In 2015 Simbisa Brands – the company known for it’s Quick Service Restaurants (QSR) spread across Africa- unveiled Dial-a-Delivery (DaD) with the launch of a centralised call-centre in Zimbabwe. Leaning heavily on Simbisa Brand’s financial reporting we are going to explore how DaD has evolved over the 9 years since it was launched.

Dial a Delivery is a stand-alone brand that is an integral part of the Simbisa Brands portfolio. Its primary focus is to extend our brands and products to our consumers in a convenient and efficient way via our centralised call centres. Customers simply phone in their orders to the agents on call, and the meals are quickly dispatched. Through an automated process, all orders are mapped and tracked in the system.

Simbisa Brands | 2017 Financial Report

Before getting into insights in the reports, I’m going to map out how Simbisa Brands financial calendar revolves so as to avoid any confusion:

- Q1 – Ends September 30

- Half-Year – Ends December 31

- Q3 – Ends 31 March

- Annual Report – Full-Year Ends June 30

Brief history

Following the aforementioned Zimbabwe launch DaD’s launch, a year later Simbisa Brands moved into Mauritius. At the time Simbisa Brands reporting indicated that the service had been “well received” in Zimbabwe with presence in Harare and Bulawayo. They didn’t share any numbers on how the delivery service was doing – and this would continue to be the case until 2020.

In 2017 – the call-centre service expanded to Kenya and more interestingly Simbisa Brands announced that an application was expected for 2018 along with expansion of the service across all their markets. Whilst the application did launch – the service hasn’t been offered in all their markets to date. The fourth market, Ghana would get Dial-a-Delivery in the first quarter of 2021.

The Dial-a-Delivery mobile application has now been launched in four of our markets with extremely positive uptake and the balance of our 2 (Zambia & Namibia) markets will be launched in Q1 FY2021.

Simbisa Brands | 2020 Annual Report

At this point it’s important to clarify how Simbisa reports the markets it is present in. Zimbabwe tends to be on its own – whilst Kenya, Zambia, Ghana, Mauritius, and Namibia are referred to as “regional operations”. Whilst Simbisa launched an application for the Zambian market 2023, Namibia was not as lucky. In 2021, Namibia was converted into a franchise market and DaD didn’t make it to that market.

Interestingly – Ghana and Mauritius haven’t seen much activity and so we will not explore those territories as much. Mauritius’s Dial-a-Delivery brand was dissolved in 2022 and replaced by Pizza Inn delivery – something will touch on later in the article. In the reports we went through from 2016 until 2023 – Ghana was only mentioned in association with DaD once – when it was launched. This suggests to us that there hasn’t been any noteworthy developments in that market therefore we won’t explore that. Our focus will revolve around Zimbabwe, Kenya as those are the markets Simbisa Brands most frequently mentions when communicating with their investors. Zambia will be mentioned here and there as well…

Challenges of delivering food in Simbisa’s markets

Our Dial-a-Delivery App (DAD) is developing into a market leader, and the Group is investing further in the delivery channels.

Simbisa Brands | 2020 Annual Report

By 2020, Simbisa Brands was speaking very glowingly of Dial-A-Delivery. The market leader claims were not backed up by numbers which probably speaks to the fact that the numbers weren’t impressive enough place to share with investors. It’s important at this point to explore the context of delivering in Africa. There are some issues that players in these industries have to contend with.

We need to talk about the fact that the market itself is made up of people with low disposable incomes for the most. Below is a graphic illustrating the potential difference between the markets Simbisa Brands is operating in and the USA. Yes, a bit unfair but necessary context to understanding one factor why the food delivery market in the US is more vibrant than Africa’s.

I think this graph explains why Simbisa Brands is yet disclose the amount of DaD deliveries completed. The low disposable income leads to relatively low usage patterns and some of the reporting from Simbisa to its investors echoes this. In Q1 of 2022 noted the following:

The strategic focus in FY2022 will be to grow the delivery business in the rest of the region and in Zimbabwe, where deliveries contributed just 2% in Q1 FY2022 and therefore an opportunity for significant growth has been identified.

Simbisa Brands | 2022 Q1 Report

In Zimbabwe – major market for Simbisa – sales completed via delivery made up just 2% of revenue (revenue total not disclosed). This low number is made even more surprising when you consider that early 2022 the world was still dealing with the impacts of the pandemic and one would assume that deliveries would make up a higher % of revenue given that social context.

Further reading of the report seemed to attribute the problem of low delivery revenues in Zimbabwe to infrastructure. Simbisa later reported in their annual report that they would be “acquiring more bikes and increasing the number of call centre agents,” to address this issue. The recently released annual report notes that deploying more agents and bikers on the road – led to an increase in deliveries:

The drive to increase delivery capacity through the scaling of operations has been successful, with the total number of deliveries increasing 53% in FY 2023 versus prior year, despite generally depressed consumer income levels in the market.

