The state of rail for logistics and passenger transport in the Southern African Development Community (SADC) is a far cry from where it could be. Just as a quick refresher, there are 4 main modes of freight of goods and passengers road, rail, maritime, and air. Of all those, rail stands at 0.3% share of total passenger freight and logistics volumes in Africa. Rail in SADC is operating below capacity and is not coordinated at a regional level but functions as a collection of national systems.

South Africa has the longest rail network on the continent

What’s curious about these numbers, as low as they are, is that Southern Africa’s total rail network is 44.25% of the total rail network on the continent. Of the 86,820km of rail on the continent, 38,415km is in SADC and South Africa alone has a rail network spanning 21,565km which is 56% of the total length of rail in the region.

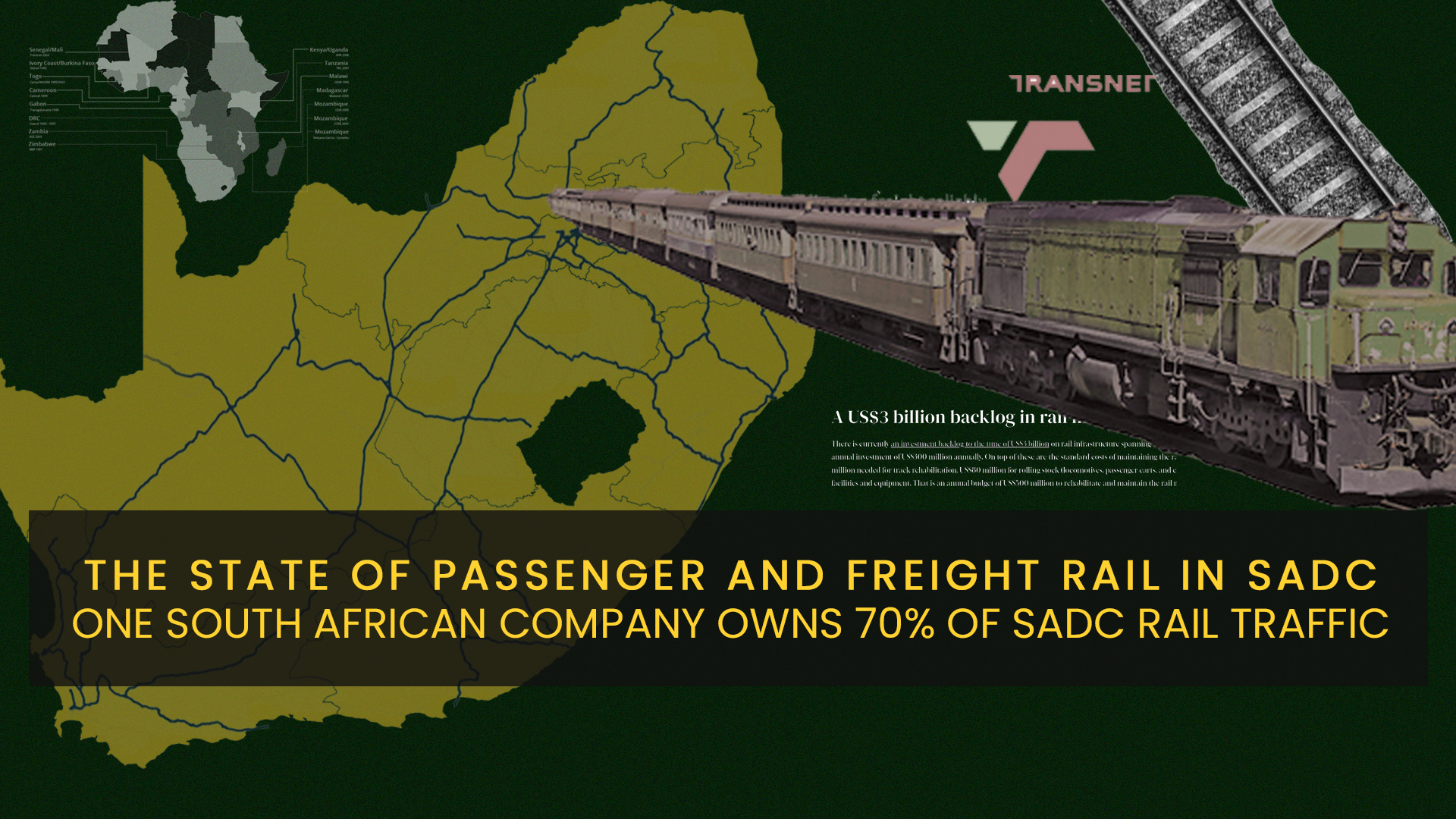

To bring all of that more into perspective, 13 countries in Sub-Saharan Africa have no operating railway. Furthermore, 50 companies operate around 55,000km of rail in sub-Saharan Africa, a majority of them being small operators. Transnet Freight Rail or TFR (formerly known as Spoornet), a single company in South Africa represents 40% of the operating rail network and 70% of the rail traffic.

All that being said, Southern Africa is a good way ahead of the rest of Africa when looking at the route-km of rail in operation. It stands at 34,173km versus a combined 33,282km for North, Central, East and West Africa. North Africa has the largest passenger traffic on its rail at around 46 billion passenger-km primarily in Cairo and Alexandria. And Southern Africa comes in second at 13.5 billion passenger-km. Of that, around 10.8% of North Africa’s rail passengers are suburban with the rest being non-urban. In Southern Africa, this trend is the reverse with 85.2% being suburban passengers and 14.2% non-urban passengers.

South Africa represents close to the full complement of rail passenger traffic in SADC

Going deeper into this, a very significant portion of passenger rail traffic is located in South Africa. It has the largest commuter rail network system in Sub-Saharan Africa with extensive electric multiple-unit (EMU) services in Capetown, Durban Johannesburg, and Pretoria. These commuters carry about half a million commuters each day and over 500 million paying passengers every year. Metrorail being the dominant player operated as a standalone business unit within TSR before it was consolidated into the South Africa Rail and Commuter Corporation (SARCC) in 2006. Its fleet constitutes 4,200 carriages of which 70% are in operation and runs services on over 2,000 route-km partly owned by it and TFR.

