Online retail is a long-standing area of interest for retailers/merchants. Having observed the phenomenon rise to prominence in countries like China and the USA, businesses all over the world are trying to varying degrees to embrace this method of transacting. Africa is no exception though we recently outlined the factors presently limiting e-commerce on the continent.

As a follow-up to that article, we thought it apt to take a closer look into one of the few retailers that has experienced well-detailed growth in online retailing within the African context – Woolworths SA.

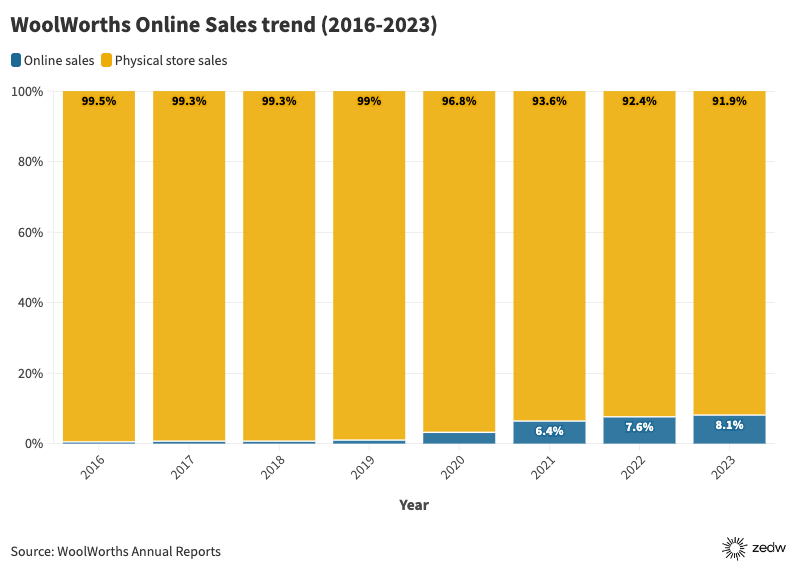

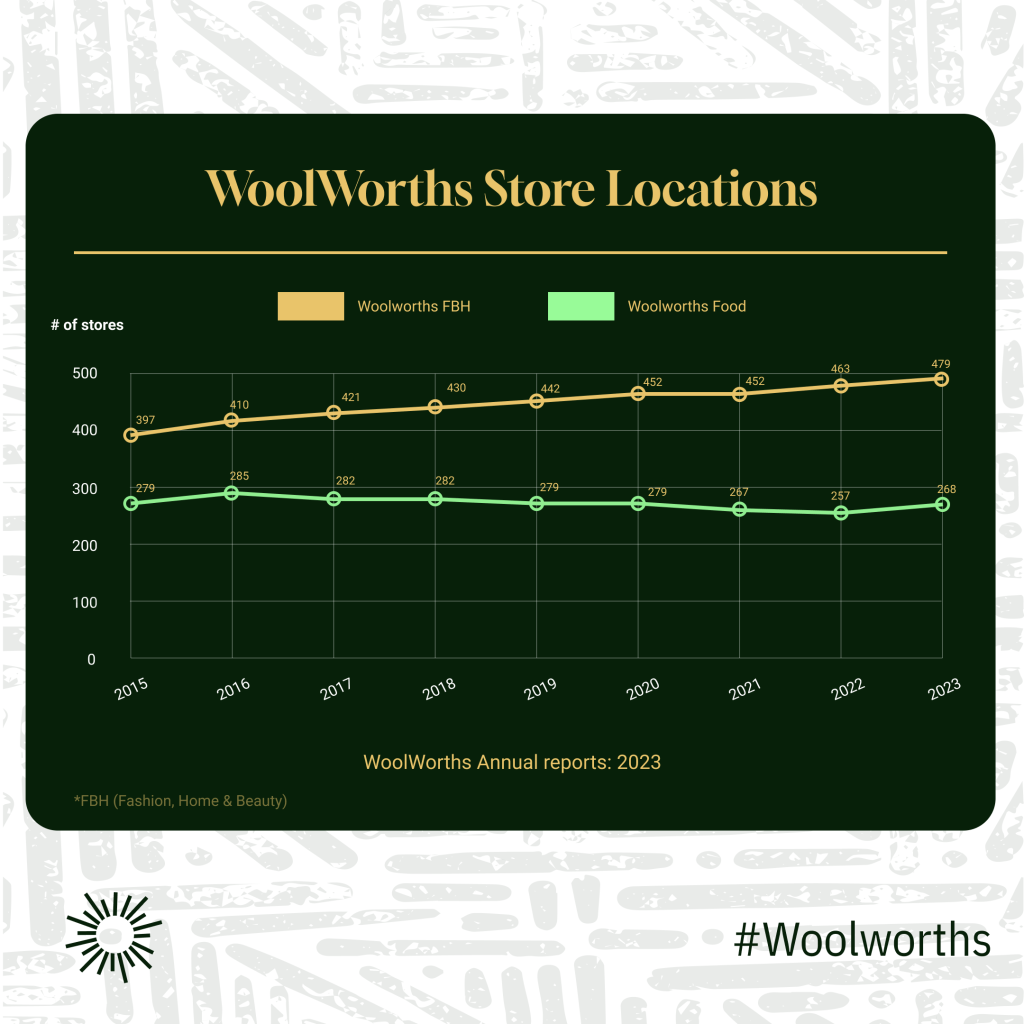

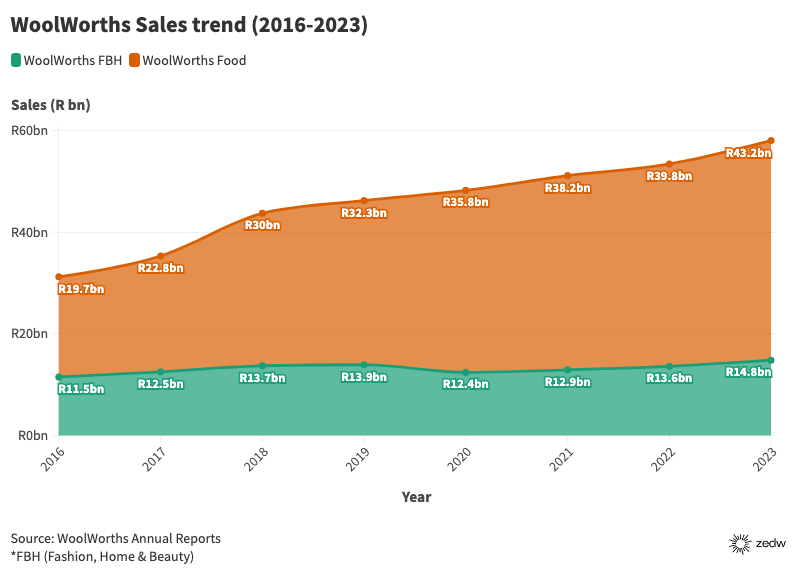

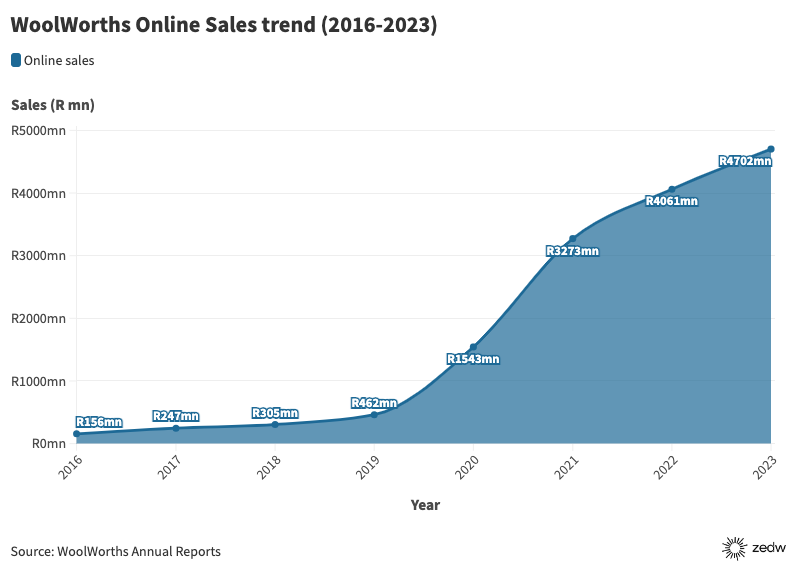

Split between its Fashion, Beauty and Home (FBH) and Food divisions, online retailing grew to represent 8.1% of all WoolWorths sales – a far cry from online sales share of 0.5% back in 2016. We analysed annual reporting by WoolWorths over an 8-year stretch to better understand what drove this 16.2x growth over an 8-year period.