Simbisa Brands | 2023 Abridged Report

Disposable income aside there are other problems. The approach for DaD – in Zimbabwe at the very least- is to provide the service to urban-dwelling consumers. This isn’t about money but rather something more complex. Mapping. Most of the markets DaD is operational in live with a simple truth. Outside of the cities mapping is almost non-existent. This is a distinctly African problem that has been haunting the eCommerce market for years now.

Even in the cities there are some areas that have houses with no addresses or clear street names. This means anyone offering food delivery services is limited to primarily target urban areas that are well mapped out and identifiable on satellite applications such as Google Maps.

How many of you have been dropped a pin? How many ended in a dead-end? That is the other problem of our system. If I buy something and someone calls to find directions, it becomes another e-commerce activity just to get instructions on how to deliver it. Those are some of the inefficiencies.

Orlando Lyomu | Standard Group plc CEO (Kenya)

To illustrate this point further, in Zimbabwe there are 25 Dial-a-Delivery branches as of September whilst Simbisa has an estimated 261 outlets in the country. This means Simbisa has only incorporated 9.5% of its stores as part of DaD’s distribution network.

There are more challenges of course such as poor road infrastructure and volatile economies that Simbisa Brands has to contend with in delivering their food service which partly explains why the expected delivery time they’ve shared on their FAQ section is 60 minutes.

Investments & improvements

2020

Will start with marketing – there have been extensive marketing campaigns undertaken by Simbisa Brands to acquire new customers with increased marketing activity following the launch of the mobile app. We assume the highlight of the promotional campaigns was 2020’s 4-month deal with Zimbabwean musician Gemma. We assume this was the most successful campaign to date as it was the only one we found mention of in the companies reporting to investors.

Simbisa reported that over the course of the collaboration Gemma’s promotional content reached over 700,000 people across different regions. Whilst the company didn’t share the direct impact on metrics they attribute to this collaboration, Simbisa described it as “a truly meaningful and uplifting collaboration,” in their FY 2020 report.

In July, Simbisa Brands acquired 75% of Kutuma Kenya – a food delivery company that already had Simbisa and other third party restaurants as clients.

2021

Beyond the marketing, Simbisa has informed investors on how they are iterating and expanding on Dial-a-Delivery at different points. In 2021, investor reports from Q1 noted that there was move to outsource “bike, riders and logistics management in order to leverage increased market uptake during the pandemic.” Again no explanation was given as to which company in Zimbabwe was going to take over in this regard. Simbisa Brands also restructured prices in the Dial-a-Delivery app to match in-store pricing further incentivising use of the application.

A key focus area remains on growing and improving the delivery business which is being realised through the continued development and refinement of the Dial-a-Delivery mobile application in order to enhance the user experience and with the target of growing application-related customers and orders. In Zimbabwe, the number of delivery zones has been increased in order to shorten delivery distances and to improve on delivery times and coverage. (HY)

Simbisa Brands | 2021 HY Report

On the side of service delivery Simbisa Brands announced they were building a “Customer Data Platform to collate, analyse and interpret the data and information available through the mobile application, to improve the delivery businesses’ performance and the customers’ experience,” in their half-year report for 2021.

2022

Kutuma Kenya – the subsidiary spun off to exclusively handle delivery was restructured with a new operational model implemented. The reporting to investors indicates that this restructuring was a success that resulted in reduced delivery times and improved customer service experience. Unfortunately no metrics were shared in this regard so it’s hard to know the full impact of these measures. The only useful information we can glean on these documents is that a new rider application was put in use along with new dispatch technology – around April 2022.

In Kenya – Pizza Inn was transitioned to delivering exclusively via Dial-a-Delivery from September of 2022. Prior to this the product had been available on multiple food delivery services in Kenya. Simbisa stated that they intended to take control of the end-to-end customer experience and increase delivery volumes. They later declared this shift a success with “90% of orders previously done through third-party aggregators now directed through Simbisa’s in-house platforms.” It’s also safe to assume that using third party deliveries means giving away a lot of data – as the food delivery services are the ones capturing details such as customer demographic and location data. This to me seems like a no-brainer in regards to strategy.

2023

In Kenya the revenue per delivery increased by 14% (revenue amounts not disclosed), along with a 20% increase in deliveries compared to the previous year. There was a similar trend in Zimbabwe where revenue per delivery and deliveries increased by 54% and 34%. Unfortunately – Simbisa is still not sharing the specific delivery numbers so it’s hard to get a clear picture of what this means on the ground.

Interestingly – it appears as though Simbisa is now looking to make more use of their outlets outside of the urban areas in Zimbabwe going forward:

The delivery segment remains a key growth area, with the focus in the period under review being on enhancing the user experience through the introduction and upscaling of Dial-a-Delivery in smaller towns, improved rider productivity and shortened delivery times.

