There really is no delicate way of saying this… If you are a startup operating in Zimbabwe, relying on EcoCash or any other mobile money API to receive payments from your customers as a primary source of income, then you are in serious trouble…

Although I doubt my saying this is news to those entrepreneurs.

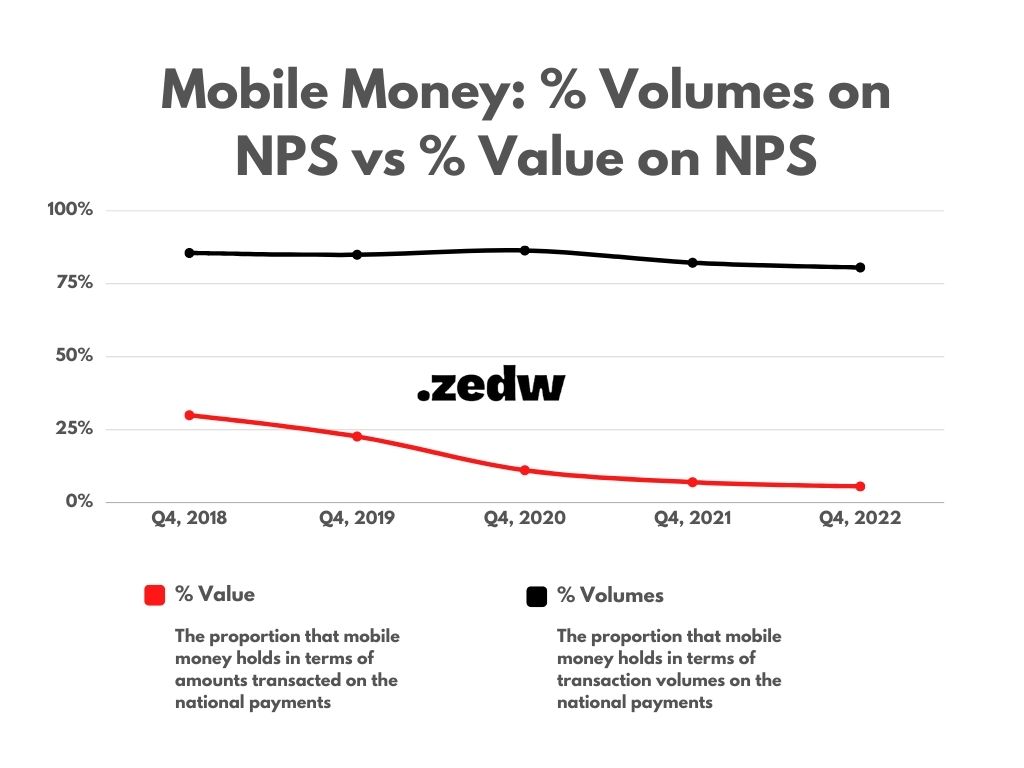

According to the Reserve Bank of Zimbabwe’s (RBZ) National Payments System report for Q2, 2022 they are fighting for 5.47% of transaction values on the NPS.

That proportion translates to just over ZWL$320 billion of the more than ZWL$5 trillion and some change transacted in Q2, 2022.

The reasons for this are pretty obvious, the RBZ instituted a number of directives that limited the amounts people can send with mobile money because it was allegedly responsible for the runaway exchange rate around 2019 – 2020.