Shifting focus…

In 2015, WoolWorths briefed investors on the evolving retailing landscape. The retailer noted how they expected the internet to play a bigger role in retail experiences going forward:

“Online retailing in South Africa is still developing, having been historically constrained by infrastructure, lack of choice and security/payment concerns. However, the increasing penetration of smartphones, improving broadband accessibility, significant corporate activity (in both pureplay and ‘bricks and clicks’) and continued strong online sales growth, signal that consumer behaviour and market dynamics are shifting. While stores will remain the dominant channel for Woolworths South Africa in the coming years, our customers are increasingly researching our products online before buying in store or online. Consequently we remain committed to improving our service for online customers and growing and improving our digital presence.”

WoolWorths Integrated annual report | 2015

When you consider that this is reporting from a decade ago, it’s quite interesting to note that WoolWorths at the time was already integrating the internet in its shopping experience though sales online were still quite low. Back then however customers could view and purchase items online – with WoolWorths Food comprising the majority of online revenue (undisclosed and probably insignificant) at this moment in time.

An important thing to note however from these 2015 results was that shareholders were already being informed on how the business was investing in the supply chain with a view to, “enhance store replenishment and online fulfilment capabilities.” WoolWorths felt this investment would lower transport costs along with improving delivery lead times. It’s interesting to note that the online customer experience was already being refined even though online sales were almost certainly below 0.5% at this time.

Another key detail revealed during this period of reporting was the target customer with the business outlining that their primary focus was on “upper-income customers”. The reason given for this in the report was the resilient spending customers in this group had even during challenging economic times. Focusing on this customer segment has an added benefit as it meant WoolWorths were already catering to the demographic best placed to make use of e-commerce services as they tend to come with a price premium (delivery fees).

Growth starts to kick in (2016-2019)

During this four-year stretch a few things of note happened. WoolWorths Holdings Limited (WHL) started disclosing the share of online sales for their Africa business – a change in tact as before they were sharing these figures for their Australia and New Zealand business. During this period online sales grew modestly from 0.5%-1% of total sales. As a percentage it sounds negligible but the online sales during that 4 year stretch amounted to R1.1bn (US$60mn using current exchange rates);

| Year | Online Sales(R, mn) |

| 2016 | R156mn |

| 2017 | R247mn |

| 2018 | R305mn |

| 2019 | R462mn |

During this period we wanted to track what actions were being taken within the business that could have stimulated demand and we flagged the following:

2016 (online sales grew by 25%)

Improvement in the conversion rate of online purchases was driven by:

- increasing site speed,

- enabling upfront delivery slots selection and;

- launching various site enhancements such as interactive ‘look books’ and bigger images.

During this year, WoolWorths also started work to expand their capacity through building “a new long life Food distribution centre in Cape Town.” This facility went into operation in 2018.

2017 (online sales grew by 33%)

WoolWorths revealed that they had 4 distribution centres, 3 cross-dock facilities and 1 outsourced online fulfilment centres in South Africa. These facilities play important parts in the execution of e-commerce;

| E-commerce backbone facilities | Functions |

| Distribution Centre | |

| Storage and Inventory Management | |

| Order Fulfilment | |

| Reducing shipping costs | |

| Cross-dock facilities | |

| Sorting of goods for delivery | |

| Reducing wait times | |

| Outsourced online fulfilment centre | |

| Third-party logistics provider handles delivery | |

| Increased scale | |

| Lower overheads |

It could be that the online fulfilment centre referenced in the above table was the “new online fulfilment model in clothing, improving the availability and customer service” that WoolWorths pointed out to shareholders in their 2017 annual reporting. Beyond this, WoolWorths also introduced free WiFi in their stores during this year. Some of the touted benefits of having WiFi in-stores include increasing shopping time along with being able to collect data on customers usage patterns during their sessions whilst in-store.

