Zimbabwe’s regulatory environment has thrown a few spanners in the works for its citizens. The latest one comes from the Ministry of Finance through the National Budget Statement in which the Minister proposed a Wealth Tax.

“To ensure vertical equity, where taxpayers with more income or property contribute proportionately to the Fiscus, I propose to introduce a Wealth Tax levied at a rate of 1% of market values of residential properties with a minimum value of US$100 000. The tax is payable in every year of assessment”

Prof. Mthuli Ncube

This Wealth Tax means property could be taxed at the municipal & state levels

This proposal by Prof. Mthuli brings up an interesting problem because property tax has been the realm of local councils according to the Urban Council Act [29:15]. Ratepayers will know that their municipality charges them an annual property tax for the homes.

The methodology of this tax is based on the average land area of the property holding as well as factoring in the amenity services and zoning of the suburbs or areas. This then gives the city councils an average charge for the land that comes on monthly council bills.

If this musing becomes law, the government will need to define what exactly it is charging. If it is the land that the house sits on then it brings up double taxation because City Councils are already levying a tax for that. If it’s an assessment of the improvements made above that land then the taxpayer will be paying a tax for the land their home occupies and the land it sits on.

The Zim govt is closer to property valuations than most think…

Aside from the distinction of which part of the property the government is going to tax, it will first have to value all the properties in the country.

Property valuations are contingent on several factors, primary to this are the types of properties and much like the aforementioned City Council outlines and can be approximated with the following

This process is very complicated and time-consuming, there are just over 3.8 million private households in Zimbabwe, and just over 650,000 of those are in Harare.

Many early commentators mentioned just after the announcement of the wealth tax that it would be very difficult to accomplish an evaluation audit of the properties in Zimbabwe. However, in 2022, the City of Harare reportedly allocated ZWL$39 million to conduct the first General Valuation Roll (GVR) in just over a decade.

“The City of Harare has appointed GMP Real Estate and Global World properties to undertake the general valuation roll services of all properties in terms of the Urban Councils Act Act”

Harare City Council (via The Sunday Mail)

The results of the GVR have yet to be released but it is not inconceivable that the confidence of Prof. Mthuli Ncube is based on whatever preliminary results from the valuation exercise, if they have access to those early findings. What this means for other Cities is unclear however, what we know is that the City of Bulawayo resisted a call from the government to make a GVR in 2021.

“As the Bulawayo City Council our valuation roll is up to date, in fact this is the last year of it being valid because according to the law valuation rolls are valid for 10 years and ours expires this year, where in terms of the law we are now expected to rework on this roll. However, we have set down as management, where we have decided that we will write to council saying this revaluation may not give us the desired outcome because there has been very little development in Bulawayo in the last 10 years and mind you the valuation is a continuous exercise which is done every year for anything that comes on board,“

Christopher Dube Bulawayo City Clerk (via the Sunday Mail)

Harare might be the benchmark by which all properties in Zimbabwe may be evaluated. This is a dangerous precedent, however, if we are looking at the size of the dragnet that the wealth tax is built on, with the government looking for the path of least effort, it might just be how things are done…

Who is affected most by the Wealth Tax?

If we are looking at the schedule for rate payments for Harare, they look nominal depending on which side of Samora Machel Avenue you are living. In the more affluent neighbourhoods, with property valuations that are brow-raising to eyewatering, it’s hard to see the impact of the standard rate. The assumption would be that the socioeconomic standing of some neighbourhoods indicates that they can afford the rates or they say they can.

It’s similar to owning a vehicle, you are essentially taxed on the capacity of the engine you have and that is a decent indication of your financial capacity or the line of business you are in. However, this doesn’t discount outliers who might be punching above their weight or exist in a set of unique circumstances.

Those individuals can exist in one of two scenarios as it pertains to the wealth tax. The first are groups like civil servants who were able to buy property at one point in time that has appreciated to now being worth US$100,000.

The second scenario is those people who inherited property and the 5% estate tax commitment was met and are now saddled with a property that is above the Wealth Tax threshold.