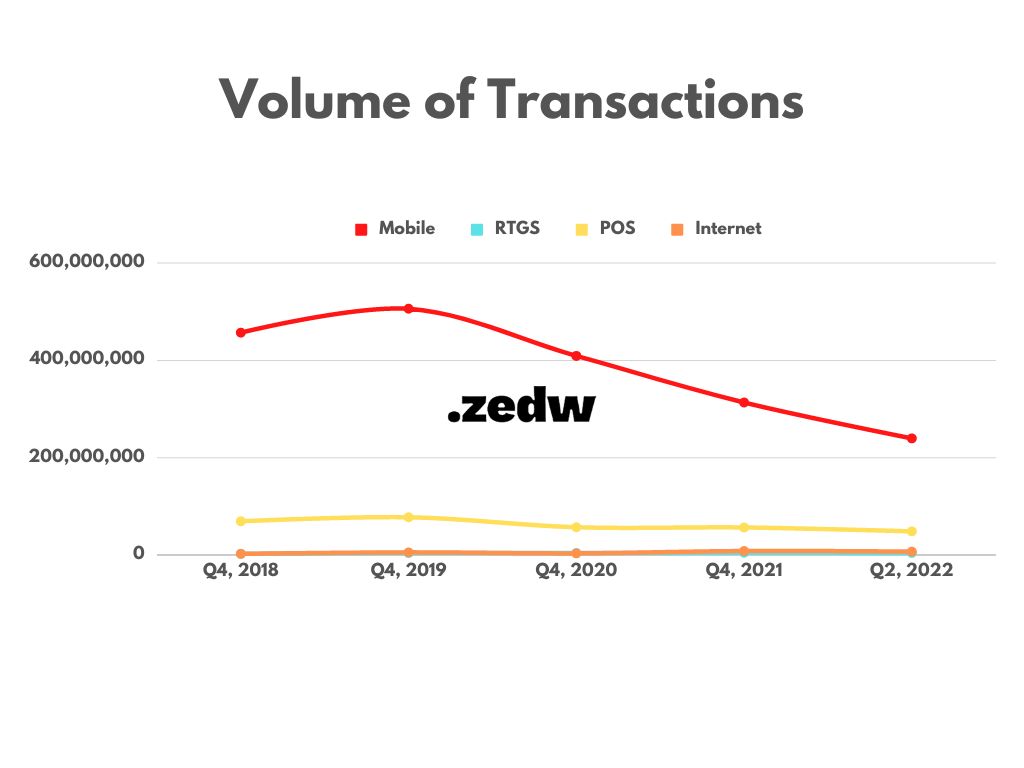

What really hit mobile money hard were the transaction limits and the permanent suspension of EcoCash’s agent network. The former, as you may have already guessed, limits the amount of money sent from EcoCash wallets to merchants and peer-to-peer. But it doesn’t deter the number of transactions as long as you stay below the limits.

The latter, on the other hand, meant that cash couldn’t be easily converted into a wallet balance to be traded for goods and services, both physical and digital. EcoCash, as I am sure you are aware, was rumoured to have the lion’s share of mobile banking agents across Zimbabwe. That number stood at 73,281 in Q1, 2020 which dwarfed the reach of bank branches by orders of magnitude too vast to even begin to think about.

Since that instrument of financial inclusion was shut down, people have had to rely on the banks and their retreating branches for high-value transactions…

A ZWL$ mobile money wallet is no longer viable considering the escalating cost of living and the transaction limits. Moreover, the lack of cash-in and cash-out services makes the case for the financial service even weaker compared to what the banks can offer and this impacts startups that make a living by way of ZWL$ mobile money APIs.

Also Read: EcoCash transaction limits: impact on the National Payments System in numbers

Values vs Volumes: It’s not how many people are paying but how much they can pay through that channel

Mobile money accounted for nearly 240,000 transactions in Q2,2022 which was a mammoth 80.53% of the volume of transactions on the NPS, the most of any channel. However, having volumes is almost a vanity metric for mobile money because it is capped at how much individual users can send per transaction and overall per month.

To make matters worse, mobile transactions as defined by the RBZ also include lite accounts or wallets offered by services like Inn Buck, My Cash and many others. So this suggests that EcoCash API dependent startups are fighting for a further fraction of the 5.47% reported by the RBZ.

Additionally, it’s a fraction, of a fraction of a currency that is struggling to retain its value…

Cover Image Credit: NewsDay