Why don’t SADC central banks like reporting which countries amount for the most in remittance out and inflows? I thought that it was a uniquely Zimbabwean issue but the South African Reserve Bank (SARB) seems to also be shy about publicising which countries receive the most from its bustling economy. I mean… SA is the largest remittance-sending nation in Africa and that kind of status should be an incentive to flex which SADC and other African regions depend on the stability of its economy.

That being said, it’s not hard to find out which country sends out the most because diaspora population estimates make that bit of math easier. Zimbabwe has the most migrants, both informal and formal, who live in South Africa.

The exact number is a bit up in the air because there are a lot of undocumented people who crossed the border illegally to escape the hardships on the other side of the Limpopo River.

However, the figure that is commonly referenced is around a million, give or take a hundred thousand on either side. Additionally, many who quote any population figure tend to stress that it’s an estimate because the true number is hard to get to…

The rise of Zimbabwean diaspora remittances from SA

Zimbabwe as a nation has been grappling with economic fluctuations over the last couple of decades which drift from near normality to Weimar Rebupic Germany depending on the stress factors like changes in the economic and political policy.

The height of that crisis was between 2005 – (and peaking in) 2009. If you ask any Zimbabwean about that period you’ll most certainly get a deep sigh before they give their own harrowing experience of that time and it won’t be hyperbole.

What happened during that period of turmoil was an increasing migration of Zimbabweans across borders particularly the country’s southern one. Even then there were already estimates that said that the Zimbabwean community in SA was already at a million or just under.

Among the reasons why Zimbabweans sought to make the journey south was to study and seek greater opportunity. The people who migrated (and continue to do so) are from all strata of society from unskilled labourers all the way to tradesmen/skilled workers.

What this did was create an ecosystem of remittance services that were meant to alleviate the stresses for the family and friends they had left back home.

In 2009, FinMark Trust published a study called “Cash and carry”: understanding the Johannesburg-Zimbabwe remittance corridor that started to reveal what was going on in the Zimbabwean community in SA.

Formal vs Informal remittance channels in SA

What FinMark Trust (FMT) found, at the time, was that there was a thriving informal market for remittances going from SA to Zimbabwe. The main reason for this was that many of the migrants were undocumented which meant that they had little to no access to banking services

With this being the case, there were two main ways in which value was sent back from Zimbabwe:

- Cash: this was meant to pay for basic essentials and recurring costs like school fees, rent, utilities and others. (according to interviews done by FMT, only 2% of cash remittances went through banking channels.)

- In-Kind: because of the shortages of basic commodities in the late noughties, the most effective way to get food to family back home was by sending them actual food, clothing and other amenities.

Most of these went through chicken buses, cross-border taxis, or informal (unlicensed) service providers including oMalayishas and individuals who could be family or friends.

The ratio of in-kind and cash remittances typically depended on the availability of amenities in Zimbabwe. If the shelves were stocked then it was prudent to send money rather than groceries because they could acquire them on the other side. But if like between 2008 -2009, there was nothing in the shops, Zimbabweans in SA would gamble with the informal transporters to send groceries back home.

At the time the report was published, most Zimbabweans were said to be earning below R2,000 (or US$103 in 2009) which showed that a good number of them were unable to establish a formal presence in SA and were desperate to maintain whatever employment they had.

FMT (via Professor Makina's 2007 Study on the Profile of the Zimbabwean Migrant in SA) found that the frequency of remittances was every month or once every three months and the send values were between R500 - R1,000. Thus in 2009, the conservative estimate for the value sent through the SA to Zim remittance corridor was the equivalent of between US$289 million to US$360 million most of which was through informal channels...

What made formal channels unattainable and unattractive was the aforementioned legal status of most migrants as well as the cost of sending money through banking channels that had a monopoly on the industry until 2014 when the SARB started issuing Authorised Dealer Limited Authority Licences (ADLA) that ushered in a host of service providers who were better designed to shift remittances from SA to formal channels...

There are four categories of ADLAs:

– Category 1: Bureaux de change only (buying and selling of foreign currency)

– Category 2: Bureaux de change licensed to offer money remittance services in

partnership with an external MTO (single remittance transactions up to ZAR 5,000)

– Category 3: Independent MTOs (able to offer cross-border transfer services up to ZAR 5,000 per transaction or, once a business relationship has been established with the customer, ZAR 5,000 per day up to ZAR 25,000 per month)

–Category 4: ADLAs permitted to cover business activities under all above

categories; there is no higher threshold for transaction limits in this category

Levelling off the playing field

The emergence of Remittance Service Providers (RSPs) like Mukuru, Hello Paisa, EcoCash Remit, Mama Money, Access Finance and many others drastically dropped the prices of remittances through the SA to Zimbabwe corridor.

According to RemitScope's South Africa Diagnostic report

"The new ADLA licensing regime in 2014 enabled RSPs to enter the market, after which competition intensified and prices fell. The services of ADLAs are aimed at low-value diaspora remittances and are more competitively priced for low-value transactions."

The complexion of prices as of Q3, 2022 shows that the competition has helped.

Before the advent of ADLA licence holders, banks and Money Transfer Organisations (Western Union, Money Gram etc) were the only way to send money through formal channels. As the tables above show, even today their prices are quite high with banks charging an average of 20% and MTO above 10% as compared to ADLA licence holders who are more favourable, particularly for low-value transactions.