A concession was also awarded for a standard gauge (1,435mm) rapid (160kph) regional line between Johannesburg and Pretoria for the Gautrain service. This project was completed in 2012 and is still operational to date.

In comparison with other passenger rail services in southern Africa, most operate on average one to two locomotive-hauled return services per day, one in the morning and another in the evening. Harare with 2 routes, Bulawayo and Luanda with 1 route, and Maputo and Ningshasa also operate single routes each. Annual traffic is typically in the low millions versus over 500 million in South Africa alone.

At 115 billion tonne-km, Southern Africa commands the largest complement of freight transport on the continent with North Africa coming in at a distant second with close to 15 billion tonne-km which is predominantly general freight. Southern Africa has an almost 50/50 split between mineral and general freight. When looking at freight composition, agricultural produce, ores, and minerals constitute the bulk of rail tonnage in Southern Africa. In Central Africa, Timber minerals and ores are the major portion of their rail tonnage and in West Africa, the bulk of rail tonnage is petroleum products, ores, and minerals.

The state of rail infrastructure in SADC

The current state of rail in SADC is marred with substantial challenges. Deregulation of roads accelerated the uptake of roads for freight reducing the activity of freight in rail significantly as just-in-time higher value traffic switched to road. With these substantial reductions in freight traffic, operators were forced to operate at a loss with any income being diverted to salaries and fuel costs rather than to maintenance and upkeep of the railway networks. Unlike roads, costs associated with rail are mostly fixed, which means that lower freight volumes, and therefore lower income, do not cover the same fixed costs and result in operational losses. As a result, the state of rail and its subsequent communication infrastructure is in a deplorable state.

