Africa has potential to become a global leader across various industries as the continent is blessed with an abundance of natural resources and human capital. Agriculture production is essential to the eradication of poverty and economic prosperity with 51.76% of the Sub-Saharan African population living in rural and communal farming areas. Agriculture contributes to 30%-60% of the continent’s GDP, 30% of total continental exports and employs 2 thirds of the continent as reported by The Exchange Africa.

According to the African Development Bank, Africa’s food and agriculture market could increase from US$280 billion a year in 2023 to US$1 trillion by 2030. As farming methods improve across the continent with advanced technologies and mechanization, the question of which method best suits the African agricultural landscape arises. This article will provide a backdrop of agritech and mechanization in Southern Africa providing details on the startups involved, how they are funded ,and impact of mechanization on food production.

Background of Agritech

Tech Target defines agritech as the application of technology and digital tools to farming. It encompasses a wide range of technologies including automation, biotechnology, information monitoring and data analysis. Some of the advantages of implementing agritech are that it improves efficiency, increases yields, reduces costs, and boosts sustainability.

Although agritech has been adopted in some parts of Southern Africa there have been limitations to it being adopted by the mass market due to limited access to infrastructure, lack of digital literacy in communal areas and affordability as a barrier to entry.

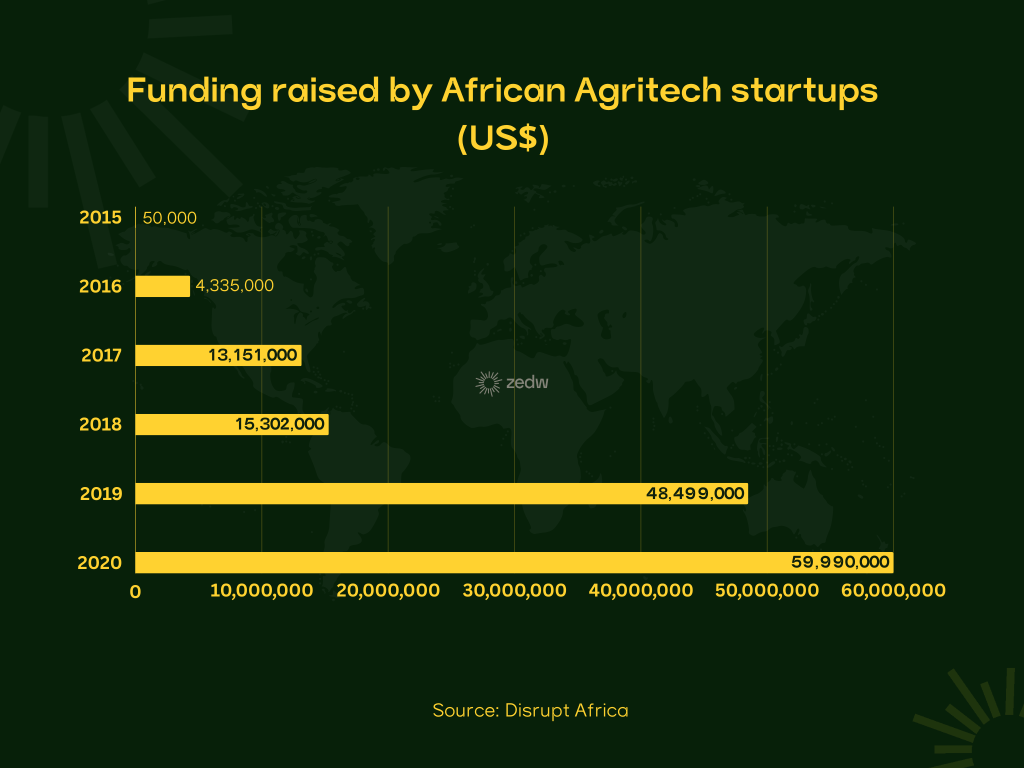

African agritech startups received a total US$95.1 million in funding according Ventures Africa in 2021. When it comes to the agritech market on the continent, Kenya and South Africa dominate with 59.5% of total investment on the continent going to Kenyan startups in 2020. The main funders of agritech on the continent are international development agencies such as the World Bank and the African Development Bank, Venture Capital firms such as Accion Venture Lab, local government, philanthropic organizations and private sector companies.

