For the very first time, people aged under 35 will have representation in Parliament to further causes that have been overlooked or not lobbied with the correct context. The Youth Caucus, which is now almost a year old, has been rather quiet regarding the initiatives it wants to bring about.

Meet the representatives

| Province | Candidate | Sex | Party |

| Bulawayo | Zana Sivina Evidence | F | CCC |

| Harare | Ngadziore Takudzwa Godfrey | M | CCC |

| Manicaland | Sakupwanya Stanley | M | ZANU PF |

| Mashonaland Central | Raradza Emmerson | M | ZANU PF |

| Mashonaland East | Mudowo Tawanda Titus | M | ZANU PF |

| Mashonaland West | Ziyambi Mutsawashe Carl | M | ZANU PF |

| Masvingo | Maunganidze Naledi Lindarose | F | ZANU PF |

| Matabeleland North | Sibanda Lovejoy | F | CCC |

| Matabeleland South | Mushipe Tinashe Tafadzwa | M | ZANU PF |

| Midlands | Mnangagwa Kudakwashe David | M | ZANU PF |

Progress for a population with an average age of 18

Zimbabwe’s population is very young and with that comes a certain responsibility for policymakers to understand the needs that the large proportion of the population has. The current regulatory framework from a business perspective has been tone-deaf to the evolution of business practices.

The country is no longer on par with what is happening around the world and most high-potential startups are leaving the country to seek their fortunes elsewhere. One of the key reasons this has been happening is because there are regulations not framed for the speed at which business is happening in the 21st Century and the environment to incubate innovation of all kinds.

The prevalent legislation of the Company’s Act and its accompanying tax regulations are not suited to entice the informal economy let alone attract and incubate startups. This is made worse by the fact that individuals between the ages of 15 – 34 contribute to the largest proportion of persons “engaged in SMEs on a full-time basis” according to ZIMSTAT.

Startup founders may not like that we are conflating SMEs with them. However, for this article, the commonality of issues when it comes to formalisation works for both SMEs and startups.

Policy needs to reflect the present concerning SMEs

Situational awareness from a policy perspective has been lacking considerably in Zimbabwe. This is despite there having been two National Development Strategies. Those documents look at SMEs as an undifferentiated mass, where they should be looking at them through the peculiarities of their current state.

What is meant by that is saying SMEs need access to capital, capacity utilisation, and the rural/urban divide doesn’t go far enough. There needs to be a nuanced approach to understanding the SME landscape in Zimbabwe.

Building a baseline

The starting point for all of this compliance. Without being legal entities, SMEs in Zimbabwe are not going to be able to get a share of financing opportunities or contracts with companies that only deal with registered and regulated entities.

Furthermore, registration and compliance are needed so that the informal sector can contribute to tax revenue collections. Current methods like the Intermediary Money Transfer Tax (IMTT) are inelegant and unsustainable solutions to the problem of taxing the informal sector.

Granted they are an emergency means of getting revenue into the government, it has been nearly half a decade and all that has been done to it is reduce the amount that is levied for every transaction Zimbabweans make.

The lack of progress in concocting a tangible solution to getting SMEs formalised is concerning, however, there are ways of starting that push…