This poor state of rail had a snowball effect on the traffic using this mode of transport. For safety, speeds on rail infrastructure were lowered which made this mode of freight slower than before but also much slower than road at 10 km/h in some sections. Furthermore, the cost of developing the road network was seen as a preferred investment over investment in rail infrastructure. Road networks are more expansive reaching more remote areas, more convenient, and support a wider variety of traffic making them more cost-effective (tolls) and desirable for both passengers and transporters.

…the cost of new construction of a single-track, non-electrifi ed railway on relatively flat terrain is at least $1.5 million per km, increasing to about $5 million per km in more rugged country…

Restructuring and Recovery in railway systems

He explained that the cost of the roads varied between $500 000 per kilometer to $1,2 million per kilometer depending on the quality and additional costs.

Eng. Kangara – Chronicle

Rail in its current state is much less efficient

The Copperbelt used to be one of the biggest contributors to rail traffic in SADC. Copper concentrates which are bulky and more suited for rail were being sent over to South Africa for processing. Over time, Zambia improved its industrial processes allowing it to process its copper concentrates into copper ingots which are more suited for transport using road. A case study done for Botswana has shown a copper mine close to Franscistown producing copper concentrates that are then sent to a smelter in Slebe Phikwe, a 400km round trip. With the use of 2×5 axle tipper trucks, they can make 2 round trips a day with 50 tonnes of net weight in concentrates. With rail, it is estimated that they may struggle to make one round trip per day, and at an annual tonnage of 450,000 tonnes, the volumes are too low to justify investment in a rail line to support that route.

In as much as over 8 rail gauges exist on the continent (from 600mm to 1,435mm), Southern Africa managed to consolidate this to one standard gauge (1,067mm) for its trunk routes stretching from South Africa to DRC. 95% of the rail network in Southern Africa is making use of the 1,067mm gauge allowing for unhindered movement of rail traffic across the different countries in the region.

Whilst this has its advantages of not requiring a huge investment in changing the standard, maintenance, and upkeep have not been done routinely in such a long time. Hard infrastructure in the form of rail lines, control, and communication infrastructure is largely old and outdated. Thus investment in rail will need to start in the form of a backlog of investment just to get the state of the rail network to where it was when it was set up.

In the past decade, the capacity of the railway network to provide services has been severely eroded. The deterioration in track infrastructure, signaling, and telecommunication system is due to lack of regular repairs and maintenance resulting from financial constraints on the NRZ. Rehabilitation of the network and rebuilding the services offered by the rail network are therefore major priorities for the country.

Restructuring and Recovery in railway systems

A US$3 billion backlog in rail investment

There is currently an investment backlog to the tune of US$3 billion on rail infrastructure spanning north of South Africa. Spread over 10 years this translates to an annual investment of US$300 million annually. On top of these are the standard costs of maintaining the rail infrastructure in a sound state that include US$100 million needed for track rehabilitation, US$80 million for rolling stock (locomotives, passenger carts, and cargo carts), and US$20 million for maintenance of facilities and equipment. That is an annual budget of US$500 million to rehabilitate and maintain the rail network north of South Africa.

Looking at South Africa’s rail figures, impressive as they are in the region in absolute volumes, the details paint a different picture. An extract from the 2021 report “A proposed freight and passenger road-to-rail strategy for South Africa” highlights that South Africa’s return per route-km is 3 times less competitive than the world average.

The aggregate output of the FDM (Freight Demand Model) indicates that, in 2019, freight demand in South Africa amounted to 446 billion tonne-km (305 billion tonne-km line haul, 132 billion tonne-km last mile and 9 billion tonne-km in pipelines and on conveyor belts). This tonne-km demand is disproportionate to the size of the economy. Globally, approximately 40 trillion surface freight tonne-km (i.e., road and rail) were required in 2019 (International Transport Forum 2021) to generate US$87 trillion of GDP (World Bank 2021), i.e., approximately US$2.2 return for every tonne-km provided by road and rail. The South African GDP amounted to US$351 billion in 2019 (World Bank 2021), for the 446 billion surface freight tonne-km provided, i.e., the country’s return is approximately US$0.79 for every tonne-km provided. The country’s tonne-km demand is therefore almost three times less competitive than the world average

