The mining industry in Zimbabwe has long been viewed as a potential saviour for the country’s struggling economy, with billions of dollars in revenue and a promising growth trajectory. However, recent reports suggest a more pessimistic outlook for the industry, as rising costs, inadequate infrastructure, and geopolitical tensions take their toll. With mineral revenue set to decline and profitability fading, mining executives will need to find innovative solutions to keep the industry afloat in the coming years.

The recently released State of the Mining Industry report paints a bleak picture for the industry in the coming year. The report by the Chamber of Mines has painted a gloomy picture of the country’s fortunes in the coming year, with mining executives anticipating dark times ahead.

In this article, we summarise what the report says with an analysis of the Zimbabwe mining industry’s historical performance taken into context.

How did the Zimbabwe mining industry perform between 2019-2023?

Based on data from the USGS Mineral Yearbook, Zimbabwe’s nominal GDP (i.e. total market value of all goods/services produced in a country’s economy over a given period) at market prices amounted to approximately $19.1 billion in 2019. Zimbabwe’s mineral production accounted for a significant portion of global output, including;

- 7.3% of the world’s platinum,

- 5% of the world’s palladium (used in making catalytic converters for cars among other things),

- 1.5% of the world’s diamonds (by weight), and 1.4% of the world’s lithium production (excluding US production).

The country is currently ranked third in platinum production, fifth in palladium production, sixth in lithium production, and eighth in diamond production. Furthermore, Zimbabwe held the third-largest platinum-group metal reserves in the world, comprising 1.7% of world reserves (Kimberley Process Certification Scheme, 20).

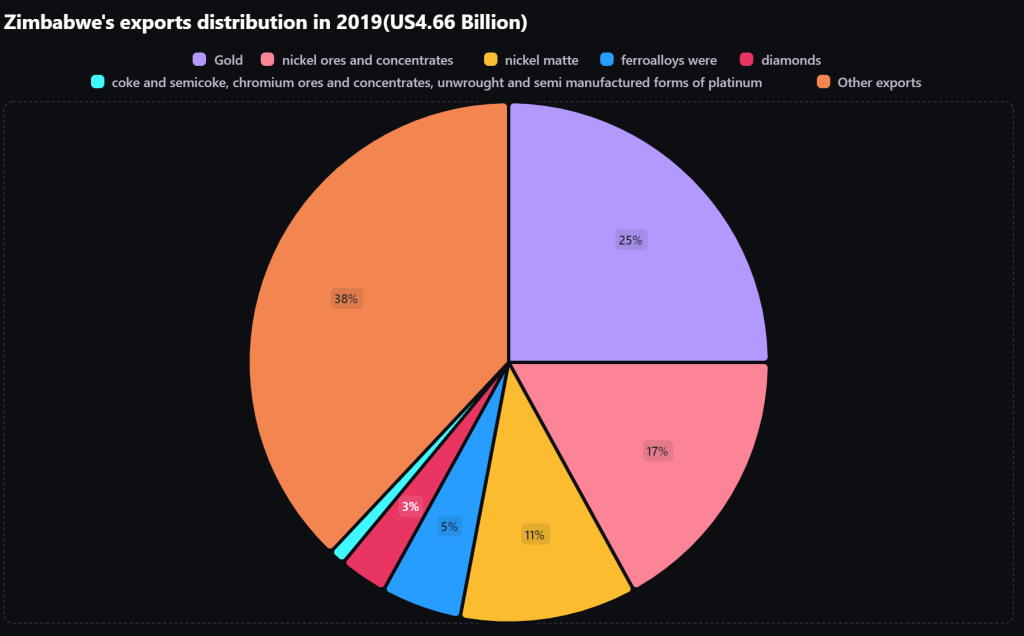

In 2019, Zimbabwe’s total exports were worth $4.66 billion, with mineral commodities making up most of the country’s exports. Gold accounted for 25%, nickel ores and concentrates comprised 17%, nickel matte was 11%, ferroalloys were 5%, diamonds were 3%, and each made up 1% of Zimbabwe’s total export value.

According to government estimates, Zimbabwe’s mining sector production increased by 3.4% in 2021, while receipts grew by 25% to $5 billion. The increase was driven by strong international prices and measures taken by the government to turn the mining sector into a $12 billion industry by 2023. Going into 2022, the government has forecasted an 8% annual growth in production which turned out to be 2% higher.

As for the Platinum Group Metals (PGM) sector, demand had increased in 2021 for a wide range of commodities, following depressed mining activities in 2020 due to COVID-19-induced lockdowns. Supply chain disruptions in South Africa and Russia helped increase global PGM prices in 2021.

