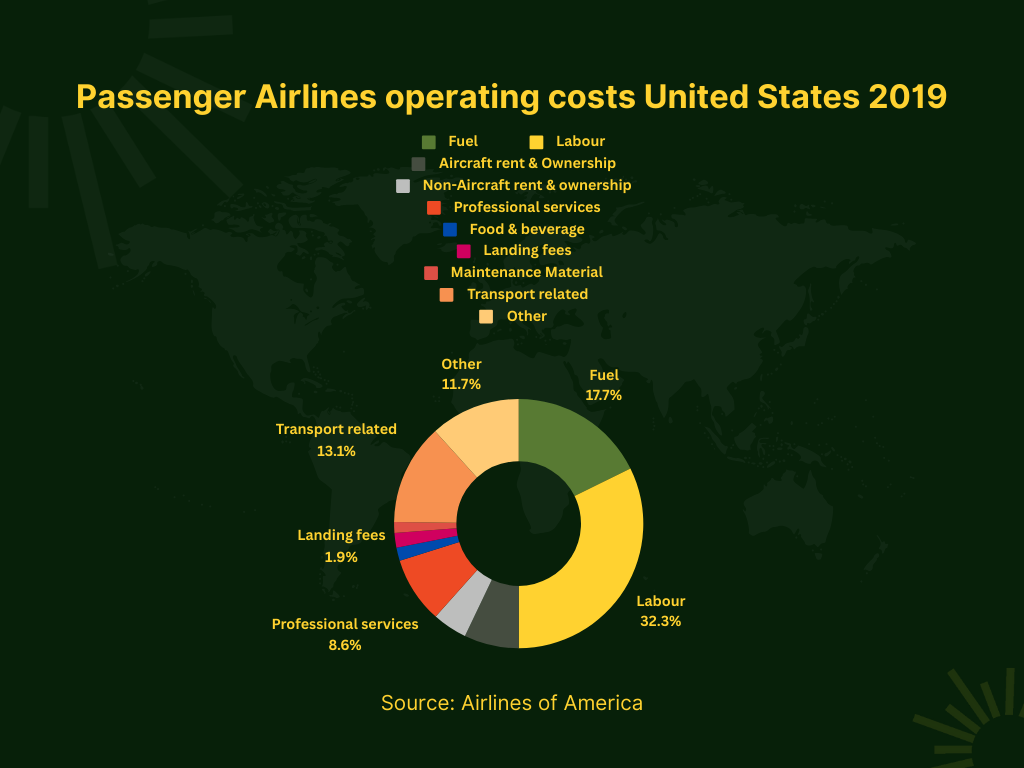

Typical airline costs – General breakdown

Labor was the most important operating cost of an airline, accounting for about 32.3% of the total expenses in the United States in 2019. This included the wages and benefits of pilots, cabin crew, ground staff, and other employees. Labor costs were also influenced by the level of unionization, the seniority of the staff, and the productivity of the workers.

Representing about 17.7% of the total expenses fuel costs were the second biggest and are highly variable and depend on the price of oil, the fuel efficiency of the aircraft, the distance and duration of the flight, the load factor, and the weather conditions. Fuel costs can also be affected by the hedging strategies of the airlines, which involve buying fuel in advance at a fixed price to reduce the risk of price fluctuations.

Maintenance came in 3rd accounting for about 10.8% of the total expenses. Maintenance costs include the direct airframe and engine maintenance costs, as well as the overhead costs of hangars and spare parts inventory. Maintenance costs are influenced by the age and type of the aircraft, the frequency and intensity of the inspections and repairs, the availability and quality of the spare parts, and the outsourcing of the maintenance services.

Ownership costs include the depreciation, leasing costs, and insurance of the aircraft accounting for about 9.4% of the total expenses in the United States in 2019. Depreciation is the accounting measure of the loss of value of the aircraft over time, assuming a certain operating life span. Leasing costs are the payments made to the lessors who own the aircraft and rent them to the airlines. Insurance is the cost of protecting the aircraft and the passengers from accidents and damages.

Other operating costs of an airline include the costs of renting terminal facilities and gates, professional services (such as advertising and legal), landing fees, airport and government taxes, overflight fees, and ground handling fees. These costs accounted for about 29.8% of the total expenses in the United States in 2019. These costs vary depending on the airport, the country, the flight route, the time of the day, and the level of competition.

Legacy Airlines failing to find sustainable

Air Zimbabwe’s financial troubles

The financial situation of Air Zimbabwe is dire. The state-owned airline has accumulated losses of US$407.84 million, while total liabilities exceeded assets by US$380.22 million, further casting significant doubt on the airline’s ability to continue as a going concern. The airline has been struggling with huge debts, viability problems, unsustainable routes, and a weak balance sheet, which have led to its reconstruction order/administration in 2018 to prevent legal action and the attachment of assets.

To rescue the airline, Air Zimbabwe was on a number of occasions either put under administration or bailed out by the Government of Zimbabwe. The airline also faced operational challenges due to the COVID-19 pandemic, which forced it to suspend all flights in March 2020. It has recently resumed some domestic and regional flights, but it still faces stiff competition from other airlines which has since gotten even stiffer with the entry of FlySafair on the second most popular route the airline has access to.