A proposed freight and passenger road-to-rail strategy for South Africa

With the capacity of rail outpacing the demand, several rail companies looked to concessions with private players. According to SADC’s paper on the Transport Sector Plan, most of these concessions have since failed and the few that remained did not yield the desired results. The most successful rail operator in the region, TFR in South Africa, was agile and innovative enough to keep its rail business viable and pursue rail business in Africa through its International Joint Ventures division. It operated in the North-South corridor covering DRC, Zambia, and Zimbabwe through the respective concessionary agreements however these ventures were not financially viable and TFR has since withdrawn from all regional operations.

Planned and implemented rail projects

That said, there is a push by SADC governments to set up rail projects within the region. As outlined in the 2012 Regional Infrastructure Development Master Plan (link), the SADC region has 31 rail projects under consideration.

- The Trans‐Kalahari railway line provides a direct route between South Africa and Walvis Bay in Namibia, possibly serving as a coal export route for Botswana

- A 300 km rail link between Lion’s Den in Zimbabwe and Kafue in Zambia, providing a shorter rail link to Beira

- A north‐west rail link between Zambia and Angola which connects with the port of Lobito

- A link between the Namibian system and southern Angola

- Various Standard Gauge upgrading proposals for East Africa

There is also the push for a European standard gauge railway (1,435mm) by the AU as well as the African Union for Railway operators which should improve the tonnage that can be carried by rail from the current 15 tonne per axle to 20.5 tonne axle loads. Locomotive speeds will also be increased from 20kph to a more modest 120kph. This is a monumental task requiring close to the whole rail network in SADC to be overhauled. Financially such a project could cost more than the rehabilitation of existing infrastructure. And with the current trends in rail freight volumes, it is not looking to be a viable investment for private investors looking to rail. Estimates stand at an annual tonnage of 2 to 4 million tonnes for rail operators outside of those in South Africa to be financially viable.

In May 2010 SADC formed a regional rail fund however not much has come from it to date. What has seen some form of success is Public Private Partnerships (PPPs) for a number of rail projects. The Bulawayo – Beitbridge Railway, Gautrain, Sena Rail Line, and the Kazungula Bridge – rail project are some such projects.

Bulawayo – Beitbridge Railway (BBR)

The Bulawayo Beitbridge Rail (BBR) was developed in a Build Operate transfer concession between the Government of Zimbabwe (GoZ) and the New Limpopo Bridge Project Investments Ltd (NLPI), in 1999. The concession allowed NLPI to build and run the railway line for 30 years, after which they would then transfer it to the GoZ. The rail project took 16 months to complete and would span a total of 350km, 150km being new track and 170km being existing track that would be rehabilitated. NLPI invested 85% stake and the GoZ through NRZ 15%. It also cost US$85 million to complete the project.

What justified this concession was that it reduced the distance for traffic passing Bulawayo by 187km from the previously used route via Somabhula. In its first year of operation, it moved 1.5 million tonnes of traffic and later obtained rights to service the Bulawayo – Livingstone route from NRZ.

Sena and Machipanda rail lines

The Sena rail line is a 670 km railway line that connects the port of Beira with the coal mines of Moatize and the Zambezi Valley and the Machipanda rail rehabilitation is a 317 km railway line that links the port of Beira with the border area with Zimbabwe. The lines were severely damaged during the Civil War and required extensive rehabilitation. The project was financed by IDA, EIB, and the concessionaire, the Indian company RITES.

The project started in 2005 at a cost of US$152.46 million and faced cost overruns bringing the project cost to US$205.3 million due to technical and contractual challenges. The project achieved some of its objectives, such as increasing the freight traffic from 0.5 million tons in 2005 to 6.5 million tons in 2011 and reducing the travel time from 36 hours to 12 hours. However, the project also faced some issues, such as poor quality of works, low reliability of services, and inadequate maintenance of the infrastructure and equipment