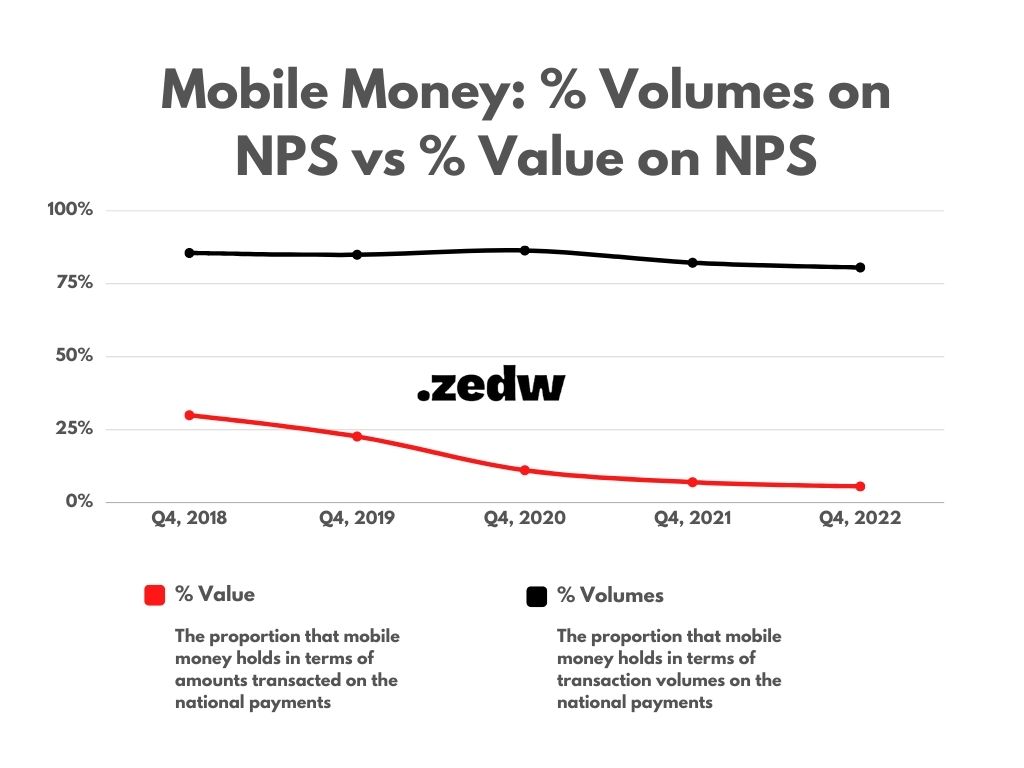

It’s a little over two years since EcoCash was brought to heel by the Reserve Bank of Zimbabwe (RBZ). During that time there have been massive changes in the nature of transaction volumes and values on the National Payments System (NPS). The biggest shift has been witnessed in the mobile money values vs volumes ratio on the NPS. Due to the ZWL$ transaction limits placed on EcoCash and other mobile money operators (MMOs), the industry now accounts for 5.47% of transaction values on the NPS while registering 80.53% of transaction volumes as of Q2,2022.

If we turn the clock back to Q4, 2018, will see that mobile money accounted for 29.87% of transactions on the NPS while accounting for 86.40% of transaction volumes.

The most pronounced decline in those proportions was at the end of 2020 when we saw the raft of measures by the RBZ that curtailed mobile money with the value of mobile money transactions falling from 22.60% in Q4, 2019 to 10.99% in Q4, 2020

These unprecedented measures have been necessitated by the need to protect consumers on mobile money platforms which have been abused by unscrupulous and unpatriotic individuals and entities to create instability and ineffciencies in the economy. Members of the public are assured that their bona-fide transactions will be processed normally

Dr J. Mangudya, Reserve Bank of Zimbabwe Governor

What this suggests is that, due to the transaction limits, there are a lot of high-volume low-value transactions that are being facilitated by EcoCash and other MMOs. This is because the utility of the ZWL$ mobile money wallet is waning… With banks offering easy-to-open accounts that have fewer restrictions, people have moved high-value transactions over to traditional financial institutions.

Decreasing the ZWL$ wallet’s inflows

Before the advent of the infamous neutering of EcoCash and other mobile money in 2020, there were five ways you could move a lot of local currency into your wallet:

- Cashing in – which could be into your own wallet or to someone else’s wallet (in the latter case that will be remittances)

- Peer-to-peer – moving money from one wallet to another.

- Bank to wallet – transferring money from your bank account to a mobile money wallet.

- Swipe to EcoCash – by way of a Point of Sale (POS) machine you could swipe local currency directly into a wallet

- Bulk payer lines – where companies could, for example, deposit salaries directly into employees mobile money wallets.

The mobile money Monetary Policy measures that were enacted between July and August 2020 banned methods one and five. Why would, for example, an employee want to receive their salary in their EcoCash wallet if it meant they couldn’t have access to all of it if it was above the monthly limit?