“Our customer’s expectations are changing radically. We see connectivity as key to a rich in-store experience. Customer free wi-fi is our next big step, and Cisco will help us roll it out.”

Patrick Misciagna| Woolworths general manager of IT, service, operations and infrastructure

In WoolWorths case it was highlighted that the free WiFi service was meant to ensure that customers could always use their WoolWorths loyalty apps whilst in-store even at times when mobile networks where being erratic. The free WiFi coincided with the launch of this app which WoolWorth claimed had “improved capability and functionality, including seamless integration with media content, enhanced search and product information, and the ability to shop online via the app.” The free WiFi was implemented across 150 stores (21% of all stores at the time).

All these efforts meant that WoolWorths Food and FBH grew their online sales by 21.7% and 98.7% respectively during 2017. The growth in Fashion, Beauty and Home division were attributed to the opening of “dark store”. WoolWorths dark stores are essentially supermarkets that aren’t open to the public. They focus solely on fulfilling online grocery orders for home delivery or click-and-collect services.

In 2017, VISA and Euromonitor were estimating that South Africa’s online retail market had reached approximately R10bn. Using this estimate, WoolWorths was capturing around 2.5% of that entire market. That same study estimated that online retail in South Africa was only 1% of the total retail market compared to 18% in the United Kingdom – suggesting that at this point South Africa was lagging behind significantly.

2018-2019 (Online sales grew by 33% and 28.8% respectively)

During this period online sales continued to grow but less details were shared regarding strategy which might indicate that not much noteworthy actions were being taken by the business to further stimulate online retail – understandable given the flurry of activity from the years prior.

One interesting detail to note during this time was that WHL noted that e-commerce was not being adopted at a similar rate as in its other territories;

“Online shopping in South Africa has yet to take off as it has done in Australia, but we expect the same trend to happen over time and are already seeing good growth across the board off a relatively small base.”

WoolWorths Integrated annual report | 2019

Whilst online sales had finally reached the 1% mark by 2019 during the same period online sales for WHL businesses in Australia had reached 20%. This is an interesting stat that illustrates how businesses employing comparable strategies across different regions can have vastly different outcomes due to market variations.

2020 (online sales grew by 57.2%)

“For us to remain relevant and successful, as a brand and as a business, we must fast-track the building of our online capability and fully appreciate the way our customers now live their lives in the digital ecosystem.”

WoolWorths Integrated annual report | 2020

As tired as I am of writing (and you’re of reading) that 2020 was a year that will go down in history it has to be said again. The COVID-19 pandemic forced the entire working world to change their approach to what it meant to deliver products/services and naturally it was no different for WoolWorths.

Share of online sales grew from 1% the year before to 3.2% – the first big jump in growth since we started tracking the numbers. In monetary terms that was a growth from R462mn to R1,543bn. WoolWorths was well placed to take advantage of the pandemic given that they had been expanding their e-commerce capacity for half a decade at this point.

This is not to say that they were not overwhelmed – WHL made some important changes to their service offering this year. In over 60 of their stores, they rolled out click-and-collect services which allowed customers to order and pay for food online and have staffers deliver it to the customers vehicle once the customer came to the store. Beyond this, WoolWorths also introduced contactless delivery along with increasing their delivery capacity by 50% and all this meant that online sales growth passed the 50% mark for the first time in half a decade.

2021 (double digit growth in share of online sales)

“We will drive online sales, leading with mobile first, by increasing speed and functionality as well as through the introduction of various tactical initiatives. These initiatives include increased personalisation, expanding delivery options, launching exciting product pages, and enhancing digital marketing and social media strategies.”

