The International Monetary Fund (IMF) recently completed a mission to Zimbabwe and we decided to take a sober look at the institution’s point of view on what is happening in the country’s economy along with some of their proposed solutions.

IMF Mission – what and why?

Essentially – IMF Missions are activities undertaken by the IMF in collaboration with specific member countries. The missions have a number of broad goals, but it all comes back to, “supporting economic policies that promote financial stability and monetary cooperation” with a view to ensuring productivity is increased, jobs are created and there is economic well-being in IMF Member countries.

In order to achieve all this, IMF undertakes missions i.e. sending its own staff to member countries to assess the state of the economy, meeting with key public officials and then the organisation issues a mission statement. The mission statement is meant to be a summary of sorts – the positive and negative things the IMF are observing in a country. All this is accompanied by advice on possible solutions to try and address the bad.

The missions are important because they are one of many “tools” used to assess a country’s creditworthiness. So if the IMF feels a country has good governance along with a well-performing economy, said country is able to borrow money for development financing – used to fund projects throughout the country- from the IMF.

So, what’s the word on Zimbabwe?

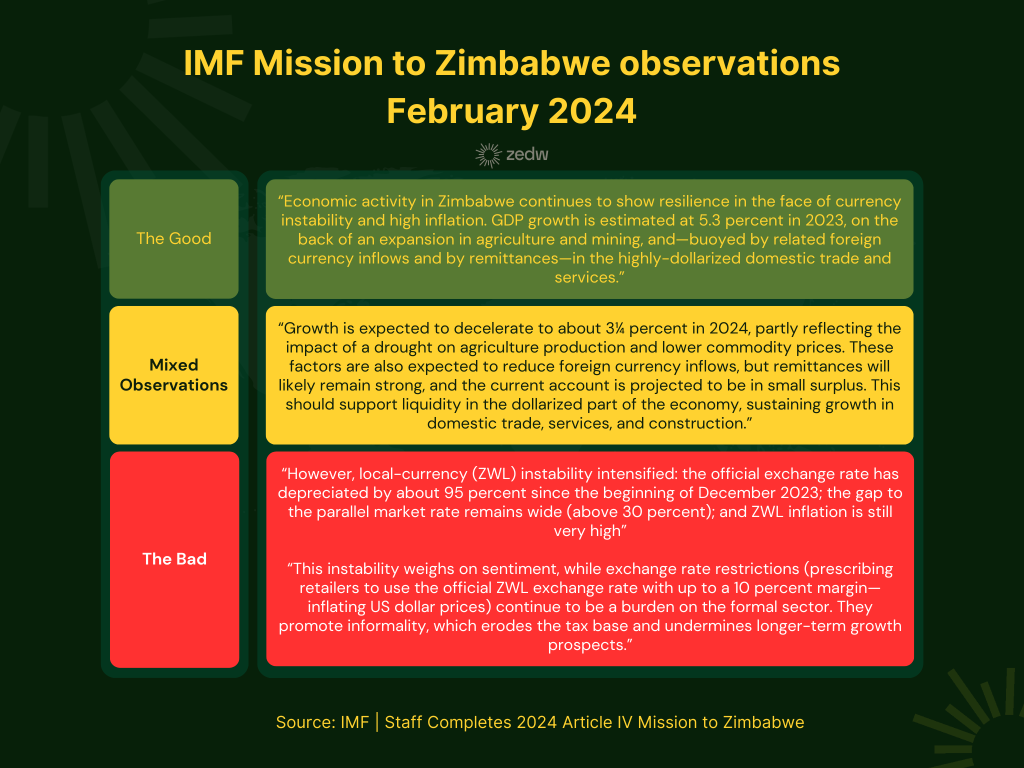

In a nutshell – things don’t look so great but there are some redeeming factors. The major positive is the economy growing by an estimated 5.3% in 2023. This growth was on the back of agricultural and mining activity – both of which were spurred by remittance inflows. Beyond this though – things start to fall apart…

Outside of the government’s control – the ongoing drought is expected to eat away at economic growth this year.

Within the government’s control – things still don’t look great either. The IMF continues to view the artificial foreign currency exchange limitations the government continues to insist upon as ruinous. The organisation doesn’t understand why retailers are forced to trade using a rate which isn’t reflective of what’s happening on the ground – where FX rates are significantly higher than the government-imposed alternatives – i.e the 30% gap noted in the above table.