Agritech Success Stories in Southern Africa

According to SADC, the agriculture sector is estimated to contribute between 4% to 27% of gross domestic product (GDP) of the region and crop production contribution is estimated at 61%. There have been several agritech success stories in SADC as startups have raised their hands in attempting to solve the region’s food security issues through innovation. South Africa’s Aerobotics is one such success story having raised US$27 million in funding since it was funded in 2014. The start-up specializes in AI-enabled pest detection, disease detection, drone imagery services, orchard and yield management serving the B2B market. With19 institutional investors including Naspers, 4Di Capital and Nedbank the future of Aerobotics looks bright.

Zimbabwean start-up Farmhut is a startup providing digital services for farmers such as advisory, logistics, marketplace and financial services to help them access loans and sell their produce. According to Tech in Africa, Farmhut received US$100k in funding from the Hultz Prize competition. With Farmhut and Aerobotics being just two examples of startups receiving funding in SADC has been a growing number of agritech startups emerging from the region.

Short falls Agritech in Africa

Food security has been put in the spotlight with the growing global population, which is projected to reach almost 10 billion by 2050, according to the UN’s 2022 World Population Prospects.

As much as agritech supplements agricultural development there are still several barriers to entry to it being fully accessible to communal farmers on the continent. Challenges such as limited infrastructure as 600 million Africans or 53 % of the continent have no access to electricity according to the World Bank and 78% of Africans have no internet access according to the Global System for Mobile Communications Association. Only 50 % of African countries have ‘computer’ skills as part of their school curriculum, compared to 85 % of countries globally as stated by the Mastercard Foundation. This results in lack of digital literacy as most of the rural population cannot operate digital tech tools, and the expensive nature of tech tools making them unaffordable for small scale farmers limits the potential reach of agritech in Africa.

According to McKinsey and Company, more than 60 per cent of the population in Sub-Saharan Africa are smallholder farmers and agritech solutions should incorporate this. With regards to addressing the particular needs of small scale farmers the mechanization question is raised.

An argument for Mechanization

Agriculture mechanization is the process of carrying out agricultural tasks using machinery and equipment, ranging from basic hand tools to more complex, motorized machinery and equipment. Mechanization improves the efficiency making it an important aspect of obtaining food security on the continent. This can help develop rural communities as farmers become more productive and can sell more produce.

However, agricultural mechanization is expensive with high initial investment costs and can lead to environmental degradation if machinery is misused. The Food and Agriculture Organization of the United Nations (FAO) estimates that Sub-Saharan Africa has the lowest tractor density globally, with only 1.7 tractors per 1,000 hectares of arable land compared to a world average of 18.7. When it comes to mechanization in SADC, governments should make it more affordable and accessible to smallholder farmers through subsidies, credit schemes, and farmer cooperatives. As mechanization can present threats to the environment it is essential to promote the use of sustainable mechanization technologies that minimize environmental impact. Lastly, investing in skills training and education can ensure that farmers operate and maintain machinery safely and effectively.

Europe’s mechanization compared to Africa

Although the African and European agricultural context differ there are several lessons Africa can learn from Europe when it comes to mechanization. Europe’s agricultural machinery market size is estimated at USD 48.65 billion in 2024, and is expected to reach USD 57.23 billion by 2029, growing at a compound annual growth rate of 3.30% during the forecast period (2024-2029) whilst the African agricultural machinery market size is estimated at USD 2.27 billion in 2024, and is expected to reach USD 3.09 billion by 2029, growing at a compound annual growth rate of 6.40% during the forecast period (2024-2029). Europa marks France as the most productive agricultural country in Europe with (27.4 million ha) followed by Spain (23.9 million ha) with the largest utilized agricultural areas in the EU in 2020, 17.4 % and 15.2 %, respectively, of the EU total. Europe’s increased agricultural mechanization has meant that 5%of the population can satisfy production making labor expensive. Many African countries combine a pattern of low growth in machinery with low agricultural output growth, including some large agricultural economies with potential for growth, such as Côte d’Ivoire, DRC, Kenya, Madagascar, Nigeria, Tunisia, Uganda and Zimbabwe.

Conclusion

The answer to whether Africa needs agritech more than mechanization can be answered by statistics. Two thirds of Africa’s population are small scale farmers with limited access to funds, lacking digital literacy and the logistical framework to implement most agritech solutions. This reflects that mechanization would be more effective as it can equip the farmers with the resources necessary to produce more. Agritech and mechanization can also merge to provide better farming solutions for small scale farmers. A combination of agritech and mechanization such as Hello Tractor, an application that connects rural farmers to tractors close to their area is an example of how the two concepts can work in unison However in order to make this a reality, government support and funding needs to be accelerated.