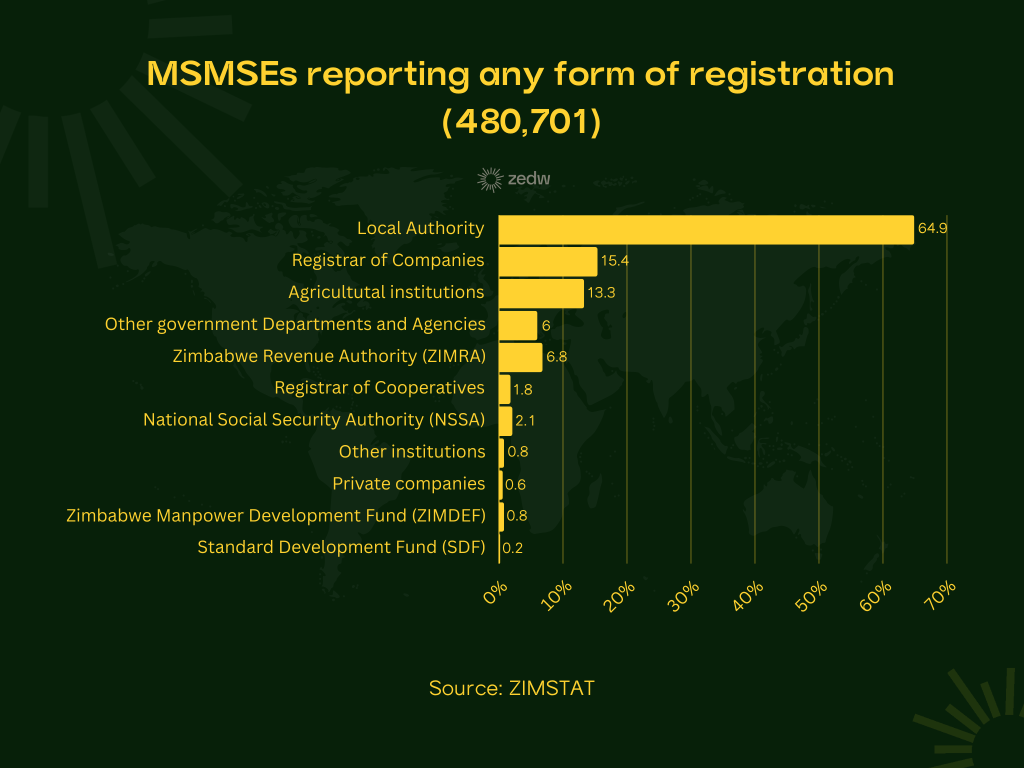

According to the ZIMSTAT SME Survey from 2021, of the 480,701 SMEs that responded only 15.3% were registered by the Registrar of Companies and 6.8% had some sort of Zimbabwe Revenue Authority (ZIMRA) registration.

As low as those numbers are, Local Authorities are leading the charge with 64.9% of some form of registration of SMEs.

This presents an opportunity for a policy framework to be built that can allow for onboarding SMEs who are not regulated at the national level and thereby contribute to the national purse. Seeing as local governments have a deep database of SMEs country-wide they would be the first port of call for gaining a more comprehensive understanding of the inner workings of how a policy and measures to improve compliance among SMEs.

