Africa’s 350 million (est.) financially excluded adults present a unique opportunity for financial service providers on the continent. One of the technologies that is rising up as a solution is Neobanking. This is a direct banking service that operates exclusively online with no physical branch network. The biggest Neobanks in Africa currently include TymeBank (South Africa), Kuda (Nigeria), Chipper (Nigeria) and Payday (Nigeria).

The unique problems being solved?

Compared to banks and mobile money, Neobanks have proven to incorporate technology and move quickly to add highly demanded features.

- For Kuda this meant deploying a smart budgeting feature with clear visual analysis to help Nigerians manage their finances effectively.

- One of PayDay’s highlight features is the ability to open a multi-currency account which receives different currencies (£,$ and €). This eliminates need for PayDay users to open traditional bank accounts to transact locally and another MasterCard/VISA for global transactions.

Beyond the agile and highly-focused feature set, Neobanks tend to offer lower charges than traditional banks. The money saved by not having branch networks & ATMs is passed on to the customers.

You may be wondering how a physical presence is established with branches. TymeBank achieved this by partnering with two retailers; Pick n Pay and Boxer Super Stores. The two retailers have a combined 2474 stores across South Africa (2204 and 270 respectively). By comparison, Standard Bank (established in 1862) has 370 branches in South Africa.

Fees

Globally, Neobanks are known to offer low to no monthly charges with this trend also being prevalent in Africa. Below we’ve listed some of the perks that make some of the largest Neobanks attractive

What do TymeBank clients get:

- TymeBank clients send money for R7($0.36) to other South Africans and at no cost to fellow Tyme Bank clients.

- TymeBank offers fee calculators on their website that break down transaction fees, savings targets and reward bonuses per transaction;

Pertaining to transfer fees, MyBroadband declared TymeBank as the second cheapest bank account in South Africa. The study included a comibination of monthly fees, withdrawals, bank transfers, purchases and notifications. TymeBank landed at a cost of R43/month ($2.28):

In Nigera oPay users get:

- 10 free ATM withdrawals every month.

- Initially charged N10 for transaction but this changed to 1% for every transaction

- Free debit card (traditional banks charge $10-$20 for these)

Kuda users get:

- 25 free transfers to Nigerian banks every month.

- free ATM withdrawals in Nigeria

- 15% savings interest on deposits

For contrast MTN Mobile Money (Nigeria) has service fees of:

- N10 for every phone to phone transfer;

- 2% transfer fees for phone to bank transfers

- 1% cash out fee (withdrawal)

Loans & interest rates

Neobanks have been praised for offering attractive interest rates that outperform most savings accounts offered by banks:

| TymeBank Goal Save | 4%-6% (7%/8%) |

| AfricanBank Access Accumulator | 4.8%-8.25% |

| Capitec Flexible Savings | 2.25%-2.5% |

| Absa TruSave | 0-2.35% |

- TymeBank offers GoalSave which has dynamic interest rates. TymeBank starts off paying 4% interest, increasing to 5% by day 31 and 6% by day 91. That 6% is higher than the industry average of 5.05% in South Africa. Customers who give TymeBank a 10-day notice of intent to withdraw get 7% interest. Finally, users who move their salary to their TymeBank account get 8% interest.

- They also have a credit card offering for South Africans earning as low as R3,000. Banks tend to offer credit cards for people earning R5,000-R10,000 making this more accessible. TymeBank’s credit card also has international transaction fees of 2% making it more competitive than the industry average of 2.75%.

- TymeAdvance allows employees (working for select companies) to access salaries in advance.

In Nigeria’s Neobanking sector let’s see what Kuda offers;

- The Neobank offers Kuda Overdraft loans allowing users to borrow upto ₦200,000 ($258) without filling a form or providing collateral. These have a maximum repayment period of three months.

- Kuda’s loan process is complete in minutes

*oPay longer offers loan services – instead having a separate subsidiary Okash Loan taking care of lending.