“landlocking” mobile money from the oceans of cash that fed it

More importantly, the permanent suspension of agent lines had a couple of key implications. The first was that without EcoCash’s vast agent network you could no longer deposit directly into your ZWL$ wallet or do so peer-to-peer. This made moot one of the core functions of mobile money which is its remittance service aspect.

So essentially the only way local currency could enter an EcoCash, Telecash or OneMoney wallet was through electronic means (methods 2,3, and 4). What this resulted in was a bottle-necked avenue for the passage of funds into mobile money wallets.

There was no longer a direct user cash replenishment of wallets.

The second issue this raised was that you now needed to go and get a bank account in order to deposit and withdraw money. And the banks, in a move inspired by the moment started allowing anyone to open an account via USSD or bank apps.

Also read: Bank accounts fall by 2.1 million vs EcoCash losing 3.1 million subscribers: How cash won the war

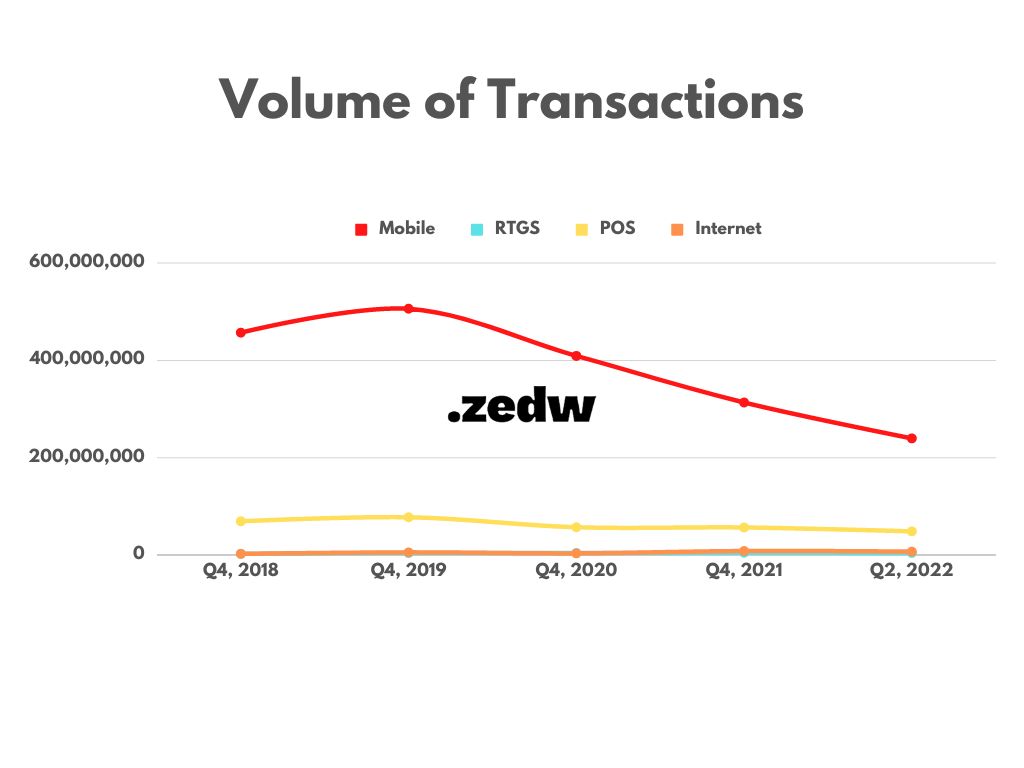

Bank-owned transaction channels are now at the top of the totem pole because they offer greater financial freedom. An example of this is how as of Q2, 2022 the value of Point of Sale (POS) transactions surpassed mobile money registering ZWL$334,550,854,923.13 to mobile money’s ZWL$320,275,022,709.41.

This might suggest that people are preferring to swipe bank cards freely than have to endure transaction limits and EcoCash charges… Additionally, the figures for mobile transactions also include entities like Inn Bucks, My Cash and other local lite wallets.

What was even more revealing was the rise of a transaction class that probably benefitted the most from the new regulations placed on mobile money…

The banking sector caught up in the shadows

According to the National Payments System, an internet transaction is one that is done through bank online portals and mobile applications. These transactions include transfers like ZIPIT, paying merchants and utilities (ZESA, City of Harare etc), and buying airtime.

The proportion of these internet-based transactions on the NPS has been on the rise. As of Q2, 2022, internet transactions made up 23.56% of the NPS in terms of value and 1.90% when it comes to volumes.

The Q2, 2022 figures put internet transactions second to RTGS (64.57%) in terms of the value of transactions but third from the bottom when accounting for the volume of transactions.

All of this could suggest that with fewer restrictions, people are moving money and paying for services through their bank apps and portals. It is unclear if this also includes bank USSD codes. But with the gap these transactions have opened up to mobile money USSD might be counted as well.

In conclusion, it seems that, in local currency terms, banks have pretty much won. However, where the playing field is still level is probably where forex is concerned. Neither mobile money nor the banks have yet to stake a claim to the USD circulating peer-to-peer.

But, it’s just a matter of time until there is movement, either by innovation or regulatory change, that shapes which of the two is dominant.