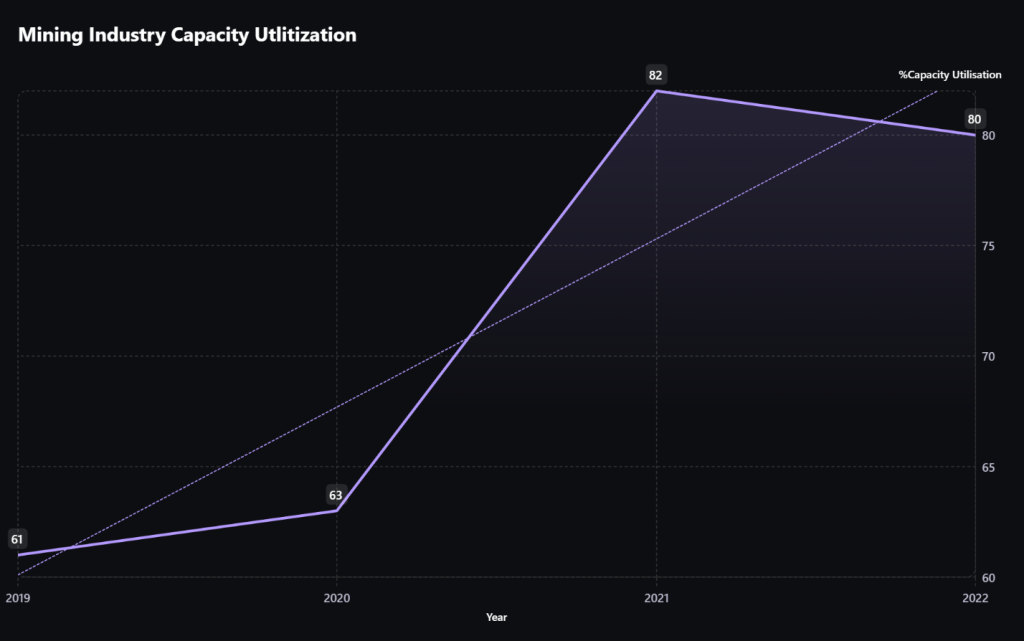

2022 wasn’t such a bad year for the mining industry. The sector had an impressive growth, with a jump from 5.9% in 2021 to 10% in 2022. Capacity utilization using existing mining infrastructure remained stable at 81%.

Gold production increased by 19%, reaching 35.2tn in 2022, marking three years of growth. Mineral exports also increased, reaching US$5.67bn, up 9.65% from the previous year. However, mining costs are expected to rise by 15% in 2023 due to power and currency issues. Forecasts predict growth between 8% and 10.4% for 2023 as we wait to see the actual figure as the year ends. However, projections have already started to anticipate a decline in growth this year, down to 7%.

This was a result of the same challenges that this latest report has singled out which are fragile power supply, high costs, foreign currency shortages, an unstable tax framework, and capital shortages.

Zimbabwe Mining Industry in 2023

As it stands, the mining industry currently contributes 70% to Foreign Direct Investment, 80% to exports, 19% to government revenues, 3% to direct formal employment, and 13.5% to National Income (GDP and GNI). All these contributions are likely to be negatively affected in the coming year, which is cause for concern.

Profitability for mining companies declined by an average of 15% in 2023 due to softening commodity prices and a high-cost structure.

Survey findings show that profitability for mining companies declined by an average of 15% in 2023 due to softening commodity prices and high-cost structure. Approximately 50% of respondents reported that they were now struggling to break even. When interrogated on profitability prospects for their businesses in 2024, most respondents (70%) indicated that they are expecting their profitability to worsen compared to 2023. Those that are expecting profitability to remain the same are mostly in the gold sector

State of the Mining Industry Report

This also comes against the backdrop of an anticipated 12 billion dollars in earnings from the mining industry which seems to be in jeopardy as well.

Report summary

Given the new report, it’s concerning that the Mining Business Confidence Index (MBCI) which gauges mining business sentiment about the industry’s prospects for the next 12 months has most respondents indicating pessimism for the future of the industry.

Notably, the report cites a depressed commodity price outlook, gloomy investment environment, and inadequate foreign exchange and infrastructure bottlenecks as key factors that weighed down the MBCI for 2024. In particular, mining executives anticipated a worsening commodity market in 2024, with prices for PGMs and base metals expected to decline given geopolitical tensions and a weak global economic outlook.

Specifically, PGM producers expected platinum prices to fall by 5%, rhodium by 15%, and palladium by 10%. Gold producers anticipated gold prices to decrease by an average of 8%, while lithium and nickel producers expected price declines averaging 14% and 10%, respectively.

Another challenge for mining executives is the new royalty increase in the PGMs and lithium sectors which were reported to be high and unaffordable, worsening viability challenges. Most respondents indicated they were expecting an unstable fiscal regime in 2024 citing recent royalty increases for PGMs and platinum as precedence for fiscal policy inconsistencies.

As a result of the above factors, mineral revenue for 2023 is set to decline by approximately 20% and is expected to further decline by an average of 10% in 2024 due to softening commodity prices. While profitability for mining companies declined by an average of 15% in 2023 due to waning commodity prices and high-cost structures, approximately 50% of respondents reported struggling to break even.