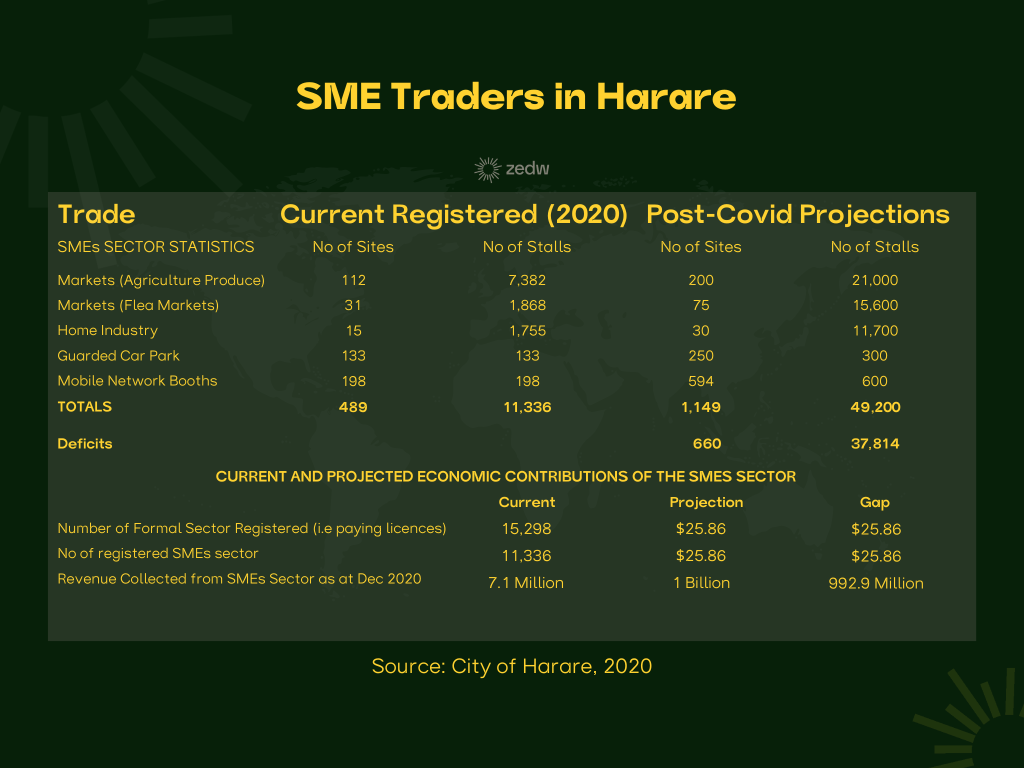

An example of this is The City of Harare’s April 2023 SME Policy, in it, the Council was able to establish a greater picture than what was offered by ZIMSTAT in its SME Survey.

This data is conservative, to say the least, with a wellspring of remote-based businesses that sprung up due to the COVID-19 Pandemic. There is more activity going on in Harare, and the rest of Zimbabwe, than what was reported by the City of Harare.

However, that information is still valuable because it will allow the Youth Caucus to build a knowledge base on the currency scope of the problem.

Understanding where pressing intervention is needed

The compliance issue can’t be tackled in the way it was before by the use of centralised means and methods. Technology adept to the Zimbabwean reality needs to be utilised to extend the reach of services like company registration and tax compliance.

Unstructured Supplementary Service Data (USSD) is what appears to be the equaliser when looking at Zimbabwe. Anyone can open a personal bank account from any of Zimbabwe’s traditional financial institutions. This indicated that the banks in the country that had been high-brow about acquiring any kind of customer needed the volumes of new transacting individuals to make their business models make sense.

Furthermore, Zimbabwe’s mobile phone penetration stands at 97.5% which means that this is fertile ground for innovation when it comes to converting processes like company registrations that are typically done through agents and middlemen.

The idea is not far-fetched because just south of Zimbabwe the South African CPIC (Companies and Intellectual Property Commission) has a USSD platform (*134*2472#) that offers that very service. It isn’t a completely contactless process but if the issue of name searches can be done without having to physically go to the Registrar’s Office or engage an agent, that would be progress.

Additionally, the Zimbabwe Electoral Commission (ZEC) has a standing USSD platform (*265#) that allows registered voters to see their status. What this underscores is that technology is clearly not anything and there is a well of experience already in the country to build such a platform for company registration.

Tax compliance

Where this is concerned, USSD again is a platform that needs to be head up the technology drive where tax registration and compliance. Inspiration can be taken from the successes just over Zimbabwe’s northern border where the Zambia Revenue Authority with assistance from the GIZ was able to deploy a USSD platform that allows Zambian SMEs to register, file and pay their taxes through mobile money or other means.

A quarter of a million tax registrations in 4 years is progress that is yet to be seen in Zimbabwe. Again the emphasis is not on trying to reinvent the wheel, but simply looking at the case studies from countries north and south of Zimbabwe’s borders to gain inspiration and implement policies that already have traction.

The Youth Parliamentary Caucus is starting to see the problem

This isn’t to say that the Youth Caucus is not seeing the problem… Member of Parliament in the Youth Caucus Stanley Sakupwanya, recently highlighted the plight of content creators in Zimbabwe being unable to receive money from online platforms directly into their local bank accounts.

Something like this has rarely been brought up in any setting at a parliamentary level and this is the reason why a deliberate policy that allows for problems like these to be addressed needs drafting.