Zimbabwe’s most notable payment gateway PayNow now has a USSD *828#. The reason it took so long for them to launch or announce it is not what I want to focus on today (although that might be something we will talk about in-depth some other time).

What, I think is really important, is that they have realised that USSD platforms are a necessary evil in Zimbabwe (and most of Africa) because they are the simplest way of extending a service to more people. This is, of course, because not everyone in Zim has a smartphone to access the web or mobile applications. And even if they do, data prices are ridiculously high these days…

So if you have a payment gateway that allows anyone to purchase airtime, electricity tokens, internet bundles etc through their mobile money wallets, you might not want to restrict access to your service to just the website…

Elevating USSD with one simple solution

What PayNow has done better than the others on the market is that they seem to have understood how to make the user experience better and transactions quicker…

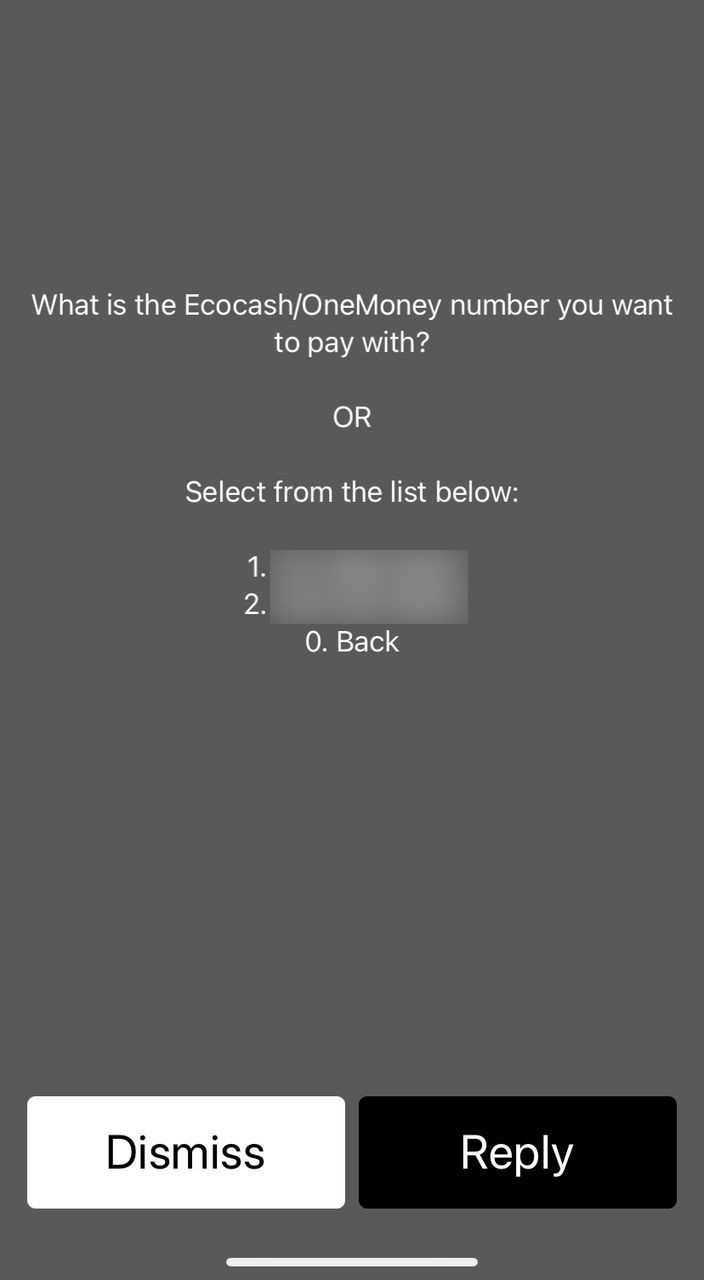

What I mean by this is that you can do one transaction and the next time you come back for a similar transaction the PayNow USSD menu will give you the option of quickly selecting numbers or accounts you’ve previously used to shorten the process.

This is something that I haven’t seen from EcoCash, OneMoney or any other competing USSD platforms like Techzim Market, Click and Pay etc. It’s a really simple solution to making a USSD feel more like a mobile app and it overall reduces the time that someone would need to spend re-entering accounts and beneficiaries they regularly use on the platform.

It’s the little things really…

This trick even trumps what most bank USSDs have on offer because to save a recurring beneficiary you would have to enter that account number first in a separate section of the USSD, and takes quite a bit of time.

There is, however, a limitation to what PayNow is doing though… You can not personalise an entry like adding a name or tag to the account or number.

But I imagine the tradeoff is that PayNow customers can get quick access with the caveat being that they have to be familiar with the actual mobile or account number.

On the other side of things, you can add personal details like your name and ID in the profile option at the bottom of the menu. I don’t yet know why anyone would want to volunteer that information because you are essentially giving a name and registration number to, what I imagine, is your PayNow user profile…

However, the option to do that might mean that PayNow could have room to scale its product for facilities that require that information like, for example, credit…

Whether that is true is something we will have to wait and see… In the interim, it looks like entering your personal details into your profile helps if you want to become a PayNow agent…