Survey results revealed that profitability for mining firms declined by an average of 15% in 2023 due to softening commodity prices and high costs. Approximately 50% of the respondents reported that they were now struggling to break even. Most respondents (70%) expect their profitability to worsen in 2024 compared to 2023, with those in the gold sector being the exception.

Despite most mining companies planning to ramp up production to compensate for revenue losses due to low prices, the production increase will be more than offset by the decline in prices. In terms of the distribution of mining companies’ revenue, payments to suppliers, electricity bills, Government, and employees are consuming approximately 88% of mining companies’ revenues.

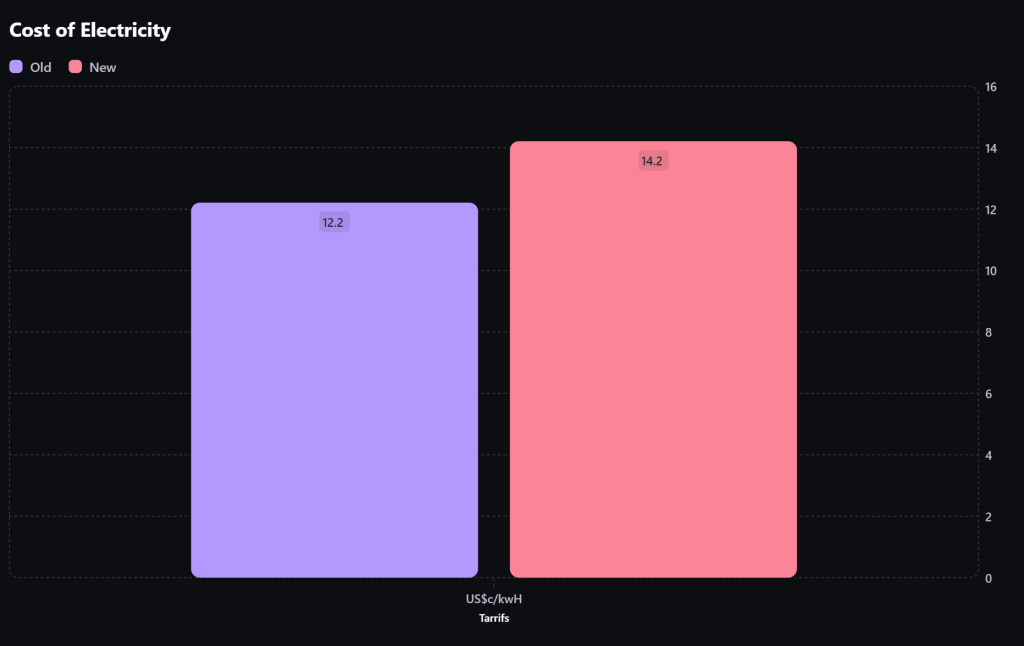

Regarding the overall cost of production, most mining executives expect an increase in 2024 citing an increase in the cost of electricity, royalty and taxes, labour costs, and financing costs. Respondents noted concern about ZESA’s proposal to increase the electricity tariff by 2 cents, which will impact the cost of production for mining companies negatively.

Analysis of survey responses shows that most key mineral subsectors including PGMs, ferrochrome, gold, and diamond sectors will experience increases in their cost of production in 2024, with high electricity charges as the major cost driver. Procurement (39%) was the major cost driver, followed by labour (32%), electricity and diesel (21%). Other costs include administration expenses.

According to the report, all mining executives expressed concern about the newly approved tariff of US$14.21/kWh, indicating that the tariff is too high and unaffordable. According to the report’s analysis, the upward tariff review from USc12.21/kWh to US$14.21/kWh will result in the proportion of electricity costs to 24%, up from 21% at US$12.21/kWh. With this review, the overall cost of production is set to increase by between 7 to 10%.

90% of mining executives indicated that they would accommodate a tariff of between USc7/kWh to USc10/kWh while 10% indicated that they would accommodate a tariff of between USc6/kWh to USc7/kWh. In sum, the situation in the mining industry is dire, and mining companies will need to find innovative solutions to mitigate the impact of softening commodity prices, rising costs, and the unstable fiscal regime.

However, it’s not all doom and gloom, as Formal employment in the mining sector is expected to increase to 57,000 in 2024 compared to 53,500 in 2023.

Moreover, across mineral subsectors output is expected to grow by an approximate weighted average of 12% in 2024. Gold and PGMs are the major growth drivers for the mining industry in 2024.

The average capacity utilization for the mining industry is expected to reach 90% in 2024, up from 84% in 2022 in line with planned production targets. Key sectors anticipated to drive the improvement in capacity utilization are gold, ferrochrome, and coal.

Cover Image Credit: Hannu Iso-Oja (via Pexels)