Selling goods and services online in Zimbabwe is tricky but some intrepid entrepreneurs are pulling it off to one degree or another… How well it is going depends on what they are selling, the channel(s) they are using, the nature of supply and demand for the product and how ancillary it is to a nation that is suffering from what appears to be a never-ending cycle of economic turmoil…

The first instalment of this series looked at the nature of internet connectivity and why the pool is extremely small because of how expensive it is to connect to the World Wide Web.

Provisionally, the conclusion that many have come to is that selling goods and services locally requires you to have a social media first approach. Trying to launch a website is a fool’s errand and there are very few people who can afford to spend more for internet access with social media and WhatsApp bundles being a no-brainer…

Understanding where to find your customer is one thing, however, comprehending who among the archetype you have built can afford it, is something else entirely.

Getting to the bottom of this is a difficult thing to do because you are essentially trying to peer into a black box. This isn’t helped by the fact that the local regulator doesn’t give granular data in its reports as to which platforms people spend their time online. It might be a privacy issue on the part of the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ) because it has been nearly a decade since it gave that kind of information.

However, that doesn’t mean it’s impossible to get closer to the answer…

How to find where people spend their time online

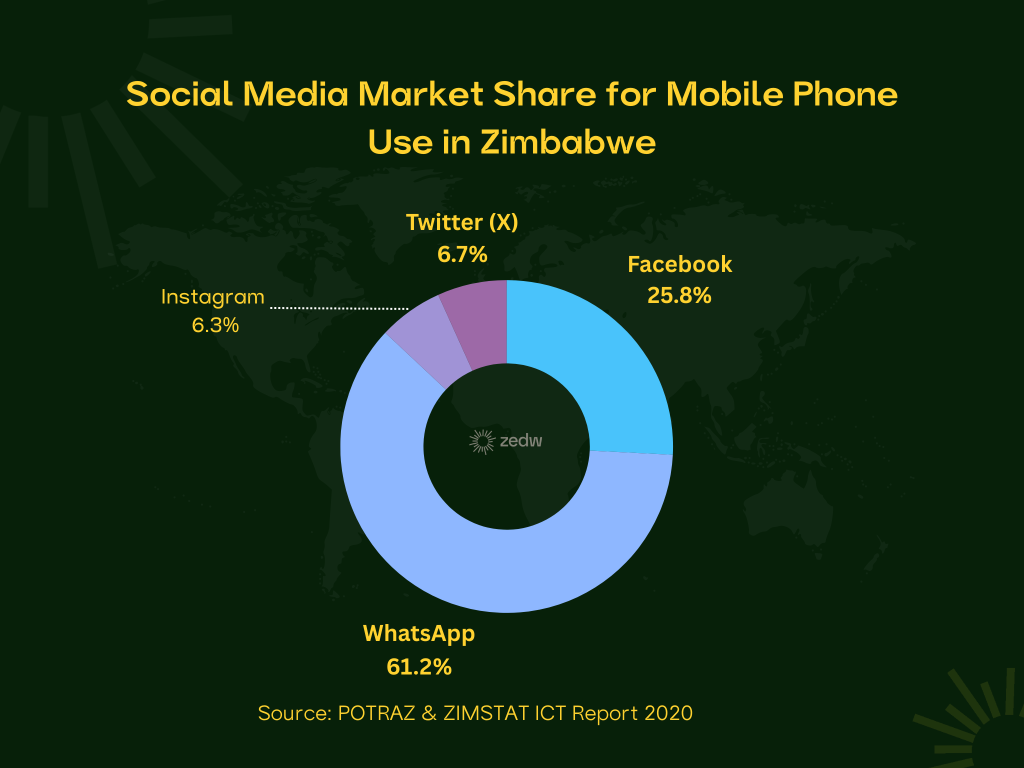

In the effort of full disclosure, POTRAZ in association with ZIMSTAT did make an effort to understand where people spend their time and resources online. It was in a report from 2020 and it revealed that the META (formerly Facebook) apps are the ones people access the most. The social network Facebook leads with the most users of any social media platform with a total of 1,458,407 users. WhatsApp (3,675,617 users) boasts a number nearly threefold of Facebook, however, until recently WhatsApp didn’t have a search functionality and relied on knowing the contact details of the person or business to access their services. This changed upon the roll-out of Channels but it’s still too early to assess that functionality’s impact on local commerce.

