Spotify just announced that they have entered a deal with Orange Mobile allowing the Mobile Network Operators’ (MNO) users in select African markets to stream music and podcasts with zero-rated data.

I am incredibly excited to announce the signature of a partnership agreement between Spotify and Orange, to allow millions of African music fans to access Spotify via the Orange platform. We embark on this common journey today, starting with launches in the Democratic Republic of Congo, Madagascar, Mali, Guinea soon and other markets in future, where Orange mobile users will enjoy music and podcasts on Spotify with free data.

Jocelyne Muhutu-Remy, Managing Director for Spotify in Sub-Saharan Africa

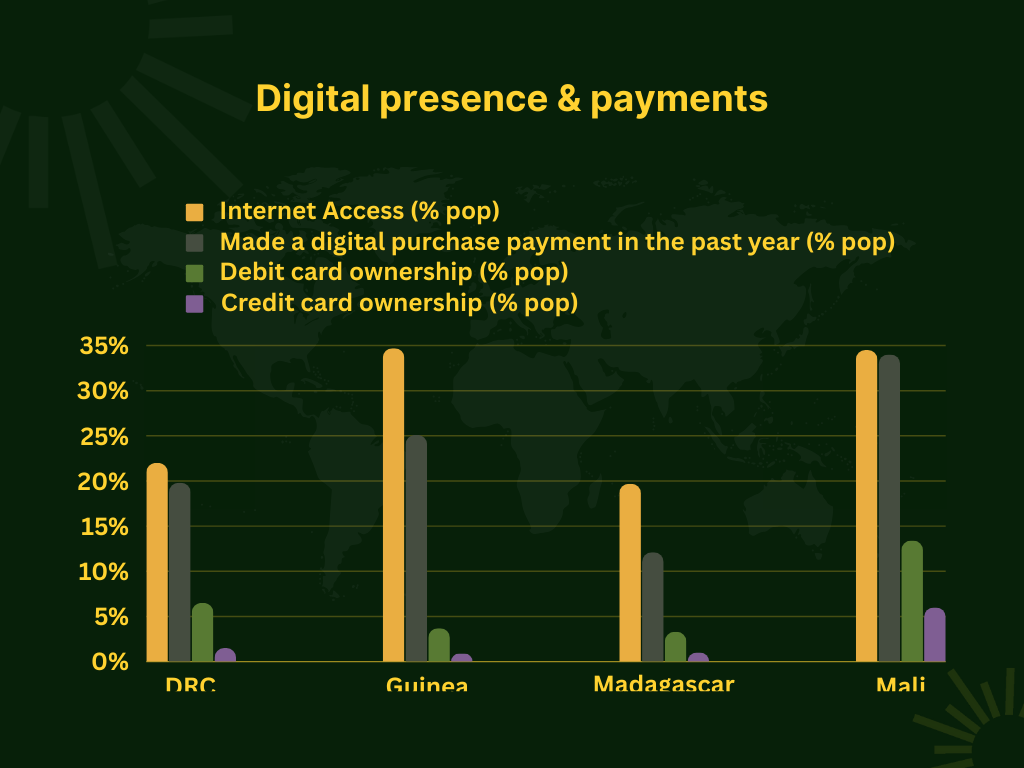

The deal in its current iteration looks like testing grounds before Spotify and Orange Mobile expand it to the 13 other markets and 80 million subscribers Orange provides service to on the continent. Looking at the 4 markets initially getting the zero-rated Spotify experience, it’s clear the deal is an attempt by Spotify to spur usage in Africa. In late 2022, Spotify execs that they were setting their sights on growth in Africa, describing the continent as a “a 100 million-plus user opportunity in the next five to ten years“. The recent partnership is clearly a step in that direction.

Tackling the 100m user opportunity

We are aware that data costs continue to be a hindrance for people who would like to stream music, that’s why we are actively working at Spotify SSA on partnerships like this one.

