The Pan African Payments and Settlement System (PAPSS) is right around the corner even though there seems to be a lull in anticipating an innovation that looks to revolutionise African payments.

Gone will be the dependency on foreign services that are not precisely attuned to the kaleidoscope of African operating environments.

If the deployment of PAPSS happens, in practical terms, in the ways that it has been theorised; then we should expect a deluge of cross-border competition from entities that may have never imagined they would be directly competing with each.

You should read: Pan African Payments System: Are We Ready As SADC & Startups?

If you are a startup and building for a single market, you might need to seriously consider how your product or service can be incorporated into other markets, but that is a story for another day.

What we are here to talk about are the participation options for the Pan African Payments and Settlement System and how that whittles down to someone looking to make a transaction.

Direct vs Indirect and what those terms mean.

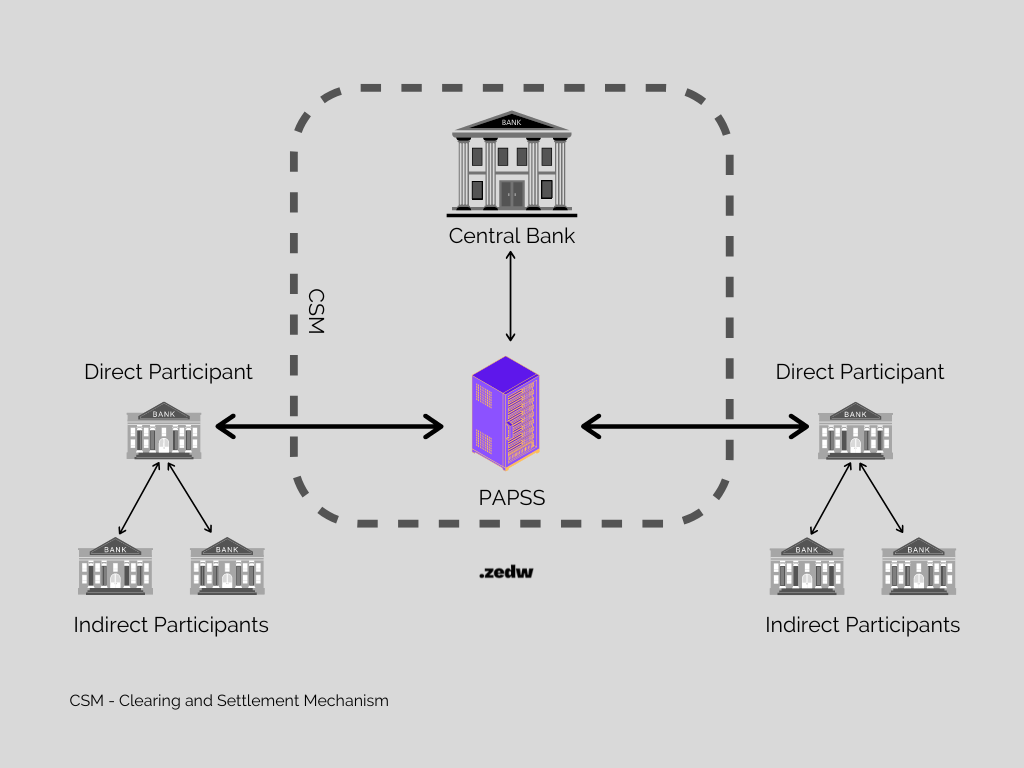

There are generally two types of participants in a payment system, those who are directly integrated and those who are indirectly associated. Those terms might sound like technical payments witchcraft but they are pretty easy to understand.

An entity that can be considered a direct participant is that which in PAPSS terms is a party that has a settlement account with the central bank of its country.

A settlement account, as many of you would have already guessed, is an account containing money or assets that are held with a central bank, central securities depository, central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants or members of a commercial settlement system.

The classic example of entities with settlement accounts are commercial, retail banks and building societies as well as players like certain classes of Remittance Service Providers in some markets.

On the other end of the spectrum are Indirect Participants. These companies or service providers typically interface with the payments system through a direct participant.

They have no direct access to the Central Bank or PAPSS but are vital players in extending the reach of financial services through innovation and products tailored to specific market demographics.

Examples of indirect participants can also be banks because it can be resource-intensive and costly to be a direct participant. Some banks would prefer, saving time and money, to affiliate themselves with a direct participant in the Payments System. The term for this kind of arrangement is sometimes called agency banking or sponsored access.

