Over the last 10 years, South Africa has established itself as one of Africa’s leading financial technology (FinTech) markets. Whilst the country is generally a land fraught with opportunities for African entrepreneurs looking to build startups, financial tech has dominated this conversation. Let’s explore what makes FinTech tick in the rainbow nation and why 40% of all FinTech revenue in Africa is captured there.

Market segments

The table below illustrates the biggest markets being pursued by FinTech startups in South Africa

| Segment | Description | Startup example |

| Payments | Entities that perform part or all of the functions required to send and/or receive value from one party to another via any digital channel. This includes parties in the value chain that facilitate or enable clearing and settlement processes. | Yoco |

| Lending | Entities that facilitate the borrowing of money or financing assets for individual consumers and/or small businesses with traditional and non-traditional financiers through internet, cloud or app-based platforms. | Jumo |

| Savings & Deposits | Entities that are deposit-taking and provide digital banking services as well as savings products and layby arrangements using mobile technology. | Tyme Bank |

| Insurtech | Entities that provide part or all of the insurance value chain functions (e.g. communication, risk analysis, distribution) through the use of specific technologies (e.g. artificial intelligence, robotics) instead of traditional methods. | Click2Sure |

| Investments | Entities that provide digital platforms for investment and/or trading activity (including cryptocurrency) or enable individuals to trade on traditional exchanges/platforms from their own device(s). | EasyEquities |

| Financial planning | Entities that use artificial intelligence and/or robotics to provide financial advice to individuals or small businesses by recommending suitable savings, investment or credit products and managing financial wellness. | 22Seven |

| Capital raising | Equity or debt funding platforms that allow businesses or individuals to raise funds for investment purposes or charitable causes. This segment also includes digital due diligence service providers. | |

| B2B Tech providers | Entities that create, or support white label platforms and/or products provided by other financial services providers, for use by other fintechs but do not provide financial services to the general public through their own brand name. |

source: Fintech Scoping in South Africa report

FinTech enablers?

Infrastructure & access

In terms of banking infrastructure – South Africa is head and shoulders above the rest of the continent making it a very attractive place to build and deploy technological solutions to problems.

With approximately 84.1% of citizens banked (40 million) – South Africa is way ahead of counterparts in Sub-Saharan Africa (43% banked) which partly explains why FinTechs are so popular. Research by GWI also indicates that 49.6% of internet users between 16-64 years old use the internet to manage their finances and savings. This means FinTech providers actually have a market demanding innovation within financial technology. South Africa also happens to be leaders on the continent in terms of access to the internet with 72% of citizens having internet access.

These are some of the factors that make South Africa the most mature financial market in Africa.

Funding

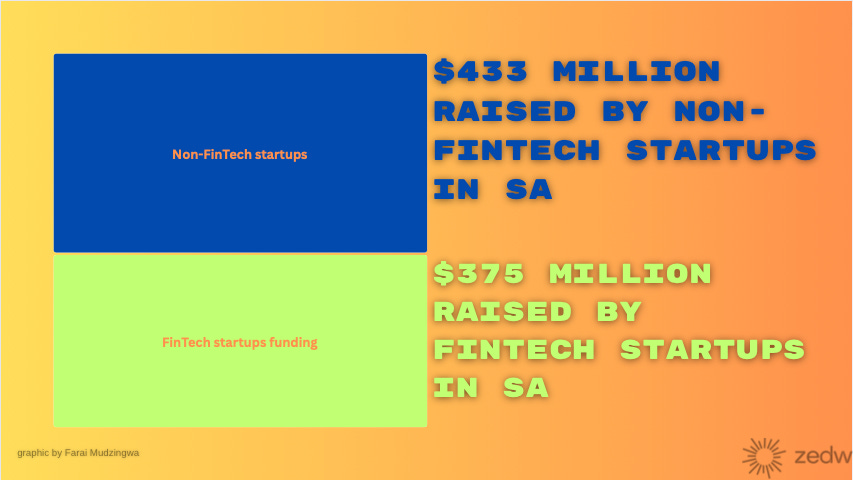

Since 2020 FinTechs in South Africa have raised $375.31 million in investment (46.4% of all startup investment received in that period).

Some of the highlight deals during this period include

- Jumo’s $55 million raise in 2020;

- Yoco’s $83 series C raise in 2021;

- Tyme Bank’s $77 million investment raised in 2023

Regulation

We are certainly seeing a FinTech revolution play out on the African continent. As regulators, we are presented with a unique opportunity to shape the policy and regulatory environment to support responsible innovation.

Lyle Horsley – Divisional Head of the Fintech Unit at the South African Reserve Bank

In 2016, South Africa’s financial regulatory bodies came together to establish the Intergovernmental Fintech Working Group (IFWG). The collaborative effort was established to understand the growing role of financial technology in the South African financial sector along with exploring how regulators can proactively assess emerging risks and opportunities in FinTech.