Jocelyne Muhutu-Remy

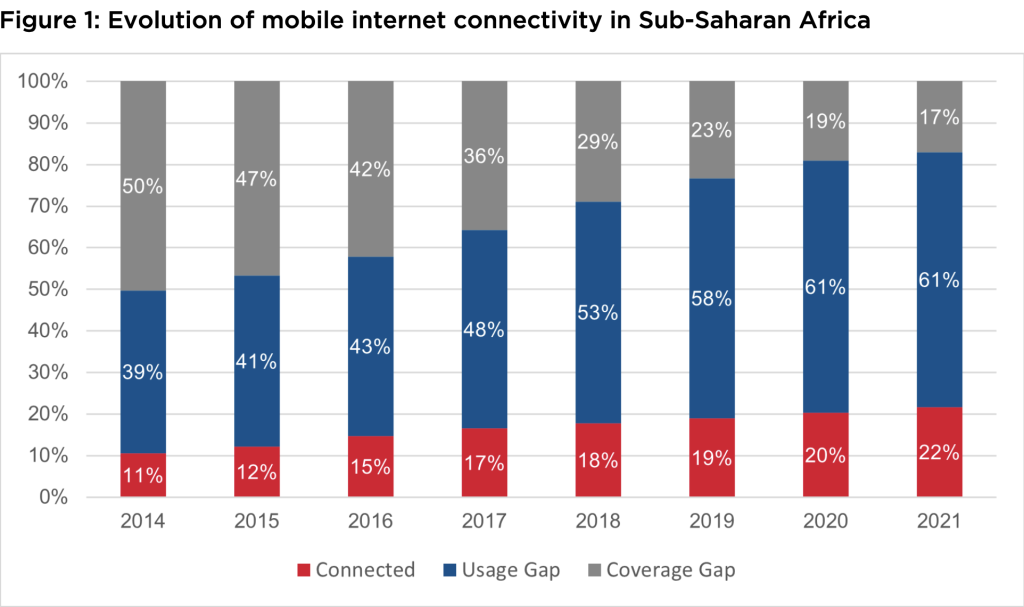

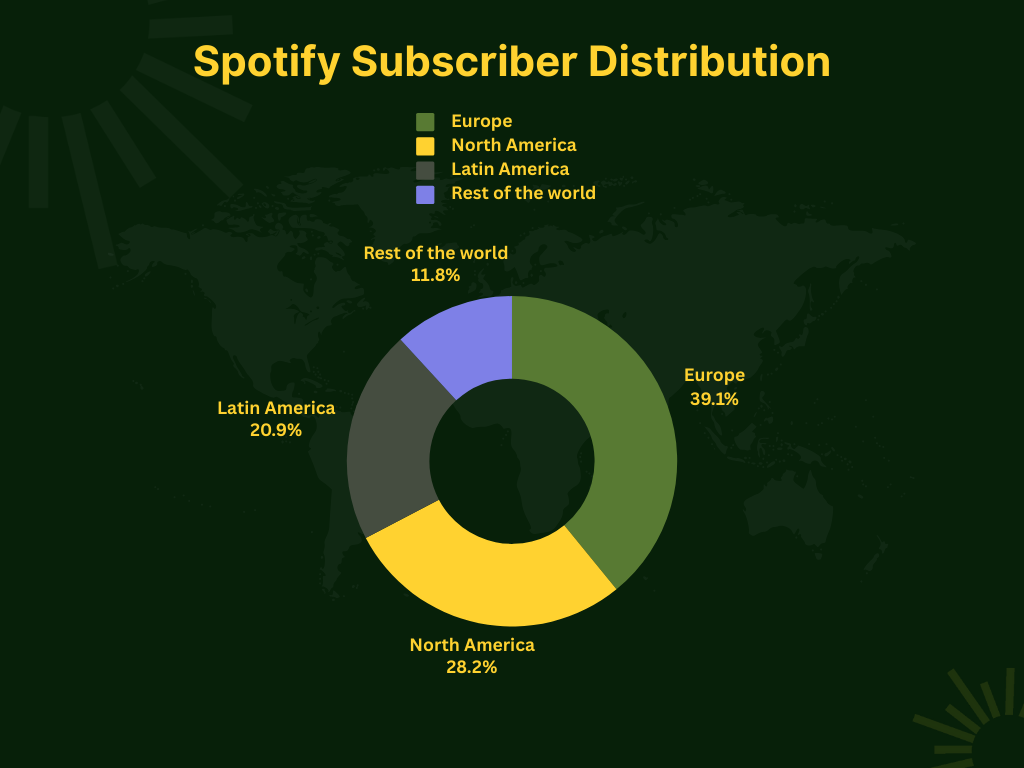

As illustrated by the diagram above, Spotify’s subscriber distribution shows that their presence in the Rest of world where Africa is covered in their reporting is lagging behind other territories. Traditionally the reason behind this sort of lag has been that internet access is beyond the reach of many Africans.

Beyond that though, there are other adoption indicators we have explored for the countries initially benefiting from the deal. Current indicators show that the habit of making digital purchases along with credit and debit card ownership in these countries is still quite low.

Historically, the issue of payment infrastructure is one of the big hurdles slowing down adoption of streaming services on the continent. Many of the streaming services don’t accept local currencies and so Africans have to get prepaid VISA/Mastercards (separate from their bank accounts) that they then use to pay for these services.We asked Spotify reps if this deal would allow Orange Mobile subscribers to pay in local currency – they are yet to reply and this article will be updated to reflect their response. The issue of payment will have to be resolved if Spotify wants to see the most enthusiastic outcomes from such a deal.

Zero rating making a come back?

This is not zero-rating’s first swing around the continent as it used to be popular in the mid 2010s with social media giant Facebook one of the big players that allowed users to access their service for free. At the time, zero rating was met with scepticism as net-neutrality proponents argued that this would create gatekeepers who control access to information.

Kenyan net neutrality proponents further that zero-rating introduces centralising tendencies that insert “gatekeepers” into an otherwise open and free Internet ecosystem. Such gatekeepers, it is argued, will decide who connects to which content, as well as how they connect.

Research ICT Africa | ZERO-RATING IN THE AFRICAN CONTEXT

Whilst the zero-rating and subsequent net-neutrality movements seem to have quietened down over the past few years – the remaining question will be around whether or not such deals will be considered as anti-competitive by the governments given that Spotify is a competitor to Apple Music in the audio streaming sphere. Historically, African governments haven’t been aggressive with regulating global tech companies so it’s highly unlikely they will start now.

Featured Image: Cottonbro studio/Pexels