The report, albeit insightful, was done as a survey and not through actual data usage metrics, that doesn’t mean it is not valuable, but there is a greater gulf that appears when it comes to approaching a conclusion.

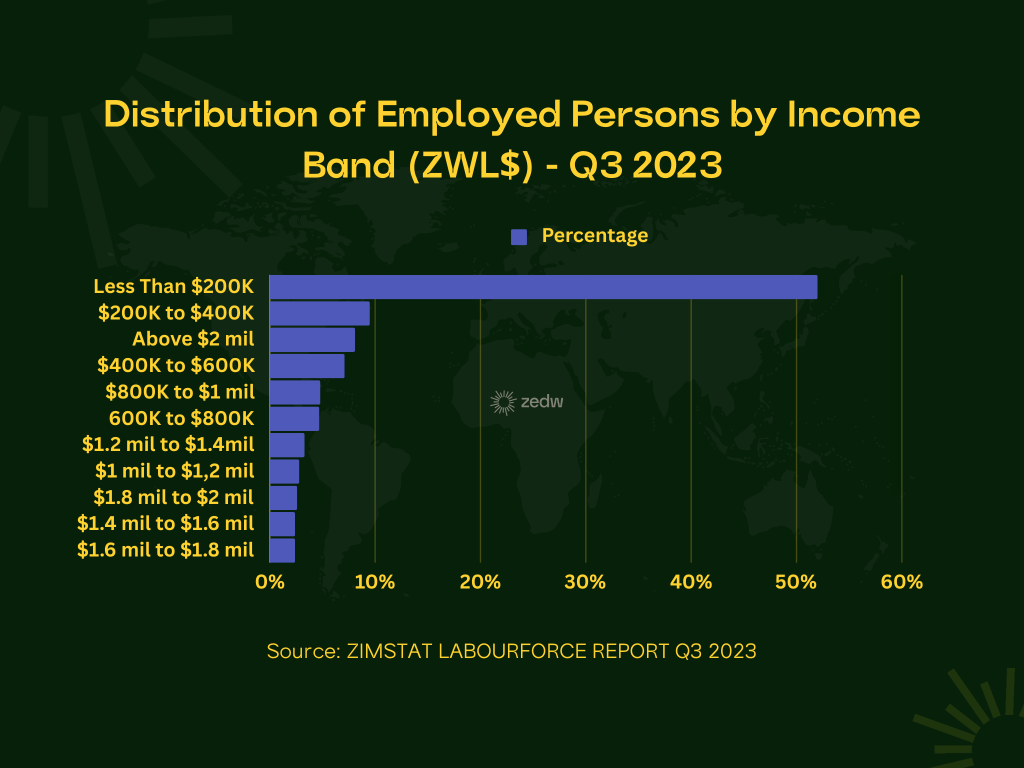

We have also put the cart before the horse because the first question to answer is how much are people making in Zimbabwe on average. This question is easy to answer because ZIMSTAT’s quarterly Labour Force Report gives us an idea of what that number is in Zimbabwe’s local currency. According to the 2023 third quarter findings, 52% of the formally employed Zimbabweans earn less than ZWL$200,000 which when converted at the purported parallel market rate is US$21.20.

What this information shows is that you have to rule out over half of the population as prospective customers if you want to enter the business of selling online in Zimbabwe.