The IFWG launched an innovation hub in 2020 with a mandate to act as a bridge between regulators and innovators particularly focused on educating innovators on what they need to focus on to be compliant with the law.

The stated benefits of the IFWG to FinTech include:

- regulatory guidance provided through the Regulatory Guidance Unit;

- opportunity to test the regulatory fit of their innovative products and services in the Regulatory Sandbox;

- access to information and insights provided through via reports and other outputs of the Innovation Accelerator.

It’s hard to assess the results of such moves in the short period of time that has passed but it is clear that the South African government has positioned itself as eager to engage and enable FinTech providers. At the very least they understand that there are benefits to end consumers (i.e the general population).

Case Studies

Tyme Bank – Deposits & Savings

Tyme Bank is currently South Africa’s largest Neobank with 7 million clients. The digital-only bank has managed to attract hoards of customers by being the one of the cheapest banking offerings in the country.

They’ve differentiated themselves from traditional banking services by:

- allowing clients to send money for R7($0.36) to other South Africans and at no cost to fellow Tyme Bank clients.

- Offering fee calculators on their website that break down transaction fees, savings targets and reward bonuses per transaction;

- a credit card offering for South Africans earning as low as R3,000. Banks tend to offer credit cards for people earning R5,000-R10,000 making this more accessible.

- Savings account with dynamic interest rates. TymeBank starts off paying 4% interest, increasing to 6% by day 91. That 6% is higher than the industry average of 5.05% in South Africa. Customers who give TymeBank a 10-day notice of intent to withdraw get 7% interest. Finally, users who move their salary to their TymeBank account get 8% interest.

- TymeAdvance allows employees (working for select companies) to access salaries in advance.

Yoco – Payments

Since its 2013 launch – YOCO has positioned itself as the go-to platform to access payments among merchants in the country. The startup aims to address the challenges faced by small businesses in obtaining card machines. Since launch – Yoco has sold an estimated 350,000 machines.

We want to offer whatever payment methods our merchants need. And we did start in the in-person payment space, focusing on terminals, which was where the biggest demand was but the pandemic, which had a devastating effect on so many businesses that relied on in-person trade, accelerated the need for businesses to accept payments online.

Yoco chief business officer Carl Wazen

Back in 2021, the startup claimed to be processing more than $1 billion in card payments per year, and in its six years of existence, it has processed over $2 billion in card payments.

On the funding front, Yoco’s most recent funding round was an $83 million series C round back in 2021.

Jumo – Savings/Lending/

Founded in 2015 and based in Cape Town, the venture offers a full tech stack for partners to build savings, lending, and insurance products for customers in emerging markets.

The startup is active in 6 markets and by 2020 claimed to have disbursed over $1 billion in loans and served over 15 million people and small businesses. Between 2014 and 2021, Jumo raised $321 million across 8 funding rounds.

Click2Sure – InsurTech

Founded in 2016, the InsurTech startup allowed retailers, service providers, distributors, and brokers to offer over twenty insurance products at the point of sale.

Click2Sure doesn’t sell insurance. We provide our clients who sell insurance with a comprehensive cloud-based, a digital platform for the distribution, management, and purchasing of insurance at the point of sale.

Click2Sure co-founder Daniel Guasco

Customers were able to purchase insurance via digital channels, depending on their preference. Some of these channels included WhatsApp, SMS, eCommerce, and QR Codes. Customers of insurers could access immediate insurance cover on their purchased goods or asset via an easy-to-use mobile app.

Challenges

Whilst we’ve explored the positive aspects that make South Africa a great location to start a FinTech there are some factors that make offering FinTech solutions challenging.

Macroeconomic environment

An estimated 40% of South Africans earn less than $3.65/day (below the poverty threshold). These poverty rates affect demand for financial services since a significant portion of the country can’t afford participating in the economy outside of survival. Individuals in this demographic also have a hard time accessing financial services.

Limited funding options

The most reliable option for funding of FinTech’s has been venture capital. Because many FinTechs have yet to build out sustainable business models participants in the field are looked at with skepticism and considered to be high-risk investments. Despite its robustness the banking sector hasn’t historically been eager to support businesses starting out:

- In 2019, only 2% of new MSMEs were able to access bank loans.

- Approximately 75% of MSME credit applications were rejected.

The big picture

FinTech’s in South Africa have resulted in benefits that are hard to argue with. South Africans have seen the number and utility of product offerings in the financial sector expand. Beyond choice and utility FinTechs have also ensured that there is more access to financial services driving up financial inclusion for citizens. Increased competition has driven down prices for financial services and created a competitive landscape that other countries on the continent can only look at with envy.