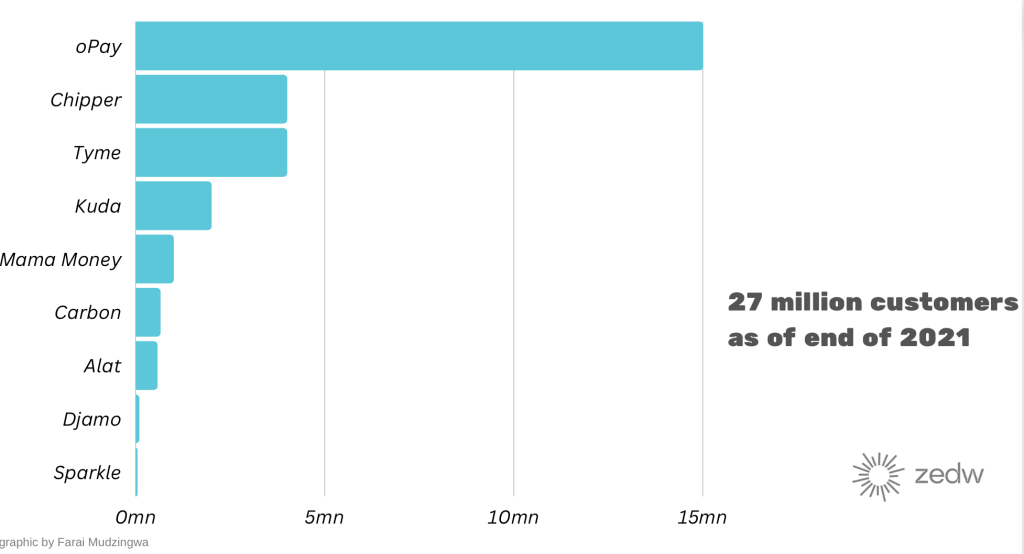

These features have allowed Neobanking to grow from 2 operators and 2 million customers to 21 operators, sharing 27 million customers in a decade.

Neobanks offer low barriers to registration compared to banks. Sign up processes typically require only an ID number and a cellphone number. Tyme Bank highlights how potential customers can sign up in under 5 minutes – much quicker than opening a bank account. It’s important to note that this level of KYC only allows customers to open a limited “Just met” account. Here is clearer requirement list for all the accounts:

| Account type | ID number | Cellphone | Biometrics (photo & fingerprints) | Residential address | Daily transaction limits | Monthly transaction limit |

| “Just Met” | ✅ | ✅ | ❌ | ❌ | R20,000 | R40,000 |

| “Getting to know you” | ✅ | ✅ | ✅ | ❌ | R200,000 | R1,400,000 |

| “Good friends” | ✅ | ✅ | ✅ | ✅ | R200,000 | R1,400,000 |

Whilst this ease of account opening helps, many African customers have experienced it with mobile money which has similar KYC requirements.