Comair cutting corners to stay competitive

Comair, a South African budget airliner had its licence revoked over safety concerns regarding their aircraft. The airline faced multiple incidents in the month of February 2022 that caught the eye of the South African Civil Aviation Authority (SACAA) leading to them suspending Comair’s operating license the following month.

One Mile At A Time

- Three “level 1 findings,” which is when a situation poses an immediate risk and must be addressed immediately

- One “level 2 finding,” which is when a situation must be addressed within seven days

The reasons behind these lax safety measures were in part contributed by their failure to secure funding to recover financially from the debts accrued as a result of the travel restrictions during the pandemic that forced them and all other airlines to ground their fleet.

The airline was also in the middle of being restructured through a business rescue process.

A series of flight cancellations and suspensions due to safety issues, regulatory compliance, and cash flow problems, have damaged its reputation and customer loyalty.

Comair also has to contend with a competitive market environment, where it has to compete with other airlines such as FlySafair, Airlink, and Mango, as well as the state-owned South African Airways, which has received billions of rands in government bailouts.

Comair’s business rescue practitioners have been trying to find a solution to the company’s financial woes, but they have faced several delays and obstacles. The latest update from them was on June 2, 2022, when they announced that they were in advanced discussions with potential funders and hoped to resume flights soon. However, as of December 4, 2023, there is no official confirmation on whether Comair has secured the necessary funding or when it will resume its operations.

Zambia Airways and a rocky start to the national airline’s relaunch

Zambia Airways (the national airline of Zambia), which was relaunched on December 1, 2021, after being defunct since 1994. The relaunch of Zambia Airways was a joint venture between the Zambian government, through the Industrial Development Corporation (IDC), and Ethiopian Airlines, which owns 45% of the shares.

It received its first aircraft, a Bombardier Dash 8 Q400, on November 30, 2021, and conducted its inaugural flight from Lusaka to Ndola on December 1, 20213. Zambia Airways plans to introduce additional domestic routes to Mfuwe and Solwezi and regional destinations to Johannesburg and Harare in the first quarter of 2022.

The national airline has also faced allegations of gross abuse of workers’ rights by its Chief Executive Officer, Bruk Endeshaw, who is an Ethiopian national appointed by Ethiopian Airlines.

Zambia Airways has also faced challenges in securing funding from its investors, complying with safety and regulatory standards, and competing with other airlines in the market, especially the state-owned South African Airways, which has received huge government bailouts

How is FlySafair thriving where other airlines are fumbling?

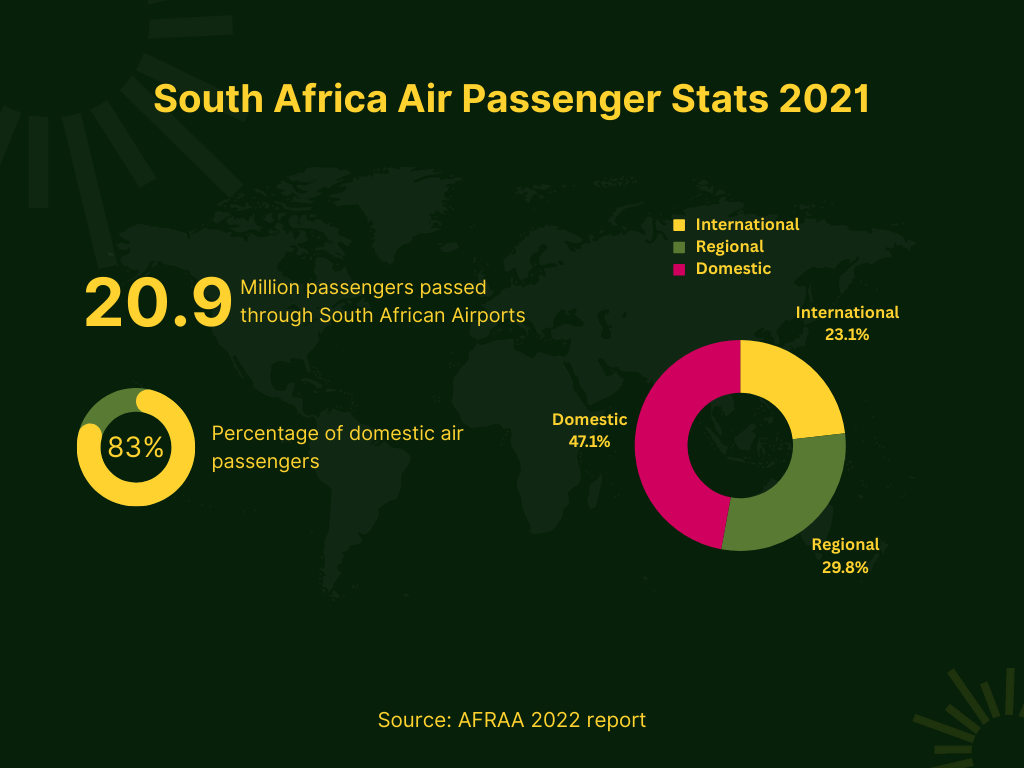

FlySafair is based in South Africa, the country with the highest air passenger traffic in southern Africa and the second highest on the continent behind Egypt. In 2021 the number of air passengers recorded in South Africa was 20.9 million of which 83% (17,347,468) were domestic passengers. This makes South Africa the second biggest market on the continent when it comes to air travel.

