The Africa Telecoms scene is still in its infancy and quite dynamic. As of 2019, 477 million Africans had access to mobile networks which accounts for 45% of the continental population. Chinese companies are the dominant brands in telecommunications infrastructure and have become leaders regarding mobile devices making use of the said infrastructure. Transsion brands (Tecno, Itel, and Infinix) are setting their roots in the African market and claiming market share from legacy brands like Samsung and Apple.

The telecoms vendors in Africa

The dominant vendors on the African continent are Huawei, ZTE, Ericsson, and Nokia with Ericsson being the legacy vendor in a number of markets. Ericsson’s first entry onto the continent was in 1896 (127 years ago) in South Africa. From there it expanded to become the de facto vendor for most of Africa long before the existence of Nokia as an equipment vendor (1979), ZTE in 1985, and Huawei in 1987. Huawei and ZTE would only enter into Africa in the late 1990s.

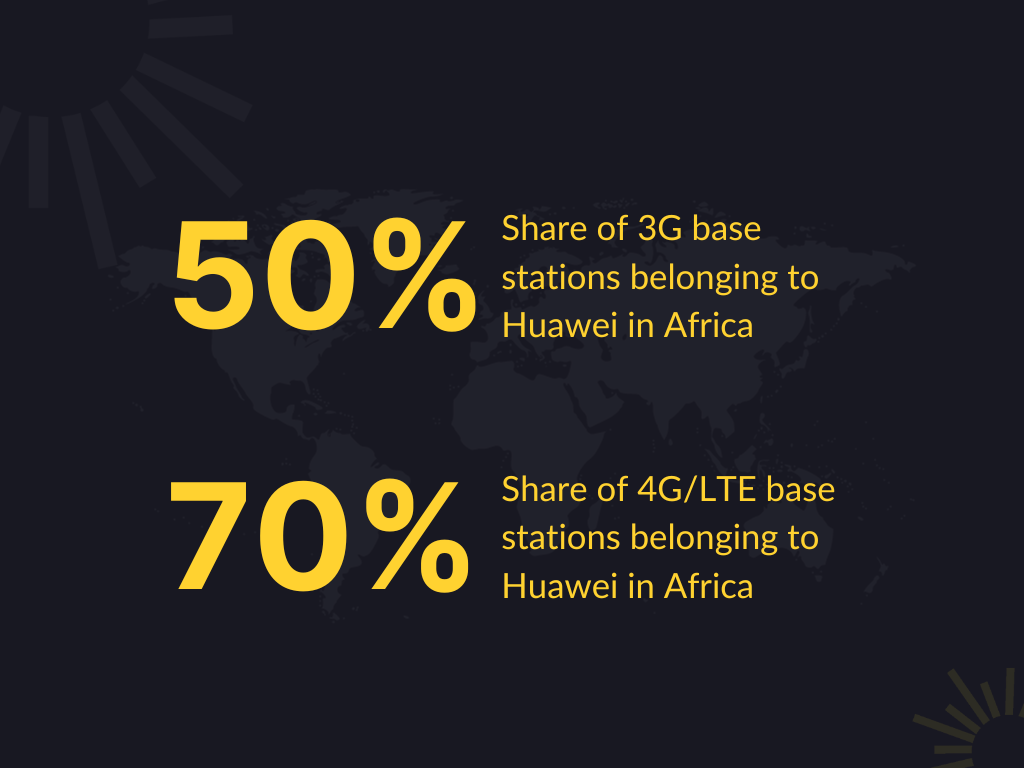

A number of Africa’s core networking systems as well as 2G and 3G networks are predominantly Ericsson hardware as this was the main vendor and equipment supplier pre-2000. From 2000, China’s infrastructure developments in Africa increased significantly with a 46.1% year-on-year improvement between 2001 and 2007. China’s ‘go out policy’ enacted in 1999 was the main driver of Chinese technology proliferating outside of China. This policy was further buttressed by the Chinese government financing projects in Africa including telecommunications projects. 50% of 3G coverage in Africa is making use of Huawei equipment with 20% to 30% being ZTE and for 4G equipment 70% of the market share belongs to Huawei.

A big push for underserved Africa

The rise of Chinese vendors on the continent came about in the early 2000s. China was on the verge of expanding its trade with the rest of the globe and in so doing, they set up the Go Out Policy in 1999. Between 2005 and 2020, Chinese technology and contract investments amounted to US$7.19 billion in Sub-Saharan Africa. This led to several telecommunications projects being deployed on the continent with Huawei and ZTE at the forefront of telecommunications projects. These projects are inclusive of data centers, backbone fiber networks, and e-government solutions.

China Telecom is part of the 2Africa subsea cable consortium

A 37,000km undersea optic fiber cable project, the 2Africa subsea cable project, is a joint project with several telecoms and technology giants like the French telecommunications company Orange and Facebook. China Mobile International, the biggest telecommunications operator in China which also happens to be state-owned, is part of this project. The project aims to interconnect 23 African countries with the Middle East and Europe and will carry 3 times the capacity in bandwidth as all existing subsea cables landing on the continent.