As of around June 2021, there was a general appreciation in property prices across all of Harare’s regions and wards.

Those two sets of individuals will now have to reckon with an additional tax on top of the property tax they pay to the council. More importantly, if this is their primary domicile it raises issues of how they can meet both commitments (council and state).

It is not at all strange that these days people are renting rooms out to meet the necessities of everyday life in Zimbabwe’s increasingly expensive cost of living.

The subtle genius of this wealth tax

On the other side of things, the government is aware that some Zimbabweans (home and abroad) with the means have been storing value in property because of the demand for housing particularly if we are looking at Harare.

The urban-to-rural migration for the nation’s capital has been the most pronounced shift inbound and outbound of all the other provinces. Harare seems to present greater opportunity or at the very least is the port of first call when looking into expanding one’s earning potential.

“Between 2012 and 2022, Harare province had the greatest number of both in-migrants (351,569) and out-migrants (317,599). In comparison with other provinces other than Harare, Manicaland province had the largest number of out-migrants (276,588)”

ZIMSTAT

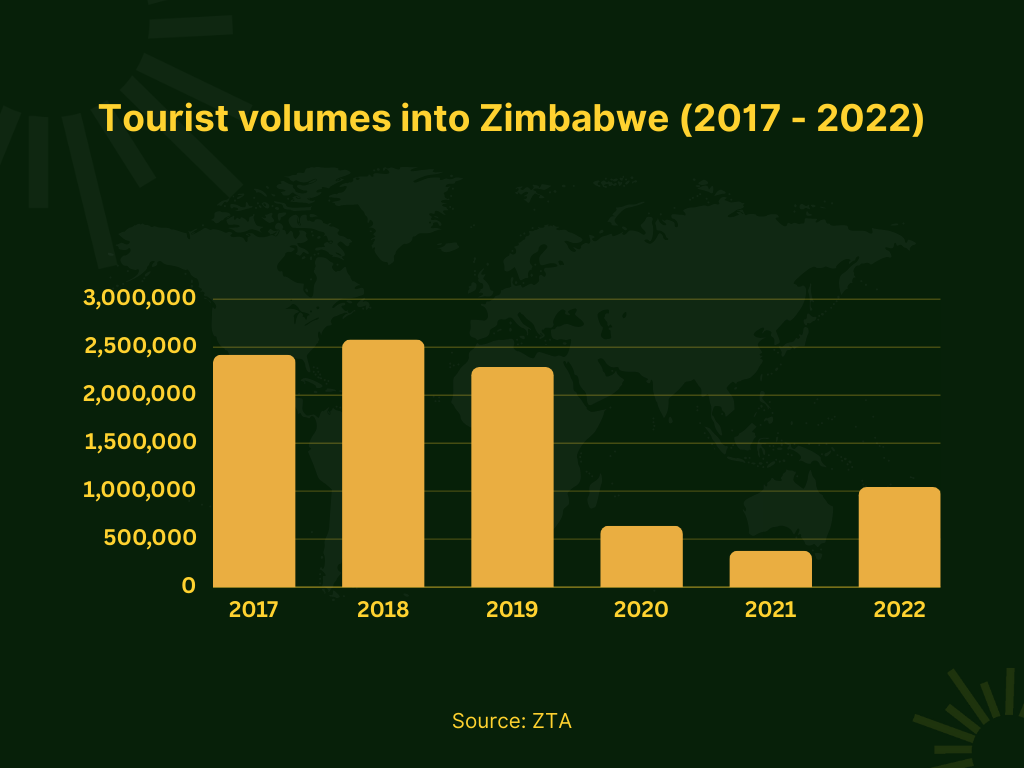

Additionally, there has been a steady increase in tourist arrivals into Zimbabwe after COVID-19 hit years. As of 2022, there were 1,043,781 arrivals which was a 54% decrease from 2019 but a 174% increase from 2021 which signals that the industry is on the rebound.

The outlook for 2023 is looking even more promising according to the Budget Statement presented by Prof. Mthuli Ncube.

