The Transactions Cleared on an Immediate Basis (TCIB) is the Southern African Development Community’s (SADC) instant payments solution for the region and a first of its kind in the region. It works on a real-time, interoperable, cross-border payments scheme that offers financial services (both banks and non-banks) corridors to expand the reach of convenient financial services.

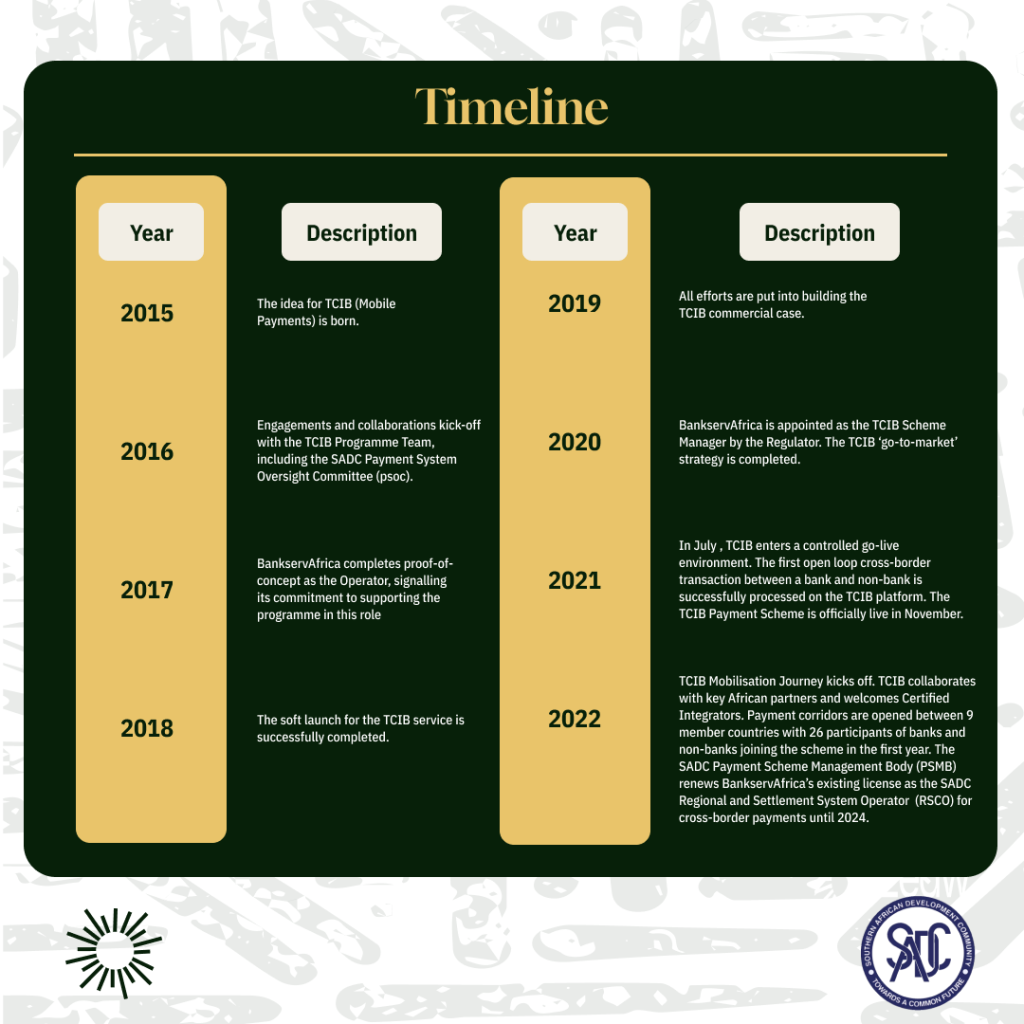

Timeline

*BankservAfrica is an automated clearing house located in Johannesburg, South Africa, serving both national and pan-African transactions

The roots of the TCIB

Regional payment integration in SADC is hardly a new concept. In July 2013 the SADC-RTGS platform (formerly known as SIRESS) was launched in a pilot program involving South Africa, Namibia, Eswatini, and Lesotho.

“Siress (now known as SADC-RTGS) went live in the CMA [rand common monetary area] in July (2013) and is now processing R10bn a day.”

Brad Gillis, CEO of Bankserve-Africa

The system was initially limited to high-value cross-border transactions in the CMA and in the following year, the platform opened up to credit payments and debit payments in 2015…

As we are sure you have already guessed, the SADC-RTGS’ settlement currency is the South African Rand.

This was done because at the time the other SADC nations could not compete with the volume and values of the South African market as South Africa accounted for 90% of all electronic transactions in the region.

SADC-RTGS was eventually rolled out to the rest of the member states…

“The main objective of the SADC-RTGS is to support SADC regional integration and development agenda, and more specially to enhance regional financial integration. The SADC-RTGS system is one of the success stories under the area of finance and investment in the region.”

10th Anniversary SADC-RTGS Statement

Impact since the inception of SADC-RTGS

| Volume of Transactions | 3.2 million |

| Value of Transactions | R12.63 Trillion |

| Participants | 90 (central banks and commercial banks) |

Why is the TCIB necessary when SADC-RTGS exists?

Unlike the SADC-RTGS system which is transacted in larger volumes, the Transactions Cleared on an Immediate Basis (TCIB) is focused more on financial inclusion by offering affordable cross-border payments for individuals (remittances) and Small to Medium Enterprises (SMEs). This is because those transactions are relatively low-value but high volume.