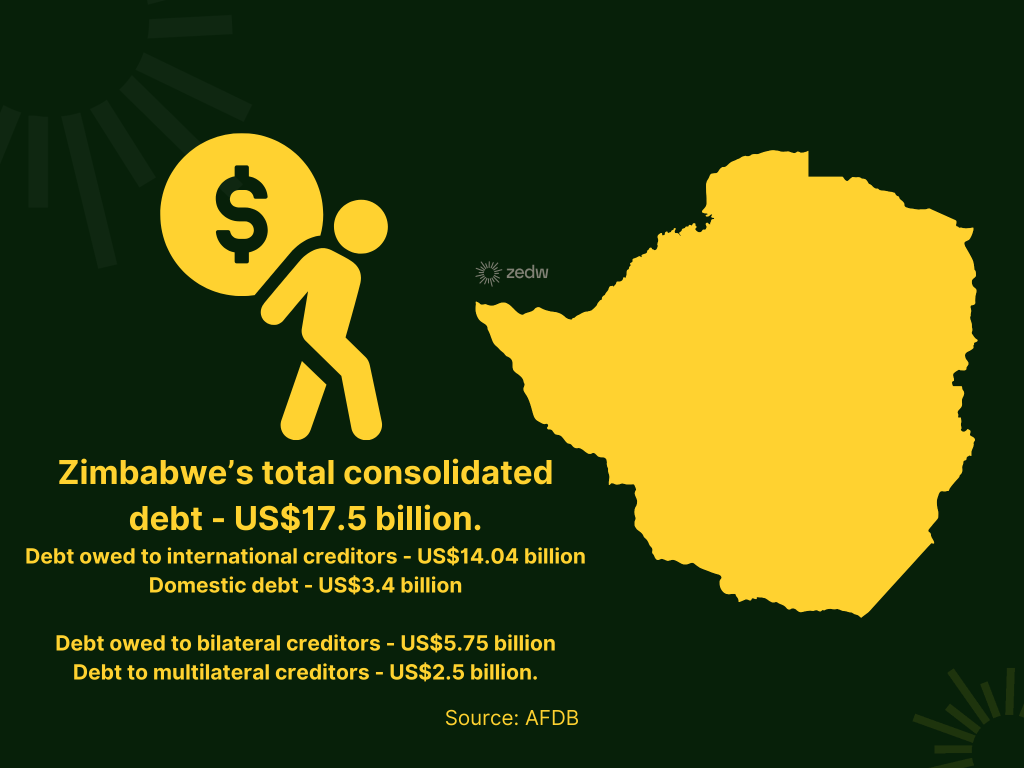

The effect of these policies is a promotion of informality which is terrible for the government. Informality tends to mean a smaller tax base which in turn reduces funds available for the government to finance projects. Less government projects tends to mean lower economic activity/growth. All of these are outcomes Zimbabwe can’t afford at the moment. This is especially so since the IMF is “precluded from providing financial support to Zimbabwe due to its unsustainable debt situation and official external arrears.”

A shrinking taxing base is a disaster as the government doesn’t have many alternative lenders willing to lend them money to ensure development takes place. This is a problem many African countries face and we explored how the AU is looking into fixing the issue of credit ratings for African countries.

Read More: Will the African Union’s Credit Rating Agency solve continental financing woes?

Either way, remember this the next time that Zimbabwe’s government comes up with an absurd tax-based solution that seemingly makes no sense. In essence some of these tax policies are meant to undo the harm being inflicted by the very same government’s policies i.e. exchange rate controls. The government itself won’t admit as much but the IMFs statement makes it clear there are conflicts as we’ll see in their proposed solutions.

What does the IMF propose as solutions?

Obviously, the International Monetary Fund isn’t a fan of the existing exchange rate controls – we’ve established that much.

“The mission encourages the authorities to accelerate the FX market reform by promoting a more transparent and market-driven price discovery in the official exchange rate and by removing existing exchange restrictions and distortions. In particular, the restriction on the 10 percent allowable trading margin for pricing domestic transactions should be eliminated.“

– IMF Mission Statement on Zimbabwe | February 2024

So not only should the government not interfere with exchange rates – they also shouldn’t interfere with retailers. That’s simple and straightforward…

One of the more surprising solutions suggested by the IMF is that the central bank amends its own act in order to “to narrow its legal mandate to core functions”. This part isn’t expanded on, but it suggests that the current act assigns the RBZ with responsibilities beyond its core functions, potentially leading to inefficiencies and conflicting priorities.

Interestingly another solution was linked to the recently established Mutapa Fund – Zimbabwe’s sovereign wealth fund:

“Structural reforms aimed at improving the business climate, strengthening economic governance and reducing corruption vulnerabilities are key for promoting sustained and inclusive growth and would bode well for supporting Zimbabwe’s development objectives embodied in the country’s National Development Strategy 1 (2021-2025). In this context, the mission encourages the authorities to ensure that the corporate governance arrangement, transparency and financial reporting, and accountability oversight of the recently established Mutapa fund are in line with international standards and good practices.”

– IMF Mission Statement on Zimbabwe | February 2024

To be fair quite a few points were explored in this section and we probably need to highlight it as well before going into the bit regarding the wealth fund. In essence, the IMF is calling for;

- ease-of-doing business reforms;

- improved management of public finances, increasing transparency and accountability, and combating corruption and;

- addressing loopholes in systems and processes that create opportunities for corrupt activities.

Read More: Startup ecosystem in Zimbabwe: Innovation Exodus the lesser known brain drain

Perhaps these three elements are being linked to the Mutapa Fund because the IMF sees the wealth fund as potentially being able to play a significant role in Zimbabwe’s development and having it be compromised by previously documented bad practices would be a missed opportunity.

Lastly, the IMF believes that sustainable development will also require “resolution of the debt overhang.” This is a key issue given that development financing will have to come from somewhere and there won’t be too many creditors forthcoming as Zimbabwe owed US$17.5 bn at the halfway point of 2023.