“During the period January to September 2023, tourist arrivals increased by 52%, reaching 1,087,445 from 714,621 during the same period in 2022. Most source markets saw an increase in arrivals, notably the Middle East (153%) and Africa (76%). As a result, tourism receipts increased by 18%, to US$724 million, up from US$615 million realised in the same period in 2022..”

2024 Budget Statement

What all of this represents are opportunities for not only serving the local housing demand but also facilitating for the arrivals coming in who want accommodation that gives them more flexibility than a hotel.

It is not uncommon for new cluster development to have Airbnb-dedicated units that manage the variable ins and outs of visitors. It isn’t just for the clusters, property all over Harare is now on the market for Airbnb, with the country now having over 1,000 places that anyone visiting Zimbabwe live in during their stay.

The demand, from tourists returning residents and locals, has fashioned a lucrative market for property and there was no way until the proposed wealth tax for the government to tap into all that revenue.

That concentration of wealth driving individual property development space has been difficult for the government to directly access because those funds are either coming from the informal market or from abroad.

Looking at the numbers it is easy to see why the Minister for Finance is keen on taxing property. According to Palmer Construction, the average cost of construction in Zimbabwe per square metre is between US$80 – US$120. A simple cottage cottage building costs around US$6400. A 3 bedroom house US$12800. 4 bedroom costs US$14400, this is without the cost of acquiring the land which varies wildly per square metre in Harare. However, if we, for simplicity’s sake take the average price of US$49/m2 on Property.co.zw’s 1617 listings.

If we also take Mashonaland Holdings’ 500m2 per house in a cluster development as a benchmark, we will land at a total cost of US$9,500 for just that land.

Those figures are of course variable and depend on the price and availability of building materials. However, if we are to use those broad benchmarks and say the total cost per 3 bedroom cluster for the land and cost to build lands us at US$22,300.

Additionally, if we say that the development is in a relatively affluent area, the valuation of that property is going to go up and the profits from such a structure, whether it is rental, mortgages or straight buyouts, will be very high.

That might be the grey area that the Minister of Finance is trying to target. Unfortunately, he is doing so in much the same way as he did with the Intermediary Money Transfer Tax (IMTT) where there was no delicate or incisive approach but a broad-stroke blanket tax. This leads us to…

What this Wealth Tax actually is…

Its definition as a “wealth tax” might be a misnomer because it is specific to residential property and would be more aptly called Ad Valorem “according to the value” Tax.

“Ad valorem taxes are typically calculated on an annual basis, such as a local property tax (e.g. State of Georgia’s annual ad valorem tax on mobile homes), unlike transactional taxes which are also proportional in nature but are charged at the time of the transaction. An example of this is a sales tax. However, many jurisdictions consider transactional taxes as a type of ad valorem tax.”

Legal Information Institute

However, in the broadest sense, a wealth tax is typically levied on the market value of assets owned by a taxpayer taking into account their liabilities. This is usually meant for the upper percentile of people who earn a large sum of money and there is typically a threshold of what that echelon is.

In the case of Zimbabwe, the proposed Wealth Tax is not going to be discriminatory and is just going to impose a blanket tax without taking into consideration the earning potential of the occupant(s).

As mentioned above, this is an attempt to swat the 0.01% by dragging the 99.99%. This tactic will have the unfortunate effect of increasing property prices and more worryingly, rentals which are already high as it is.

Another issue with the proposed Wealth Tax is that it presents another issue and it is to do with Capital Gains Tax.

“Where the specified asset being disposed of/sold was acquired before 1st February 2009, Capital Gains Tax is chargeable at the rate of 5% of the gross capital amount realized from the sale.”

ZIMRA

What we could end up seeing is a chain of compound taxes that makes it increasingly unattractive to dispose of property worsening the ease of doing business in Zimbabwe where property is concerned.

Zimbabweans can take some solace from is that it is still just a proposal, however, in Zimbabwe’s regulatory environment, it might just be announced as a Statutory Instrument at whatever point and some may have already started preparing for the ripple effect if it becomes law…