“Transactions Cleared on an Immediate Basis (TCIB) is a cost-effective, interoperable solution that caters for high volume day-to-day and low-value cross-border payments in real time and supports the SADC governments’ requirement for a solution to support regional payments integration. As an interoperable payment solution, it enables instant cross-border transfers between any two TCIB participants of banks and non-banks anywhere in the SADC region.”

The platform works in much the same way as the Pan African Payments and Settlement System (PAPSS) with the participants being separated by direct (banks) and indirect (payment gateway, processors, mobile money) participants.

Which SADC financial institutions have already registered participation in TCIB?

As of the time of writing Zimbabwe, South Africa and Namibia have been listed as countries that have been activated under the TCIB program. The countries where the initiative has opened are all SADC countries except Angola, Comoros, Mauritius, Seychelles and Madagascar.

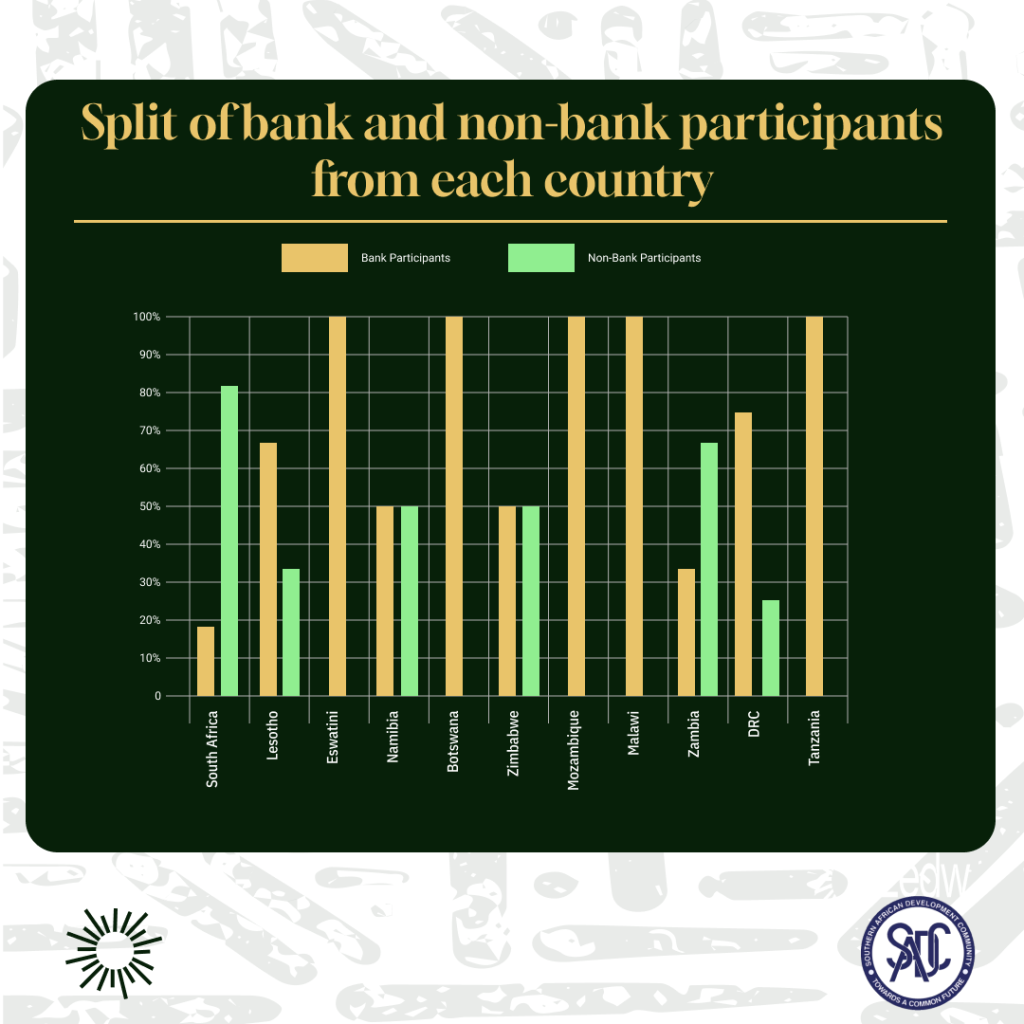

Of the countries where TCIB is open here is the split of bank and non-bank participants from each country.

The South Africa and Zambia corridor is now active

On the 24th of February 2024, South Africa and Zambia announced that their leg of the TCIB corridor was now active. This was through two entities, South Africa’s SendHome (a registered ADLA) and Zambia’s SamPay (a payments processor and e-commerce platform).

“We’re extremely excited about mobilising these corridors at this time when remittance costs in the region remain concerningly high in spite of their importance to livelihoods and economies. We are hopeful that today’s development will change this and encourage people to use this service to send home money affordably and securely. The TCIB payments platform is the digital alternative for sending money almost immediately and at a low cost,”

Ruhling Herbst, Executive Head: Africa Business Development at BankservAfrica

The hope is that partnerships like this can bring a more convenient and cost-effective way to send remittances from one SADC country to another. What is, however, unclear at the moment is what the cost structure of this engagement will look like for this engagements.

At present it costs on average US$13.54 (in Q3,2023) to send the equivalent of US$200 between South Africa to Zambia across all the major remittance service providers and banks. How the TCIB will reduce this cost is yet to be determined but something that we will be tracking as more information becomes available.