This project is also adding redundancy to the connectivity of the continent to the rest of the world. In August of 2023, a rockfall in Congo led to damage to the WACS, SAT-3, and ACE cables connecting South Africa to the rest of the world. This greatly reduced the capacity of their internet as the remaining links rapidly got congested. The 2Africa subsea cable made landings in Durban and Capetown in South Africa and will be adding that redundancy to the continent’s internet connectivity.

Africa’s rate of urbanization is one of the fastest in the world. Statista puts it at 47% and this population is additional traffic on the existing networks. GSMA projects an 8% increase in mobile subscriptions on the continent. Additional capacity from the 2Africa subsea cable will be crucial in providing capacity for the rapid increase in the uptake of digital services on the continent.

The deployment will be a part of an open and inclusive Internet ecosystem where service providers will have fair and equitable access to the cable’s capacity and landing stations.

Huawei contracted to setup Burkina Faso’s national backbone fiber network

In 2017 Burkina Faso began constructing the 2,001km long national fiber optic backbone project undertaken by Huawei and 60% of it was financed by the China Exim Bank. The first leg of the project cost US$90 million which would be paid up over 12 years. This national backbone fiber network aims to connect the 45 provinces of the nation together.

The first phase of the project completed in 2020 connected 18 provinces and 60 municipalities to the fiber network. The second phase which began in 2021 looks to connect the remaining 27 provinces and 145 municipalities. It will increase its international bandwidth capacity by a third and enable the government to trial a telemedicine project that it had in the works.

Since 2017, Burkina Faso’s mobile penetration rate has risen from 81% to 111.9%, and mobile internet subscriptions increased from 11% to 21.6%.

Huawei contracted for Kenya’s national digital infrastructure

Kenya also signed a US$172.7 million agreement with Huawei for a data center, smart city, and surveillance system. In 2009, Airtel Nigeria had Ericsson as the dominant vendor for their mobile network hardware, as was the case with most of Africa. Fast forward to 2016 and the Huawei component of Airtel Nigeria’s network infrastructure had grown to 50%. In South Africa, Huawei is the only vendor supplying all major network operators in the country.

4G and 5G will coexist for a long time. At the same time, the telecom infrastructure in most African countries is still at a low level, which reduces their capability to adopt 5G. To cope with user growth, traffic pressure and network evolution, it is recommended that operators pre-embed 5G capabilities while upgrading and reconstructing the existing 4G network.

ZTE MEA President – Darren Zhao | Developing Telecoms | 2020

| Country | Project | Financier | Borrower | Implementation | Amount | year |

| Tanzania | National ICT Broadband Backbone (NICTBB) Phase II | Exim bank | Tanzanian government | CITCC, Huawei | $100m | 2010 |

| Cameroon | National Backbone fiber optics | Exim bank | Cameroonian Government | Huawei | $168m | 2011 |

| Kenya | National Optic Fibre Backbone Infrastructure (NOFBI), Phase II: E-government | Exim bank | Kenyan Government | Huawei | $71m | 2012 |

| Nigeria | Galaxy Backbone project for National Security development system | Exim bank | Nigerian Government | Huawei | $100m | 2012 |

| Ethiopia | Telecom Transformation and Expansion (4G network and mobile expansion) 6 Circles – ZTE | Exim bank | Ethiopian Government | ZTE | $300m | 2013 |

| Ethiopia | Telecom Transformation and Expansion (4G network and mobile expansion) 7 Circles – Huawei | Exim Bank | Ethiopian Government | Huawei | $800m | 2013 |

| Tanzania | National ICT Broadband Backbone (NICTBB) Phase III | Exim Bank | Tanzanian government | CITCC, Huawei | $94m | 2013 |

| Nigeria | National Information Communication Technology Infrastructure Backbone (NICTIB), Phase I | Exim Bank | Nigerian Government | Huawei | $100m | 2013 |

| Guinea | National Backbone fibre optics | Exim bank | Guinean Government | Huawei | $214.2m | 2014 |

| Cameroon | National Telecommunications Broadband Network Project Phase II | Exim bank | Cameroonian Government | Huawei | $337m | 2015 |

| Ivory Coast | Abidjan Video Surveillance Platform | Exim Bank | Ivory coast government | Huawei | $56.7m | 2016 |

| Cameroon | South Atlantic Inter Link (SAIL) | Exim Bank | Cameroonian government | Huawei | $85m | 2017 |

| Nigeria | National Information Communication Technology Infrastructure Backbone (NICTIB), Phase II | Exim bank | Nigerian government | Huawei | $334m | 2018 |

| Sierra Leone | Fibre Optic Backbone Network Phase II | Exim Bank | Sierra Leonean government | Huawei | $30m | 2019 |

Aggressive Competitive Pricing That Entices Telecoms Operators in Africa

Huawei and ZTE are the leading telecommunications equipment vendors in China and part of their global dominance outside of China has been attributed to their hardware being of similar quality and performance to Western vendors such as Ericsson, Nokia, and Siemens. These Western vendors already have a grip on Western clients and businesses considered to be higher-value and lower-risk than African clients.