These are the sort of numbers that could get an enterprising airline to find some success. However, Comair and its sub-brands did not manage to crack this market so in as much as South Africa is pulling in the numbers, it is not a silver bullet.

What seems to be working in favor of FlySafair is that it is a subsidiary of Safair operations, an airline business operating in multiple markets including North Africa, The Arctic, and Antarctica offering a suite of aircraft services including cargo and humanitarian aid. They have been in the aviation business since 1965 which is longer than most airlines servicing Africa have been around.

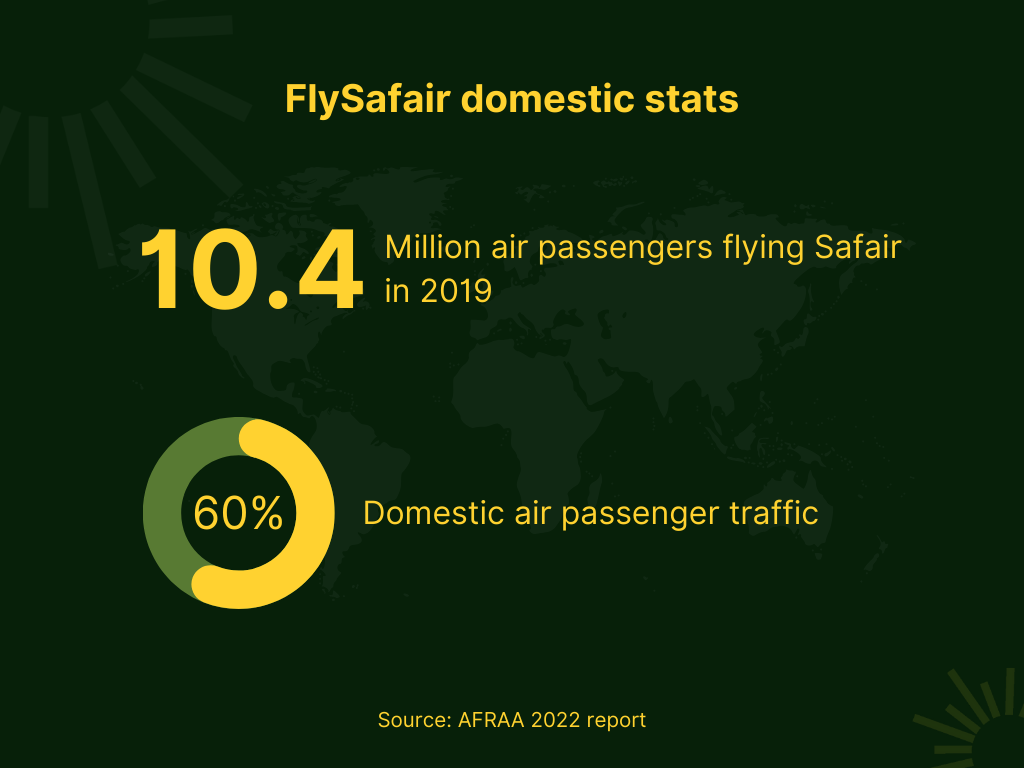

Leveraging this aviation experience got them to feed off Safair’s operational infrastructure and expertise and since the inception of FlySafair as a low-cost airline, it has managed to claim 60% of the South African Market’s domestic traffic (10,408,200) as well as increase its fleet from 2 to 9 passenger aircraft. They also claim to have reduced fares for the routes they operate in by up to 39% whilst crucially maintaining a 96% on-time performance (+/- 15 minutes from stated departure time) which informs that in as much as the airline has pocket-friendly fares, it was also a reliable airline, the biggest crowd pullers for business travelers.

To add to the wealth of experience and expertise that FlySafair can take advantage of, Safair, their parent company, has a joint venture partnership with ASL airlines with airlines operating in Europe, Asia, South Africa, and Australia.

Since they already have a solid handle on the South African domestic market, the next step for FlySafair was to disrupt the second most popular route in Africa, Harare – Johannesburg where the dynamics are similar in terms of the airlines operating this route compared to the airlines operating within South Africa. Where they pose a big threat to airlines capitalizing on this route is that FlySafair is not a stranger to a good proportion of passengers flying the route, owing to their positive reputation in South Africa.

FlySafair seems to have a huge advantage in economies of scale from their domestic business in South Africa. This muscle is further buttressed by a wealth of experience and expertise from its parent company Safair and its venture partnerships with ASL, something the rest of the airlines flying intra-Africa routes do not have. With this economy of scale, they have been able to not only jump onto the Harare – Johannesburg route but also make the competition sweat by undercutting them all on ticket prices.