WoolWorths Integrated annual report | 2021

Share of online sales doubled from 3.2% to 6.4% this year and WoolWorths continued to add more online-centric features/services to ensure continued use. 2021 was the year of WoolWorths Virtual Try On and Virtual Consultations – augmented reality experiences meant to “help consumers reinvent their beauty shopping experience at home and gain more confidence before making a purchase.”

Virtual Try On allowed customers the “opportunity to try on hundreds of shades of lipsticks, eye shadows, and mascaras.” Consultations was a partnership between WoolWorths, Estee Lauder and Clarins and it gave customers access to “one-on-one consultations with beauty specialists from their home.”

WoolWorths Food also got Woolies Dash, a same-day delivery service during 2021. Dash would become a key-focus for Woolies in the 2022 and 2023, making multiple appearances in the following year’s reporting.

2022

In 2022 – the effects of the pandemic were starting to wear-off but the share of online sales managed to continue on an upward trajectory (7.26%) even if growth was much more modest than in the previous two years. WoolWorths interestingly highlighted that focus on online-centric initiatives would have to be measured as there was a risk of eating into profits:

“We continue to fast-track our online capability to provide our customers with seamless shopping experiences, regardless of the channel through which they wish to engage. However, this is a balancing act in terms of meeting customer needs without unnecessarily eroding profit margins, particularly in the case of Food where online is notably margin dilutive.”

WoolWorths Integrated annual report | 2022

The reports for this year did highlight that the company felt there was still “significant runway to increase online sales”, testament to the fact that eCommerce is still in its emergency even in South Africa, Africa’s biggest consumer market.

WoolWorths also pointed out an interesting regional dynamic between their Australian and South African operations. The online business in Australia was described as more “margin accretive” i.e more profitable than the brick-and-mortar stores.This was not the case in South Africa and WoolWorths promised shareholders they would rely on Woolies Dash to make their online business in South Africa more profitable.

In 2022, Woolies Dash was now available from 48 stores and within the WoolWorths app. The in-app integration was a cost-saving mechanism as all online traffic would be consolidated into a single platform. The company revealed that Dash accounted for 40% of WoolWorths Food online sales.

2023 (online sales grow to 8.1%)

In the most recent year of reporting, share of online sales grew to 8.1%. Woolies Dash doubled its store presence to 100 locations with business saying the service now covered the overwhelming majority of customers. The service expanded to offer an on-demand food offering and has become key to WoolWorths online strategy driving customers to spend more:

“Dash has been a key focus area in driving online sales in our Food business and is delivering results by attracting new customers who are spending more in terms of average basket size.”

WoolWorths Integrated annual report | 2023

Dash also got it first dark store in Cape Town which is meant to serve WoolWorths Food urban customer base by increasing capacity for more delivery slots and extending delivery hours.

Beyond the reports & other dynamics affecting WoolWorths growth in online retail

Outside of WHL annual reporting WoolWorths social media growth over the last 10 years is also another pointer to how the company has ensured the brand is internet native. In 2013 WoolWorths had 288,868 and 80,717 Facebook and Twitter followers. In 2024, these metrics have grown to reach 2,1mn and 691,974 respectively.

Presently the retailer uses these social media channels to engage with customers in different ways including sharing helpful tips on recipes, advertising sales and deals along with highlighting interesting initiatives the retailer is a part of.

It also helps that WoolWorths was established in 1931 and so it can be viewed as a brand consumers trust to use when making purchases online. A 2021 study on factors influencing adoption of online retail in the Eastern Cape in South Africa noted that the issue of trust is a big factor. From their 102 person survey, 59% of respondents were either uncomfortable(44%) or neutral (15%) with the reputation of online retail shops in general. This suggests that this distaste is one of the reasons for low adoption of e-commerce – but for a brand like WoolWorths that has been operational for nearly a 100 years consumers probably feel safer engaging in purchases over the internet…

Ultimately, WoolWorths e-commerce journey illustrates many things about Africa’s e-commerce market quite perfectly. Without 2020’s pandemic – it might actually be that the whole industry would still be middling. WoolWorths is a business that has both the financial muscle and strategy in place to take advantage of online retail but even with all these chips in place – the market is still in its infancy and that’s largely why the retailer’s online share of sales is still in single digit figures…