Neobanking weaknesses

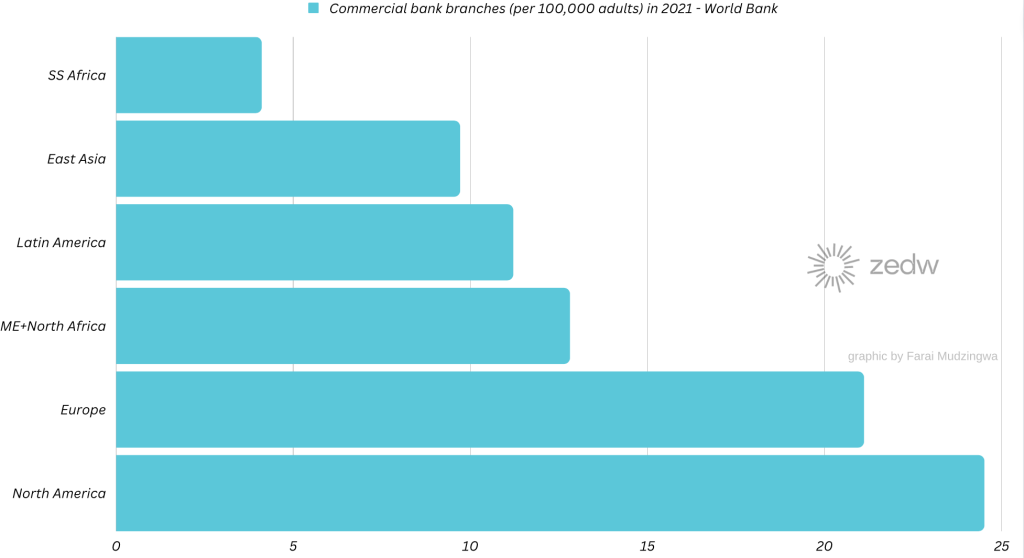

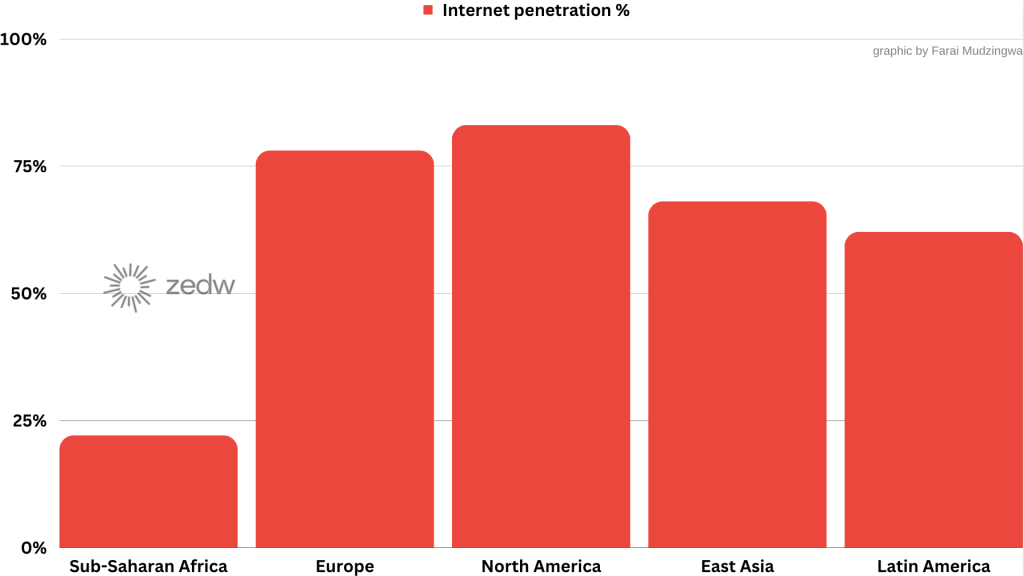

As with anything, Neobanking has weakness that contrast it’s more glamourised parts. By virtue of being internet-only offerings, Neobanks can’t scale across Sub-Saharan Africa with its internet penetration rate of 22%. This is why an estimated 80% of the Neobanks in Africa are concentrated in South Africa and Nigeria. South Africa has high penetration rate, whilst Nigeria has a large population that offsets it’s low internet penetration.

Until the internet is available at a wider-scale on the continent, Neobanks are effectively unable to scale. Smartphone penetration rate was fairing better at 49% in 2021. TymeBank’s success as a Neobank owes a lot to it’s geography. South Africa has a smartphone penetration rate of 67% – much higher than the region’s average. Additionally, an internet penetration rate 3x higher than the regional standard, makes TymeBank truly internet-first, which is essential for Neobanking. For digital banks in the rest of the region to take hold this barrier to entry will have to shift. (Worryingly this is an impediment that is outside of their control and will largely rely on government policy.)

Mobile money and banks are not stagnant

In mobile money, Neobanks face a competitor that has gained traction with 586 million active users. Mobile money services in Africa starting to offer more than payment services with insurance offerings. By the time internet penetration catches up to global averages, mobile money might just be as agile/high-tech as Neobanks. Worryingly, the banks are not standing still either:

- 95.5% of African banks indicated that digital transformation was either the most important or a top 3 priority for them.

- 68% of banks already internet banking options and 79% have mobile apps

Varying regulatory treatment of FinTech activity across Africa makes it difficult for new players to expand among the different nations. Currently it is only possible to enter the market as a Neobank, by either:

- acquiring a full banking license or

- partnering with an incumbent bank to operate under a third-party license.

African government central banks have started exploring regulatory sandboxes in hopes of accelerating FinTech adoption which might address this:

I feel like it’s becoming easier to build because some governments are beginning to collaborate and try to hear us and work with us to establish rules and policies that make it easier for us to build

Favour Ori – PayDay Founder

Are the business models sustainable?

The biggest uncertainty surrounding Neobanks in Africa is whether or not they have sustainable business models. The reason why this has become a topic of contention is because they have posted huge losses:

- Tyme Bank and Kuda lost R900mn and ₦6bn respectively in 2021. In today’s money that would be $47.5mn and $7.7mn (more at the time since the Rand and Naira have weakened).

Questions around effectiveness of the business model are justified since no one has an informed picture of Neobank performance metrics. The metrics come from reporting on the digital banks and Neobanks tend to drip-feed metrics to the media. This get’s further complicated once you consider that Neobanks have incentive to raise investor funding. There is a possibility that the numbers we get to see are the ones that appeal most to potential investors. Without a fuller picture of performance metrics, we can’t determine market size, value or overall effect of Neobanking in Africa.