How it works for you and me across borders

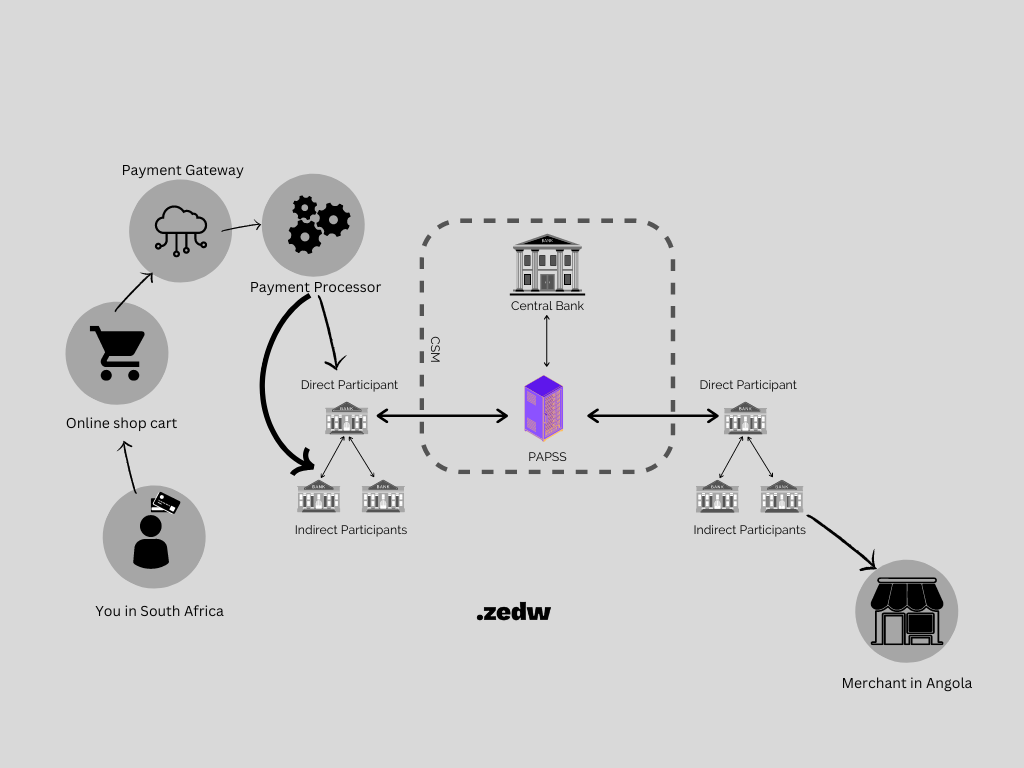

So for practical purposes, let us say PAPSS is online and you are making a transaction to an e-commerce platform in another country. The assumption here is that all members in the chain are on Pan African Payments and Settlement System.

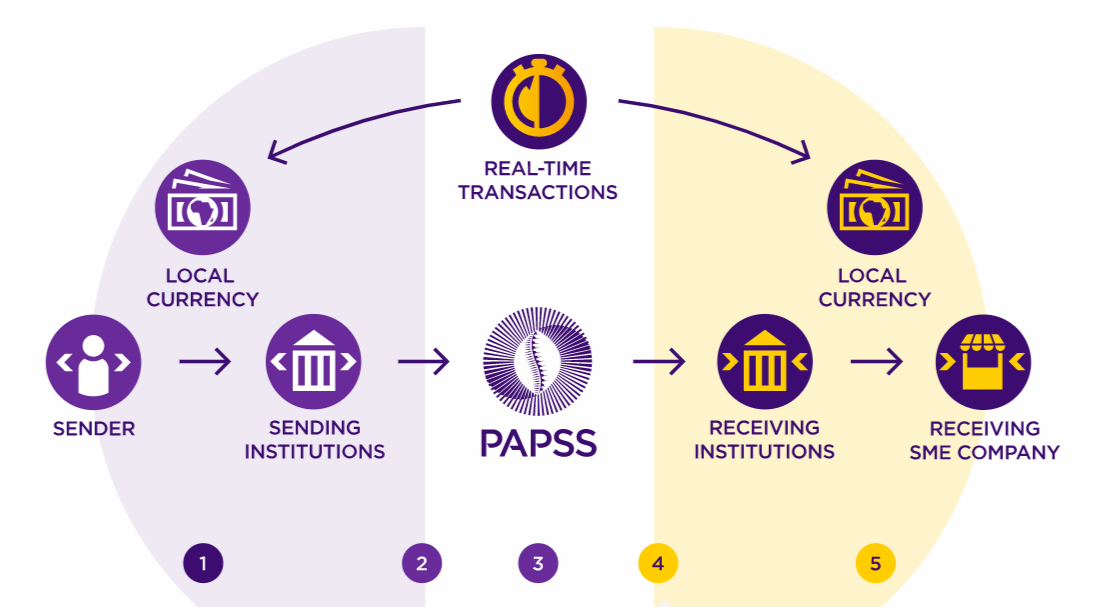

So let’s say you are in South Africa and you want to purchase goods from an online store in Angola, for example. What PAPSS is going to do is take your money from your account balance in local currency and transport it to the merchant on the other side of the transaction and they will also receive it in local currency.

The diagram above is an oversimplification of how the whole process will work but in essence, there are other parties and processes in between some steps. But for the purposes of getting an overview understanding, the transaction will be transported through a payments gateway from a transaction initiated by a user paying in Rands in South Africa.

A payment gateway is part of the chain which is, as near as makes no difference, a Point of Sale (POS) or swipe machine for online transactions.

It will then hand that to a payments processor which acts like a go-between between your bank and the merchant. What then follows is communication with the bank and an enquiry of whether there are funds in the account for the transaction to proceed.

After that, the payment is put through the Clearing and Settlement Mechanism either through a direct participant or an agency bank linked to a direct participant. And if all is clear, then the merchant in Angola will get the payment for the transaction in Kwanza when the payment would have been made in Rands.

The real kicker about all this is that the Pan African Payments and Settlements System says that these transactions will be near instant payments.

What progress has been made so far

What is truly wild is the number of partner Central Banks, Payment Switches and Commercial Banks that have already (to one degree or another) started work to make this whole affair happen. On the PAPSS website, it lists central banks from Zambia, Ghana, Guinea, Nigeria and more. As for the banks its heavy hitters like UBA, Zenith, Standard Chartered, ABSA, Stanbic IBTC, FNB, Sanlam and many others.