More importantly, 62% of Zimbabwe’s population is rural according to the latest census data, and with choppy to non-existent internet and communication services the further away you go from a metropolitan area then it’s safe to say that the initial proportion of just above half might be more. Lastly, if one is earning the equivalent of just over US$20 then their greatest concern is survival more than anything else…

Who then can pay for your product or service online?

As dire as the numbers are, the data offered by ZIMSTAT is insufficient to get closer to the answer. There surely must be a subset of people who are online for a period that earn enough to be able to afford what an e-commerce platform is selling.

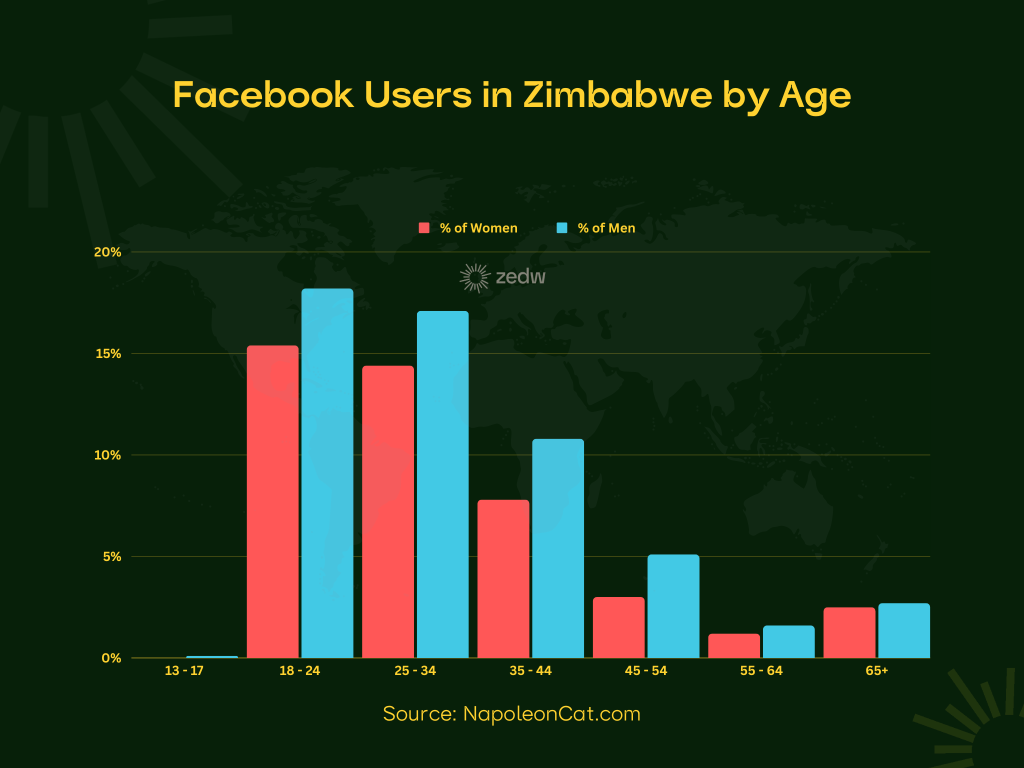

Fortuitously, the data we need to further any assumptions comes from the earlier mentioned Meta or Facebook. It appears that Facebook has a greater understanding of the age cohorts in Zimbabwe than ZIMSTAT itself. Coming by this information is simple enough because when you use ads by location. In Zimbabwe, Facebook has an estimated reach of 2.494 million people as of December 2023. Or if that is too finicky for you, websites like Napolean Cat, Statista, and others can get you ball park figures that aren’t too far off from what Facebook reports.

More importantly, this data reveals which age groups are the most active, however, it is misleading because not everyone represented there is a prospective customer. What this means is that your 18 – 24 cohort are most likely university students or in entry-level low-paying occupations even though they make up the largest proportion with 838,300.