Simbisa Brands | 2023 Q3 Report

The Kenyan market has even more interesting updates from the 2023 financial year. Simbisa Brands broke down the popularity of DaD channels. At the start of the financial year (around July 2022) under a third of orders were being made via the DaD mobile app with the majority of users preferring to dial in at call-centres. By the end of the financial year more than half of orders were being made via the application – a trend Simbisa Brands expects to continue going forward.

How much is Dial-A-Delivery contributing money-wise?

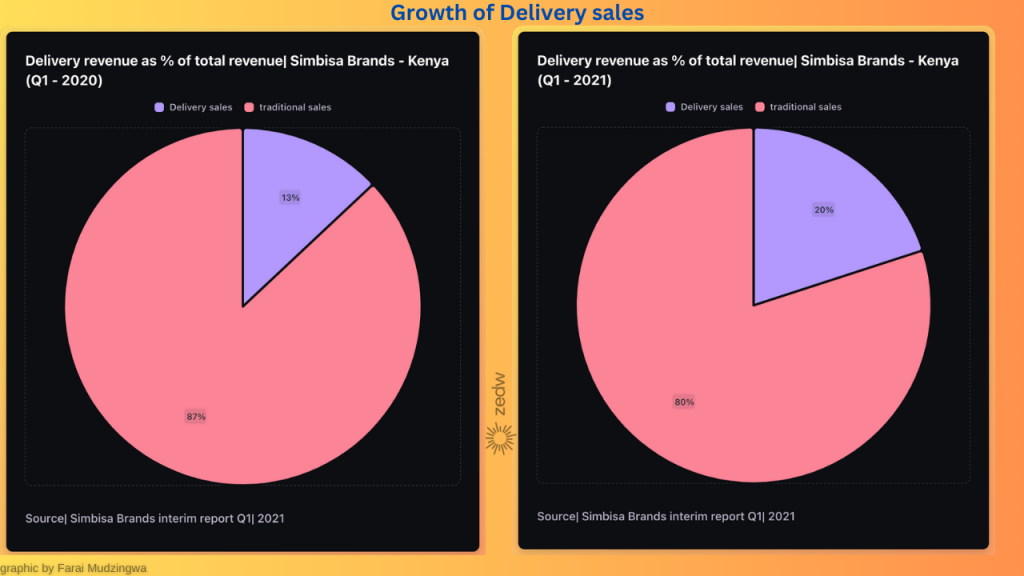

This was the hardest part to explore as Simbisa Brands have never outrightly shared exact numbers regarding how significant the revenue contributions of Dial-a-Delivery are. In 2021 Simbisa shared breakdowns of delivery sales as percentage of total revenue in Kenya for the first quarter of 2020 and 2021. Whilst illustrating growth of delivery sales as shown below.

Zimbabwe’s DaD also appears to be lagging behind Kenya massively if we are talking about how significant delivery sales are to Simbisa Brands revenues. During Q1 of 2021, delivery sales were contributed one fifth of revenue in Kenya. The only comparable figure we have from Zimbabwe comes a year later where Simbisa Brands disclosed that as of Q1 of 2022 – delivery sales only contributed 2% of revenues.

Another indicator we can look at is Kutuma Kenya which made a revenues of US$1.21 million. Kutuma also made a loss of $176,513 during the same period – using translation rates provided in Simbisa Brands’ financial reporting.

What to expect going forward?

Well it seems there is going to be a lot more fragmentation within DaD’s application ecosystem following Simbisa Brands recent revelation that key brands would have their own applications. This suggests separate applications for Pizza Inn, Chicken Inn, Nandos etc.

In line with the new organisational brand-facing structure and leveraging the existing brand equity and customer loyalty, a decision was made to launch brand-specific mobile delivery applications for the key delivery brands in conjunction with the existing Dial-a-Delivery application. This commenced with the launch of the Pizza Inn mobile application in Kenya in Q2 FY 2023 and has successfully increased mobile application orders and overall delivery volumes. This was followed by the launch of mobile delivery applications for Chicken Inn, Galito’s and Grill Shack in Kenya and will be rolled out to Simbisa’s remaining markets in FY 2024.

Simbisa Brands | 2023 FY Abridged Report

Simbisa is anticipating that each brand having its own application will result in “increased brand visibility, higher delivery volumes, increased customer retention and reachability” to improve the user experience. In Zambia, Pizza Inn mobile app was launched in January 2023 and Simbisa reported that the application contributed 13% to Pizza Inn’s revenue in the financial year.

Beyond the consumer-facing application, Simbisa has also indicated that there is going to be continued focus on improving ordering and bike tracking with the goal to reduce delivery times and improving the overall customer experience in Zimbabwe and Kenya.