This then played into the Chinese vendor’s hands and was key in the proliferation of Huawei and ZTE hardware in African ICT infrastructure. Their hardware is more affordable despite being of the same standard and Chinese vendors are more flexible with project requirements. Add to that the financial backing of these projects by the China Exim Bank and Huawei and ZTE become the most affordable and feasible route for African nations looking to expand and improve their ICT infrastructure.

Compared with Ericsson, Nokia, and Siemens, Huawei prices its equipment 5% to 15% lower than the Western vendors with ZTE going even lower at 30% to 40% lower prices. This trend does not stop at just the telecommunications equipment vendor side of things.

Transsion, the parent company for Itel, Tecno, and Infinix is also finding success in Africa making smartphones that are appealing while heavily undercutting legacy brands. As of 2019, the company had a 40% market share for smartphone shipments in Africa. Owing to their popularity, their smartphones come fitted with long-lasting batteries useful in Africa to try and beat the power cuts. They come with camera systems tuned to better represent darker skin tones and they are packaged at a price that makes them more attainable and attractive compared to equivalent offerings from legacy brands such as Samsung or Xiaomi.

Huawei & ZTE roots set deep in Africa

Huawei and ZTE’s global influence rose rapidly, partly due to their competitive pricing but largely due to their popularity with global telecommunications operators in the advent of 5G. Huawei was one of the lead developers of the technology and had the supply to meet global demand. It was the first vendor to be granted a contract by MTN-SA to set up a 5G network in South Africa and was the vendor of choice for a majority of mobile operators in Europe. Globally it was the leading supplier of 5G equipment for 3 years running (2020 – 2022).

This global dominance is now waining due to geopolitical conflicts with some US allies being forced to remove Huawei telecommunications equipment from their network as they (US) claim that they pose security risks. It saw a fall in Huawei’s global 5G market share from 30% in 2021 to 29% in 2022, a trend that will probably continue into 2023.

This has led Chinese vendors to intensify their operations in markets where they are not yet facing political friction such as Africa. On top of the numerous ICT projects Huawei and ZTE are pursuing on the continent in the form of data centres, e-government, backbone fiber, and network upgrade projects, Huawei specifically is investing in building training facilities in Africa for implementation, operation, and maintenance of their equipment.

What will we do in terms of the American statements about not using Huawei? We don’t have that situation in Africa.

Safaricom Kenya (then) Acting CEO Michael Joseph | Asia Nikei | 2020

With the way Chinese vendors are deeply integrated into Africa’s ICT infrastructure in terms of hardware, core network infrastructure and not forgetting ongoing upgrade and expansion deals, switching to alternatives, even under political pressure from the West, seems to be highly unlikely. It is also a very expensive process to undertake as seen in Europe.

Cost of replacing Huawei equipment in Europe

In the UK, the process of replacing core parts of the network with non-Chinese equipment was projected to cause a widespread delay in the provision of 5G services by 18-24 months. Such a delay is estimated to cost the UK economy as much as 6.8 billion Pounds (US$8.36 billion).

An estimated 60% of Germany’s 5G infrastructure is said to be made up of Huawei equipment and a report made on the state-owned rail operator, Deutsche Bahn, using Huawei equipment on its rail network states that replacing the equipment will cost upwards of US$434 million.

Why Africa will continue using Chinese telecoms vendors

Looking at Africa, a majority of the ICT projects occurring on the continent are happening thanks to loans either from the vendors themselves or through the China Exim Bank. The continent will not have the financial luxury to rip and replace Huawei or ZTE equipment with equipment from non-Chinese vendors due to their existing contractual obligations with the Chinese vendors and also their financial position. A few African telcos that had a pre-existing relationship with European vendors are the ones extending their relationships with these vendors. In 2022, Econet Wireless Zimbabwe announced the launch of its 5G network in partnership with Ericsson, a vendor they initially began working with upon their inception in 1998.

Chinese vendors have also been putting a lot of investment into setting up training facilities on the continent specific to their equipment. Huawei established certification courses for implementing, operating, and maintaining their products adding to the value chain of their equipment. It has established seven training centers across Africa in Angola, the Democratic Republic of the Congo, Egypt, Kenya, Morocco, Nigeria, and South Africa, and has sponsored training programs throughout the continent.

In 2019 Huawei opened an innovation center focusing on knowledge and skills transfer. Such an investment is also looking into their devotion to understanding the dynamics of the African continent and creating solutions to suit the dynamic and often unpredictable operating environment that exists on the continent. A vote of confidence in their operating in the market for an extended period of time. In Zimbabwe, Huawei networking courses are being offered by existing academic institutions including TelOne Centre for Learning and it is estimated that on the African continent, a total of 12,000 students graduate each year from Huawei’s training programs.

Cover image credit: Pexels – Furkan İnce