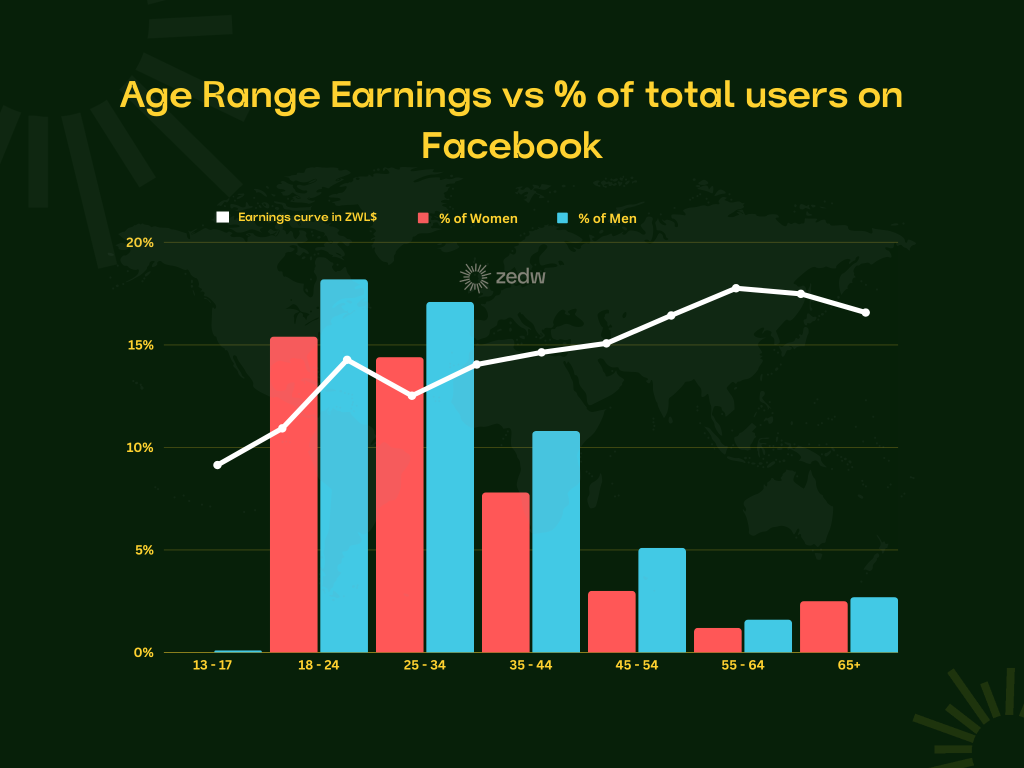

This can be easily understood by looking at the dispersion of earnings vs age that is supplied by NSSA from their annual reports. Sadly, the only report available on their website is from 2021 which isn’t ideal but can allow us to use it as a reasonable assumption.

As imperfect as the data is, taking it in combination might give some ideas as to where to find the Goldilocks Zone of who can afford internet access and pay for online-based services.

The 18 to 24 bracket may constitute 33.6% of the people on Facebook but they are also on the lower end when it comes to earnings. The most pronounced spikes are in the age ranges 25 and above, peaking at 55 – 59.

The former shows promise because it exists in that sweet spot of participation in online services by way of Facebook but where the greatest proportion of disposable income seems to be, if we assume the picture hasn’t changed in 2023, in the 50 – 65+ age range. What we are sure you have noticed is that those individuals represent the lowest participation online when it comes to Facebook.

By that measure, they may have more money but if you are selling online in Zimbabwe and you are choosing to target them, then you are going to have a tough time trying to find and convince them…

What does this tell us about selling online in Zimbabwe?

As mentioned at the beginning, it all depends on what you are trying to sell online or by mediation of an online platform. But what seems to be clear at least for those formally employed is that the older they are the more they are likely making…

If we are just staying in the realm of assumption, then that means the 25-44 (according to Facebook’s partitioning) age range may be the sweet spot for those looking to sell goods and services online.