The low-value friendly transaction charges are important because of the earning potential of many Zimbabweans living in South Africa. Moreover, there is now a variety of low KYC ADLAs in South Africa that has made it easier for remittances to flow to go from informal to formal channels.

Additionally, now those ADLAs are now servicing the remittance of groceries and other products with their licences. This means that operations that required informal logistics operators are creeping more and more through formal channels.

How much does the Zimbabwean diaspora account for SA remittance outflows

With the largest diaspora population in South Africa, one has to wonder how much of an impact that community has had on the state of transactions south of the Limpopo River and locally.

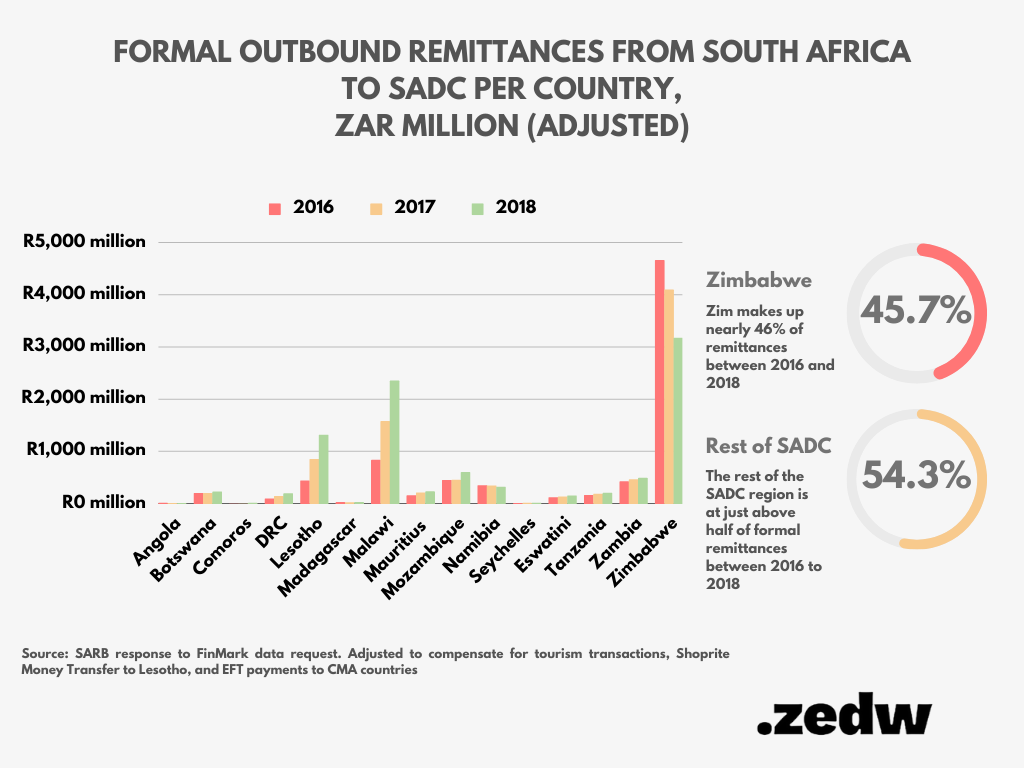

In a rare instance where the South Africa Reserve Bank (SARB) shared its remittance data, we got a picture of what is going on in the market on a broader level. This information was shared with FinMark Trust in a report they published in 2018 called SADC Remittances Values and Volumes.

The dataset that FMT got from the SARB shows that Zimbabwe accounts for 45.7% of remittances from South Africa. In saying that there was a caveat in the FMT report about how broad the data set was and that it included

- BOP category 401 – Gifts

- BOP category 416 – Migrant worker remittances (excluding compensation)

- BOP category 417 – Foreign national contract worker remittances (excluding compensation)

- Cross-border bank card transactions by individuals (withdrawals from South African bank accounts by private individuals in other SADC countries)

- The cross-border card data likely includes some additional non-remittance flows due to tourism activities, particularly for the island states of Seychelles, Mauritius, Madagascar and Comoros, and to a lesser extent, also Malawi, Tanzania and Zambia. The rationale for this concern and the adjustments made to the data are set out in Appendix 1.

- EFT bank transfers to the Common Monetary Area (CMA) countries of Lesotho, Botswana and eSwatini are treated as domestic transfers and are not captured in the balance of payments reporting system. Formal remittances to these countries are thus systematically understated by the SARB data.

Even with those qualifiers, for Zimbabwe to account for R11 billion of cross-border transactions is extremely impressive.

"The SARB dataset also provided detail on the number of transactions and thus, as shown, it was possible to generate estimates of average transaction size both per country and per the licence category33 of the firm that transmitted the remittance (this dataset includes only BOP transactions and bank account transactions – adjusted for tourism receipts)."

Authorized Dealer refers to banks

All told, the figures that the Reserve Bank of Zimbabwe (RBZ) publishes yearly for remittance and other cross-border transactions might need to be refined to include the parameters that the SARB gave to FMT in the context of remittances.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Amount | 838 million | 939 million | 776 million | 699 million | 619 million | 636 million | 1.002 billion |

Also read: Payments Zimbabwe vs Zambia: banking channels hold the reins