To say that TymeBank is an interesting financial technology (FinTech) startup is an understatement. As recently as a month ago the company was celebrating crossing 8 million customers in South Africa and being crowned “one of the world’s fastest growing digital banks.” This is quite frankly a huge milestone that means TymeBank is fast becoming one of South Africa’s most important public-facing financial institutions.

What gets less coverage in the press however is the cost of such rapid growth. At the midpoint of 2021 – TymeBank was alerting investors to the fact they are losing money at quite a rapid pace:

We draw attention to the fact that at 30 June 2021, the bank had accumulated losses of R4,793,322,479 (2020: R3,867,958,185). These losses substantially represent bank establishment and build costs. The ability of the bank to continue as a going concern is dependent on ongoing procurement of capital and funding for the operations of the bank.

The ability of the bank to continue as a going concern beyond the period 31 October 2022 is dependent on a number of factors, the most significant ones being the ongoing support from existing shareholders, the sourcing of capital from potential new shareholders, raising of working capital facilities as required, along with the execution plans for the scaling of existing services and delivery of new products and features into the market, and the impact of the COVID-19 pandemic on socio-economic conditions in the country.

Tyme Bank | Annual financial statements (2021)

Five months after sharing this seemingly alarming update – TymeBank announced they had 4 million customers. In the 2 years since they have managed to double their customer base to 8 million, with the last million subscribers being acquired in the last five months. This all raises a few questions. Why is TymeBank so popular and what’s spurring this rapid growth? Additionaly and perhaps more importantly though – how sustainable is this operation in the long term?

The obligatory history lesson…

TymeBank is a neo-bank (a digital banking service that operates online with no physical branch network) though a key part of TymeBank’s success stem from taking a hybrid-approach situating them perfectly in the South African market.

The digital bank launched in 2019 and it became clear that unlike most neobanking options they would actually establish a physical presence. At launch, TymeBank had a partnership with Pick n’ Pay and Boxer stores that gave them a physical presence in 500 stores from launch with a goal to reach 730 by the time they ended the initial roll-out of their Bank Kiosk’s.

The banking kiosks were important because they allowed TymeBank to sign potential customers in supermarket environments these people already frequented. Having a physical footprint that large at launch was no mean feat, especially once you consider that established banks like ABSA and Capitec have 800 and 589 branches respectively. Beyond the banking kiosk’s Tymebank customers could use the 14,000 tills in these stores to withdraw money (free of charge) and deposit money (at a cost of R4) – essentially a network of ATM.

The banking kiosks were important because they allowed TymeBank to sign potential customers in supermarket environments they already frequented. Having a physical footprint that large at launch was no mean feat, especially once you consider that established banks like ABSA and Capitec have 800 and 589 branches respectively. Beyond the banking kiosk’s, Tymebank customers could use the 14,000 tills in these stores to withdraw money (free of charge) and deposit money (at a cost of R4) – essentially a network of ATM.

We knew we had to simplify this, but like many other digital banks in the world, we have a different problem. A lot of other digital banks are all about an app only. In South Africa & emerging markets the physical world is important. We’re still a cash-heavy society and we had to solve that and we believe we have cracked the code

Dieter Botha | Tyme Bank Chief Information Officer | 2019

An interesting detail that was repeatedly mentioned during the launch phase was TymeBank’s reliance on Amazon Web Services (AWS). 85% of the neobank’s core systems were run on the cloud. This has been presented as one of the many reasons why TymeBank is cheaper for transacting customers since TymeBank doesn’t have to work with the maintenance and cost intensive legacy systems their traditional banking counterparts rely on – allowing them to pass these savings onto customers.

What makes TymeBank so attractive to end customers?

Naturally the question becomes how has the Neobanking startup managed reel in 8 million customers in four years? As previously explored TymeBank’s core focus can be broken down as follows

- “providing affordable access to financial services”and products…”

- “…embedded with education and training”

Before we get to the fees, it’s important to explore the registration process TymeBank customers undergo and how it was revolutionary in the South African context. Neobanks offer low barriers to registration compared to banks. Sign up processes typically require only an ID number and a cell phone number. Tyme Bank highlights how potential customers can sign up in under 5 minutes – much quicker than opening a bank account. It’s important to note that this level of KYC only allows customers to open a limited “Just met” account. Here is clearer requirement list for all the accounts:

| Account type | ID number | Cellphone | Biometrics (photo & fingerprints) | Residential address | Daily transaction limits | Monthly transaction limit |

| “Just Met” | ✅ | ✅ | ❌ | ❌ | R20,000 | R40,000 |

| “Getting to know you” | ✅ | ✅ | ✅ | ❌ | R200,000 | R1,400,000 |

| “Good friends” | ✅ | ✅ | ✅ | ✅ | R200,000 | R1,400,000 |

A frictionless sign-up process is great but once you have the customers you have to keep them using the service somehow and that’s when we come back to TymeBank’s promise to provide affordable fees. How well do they deliver on this promise?

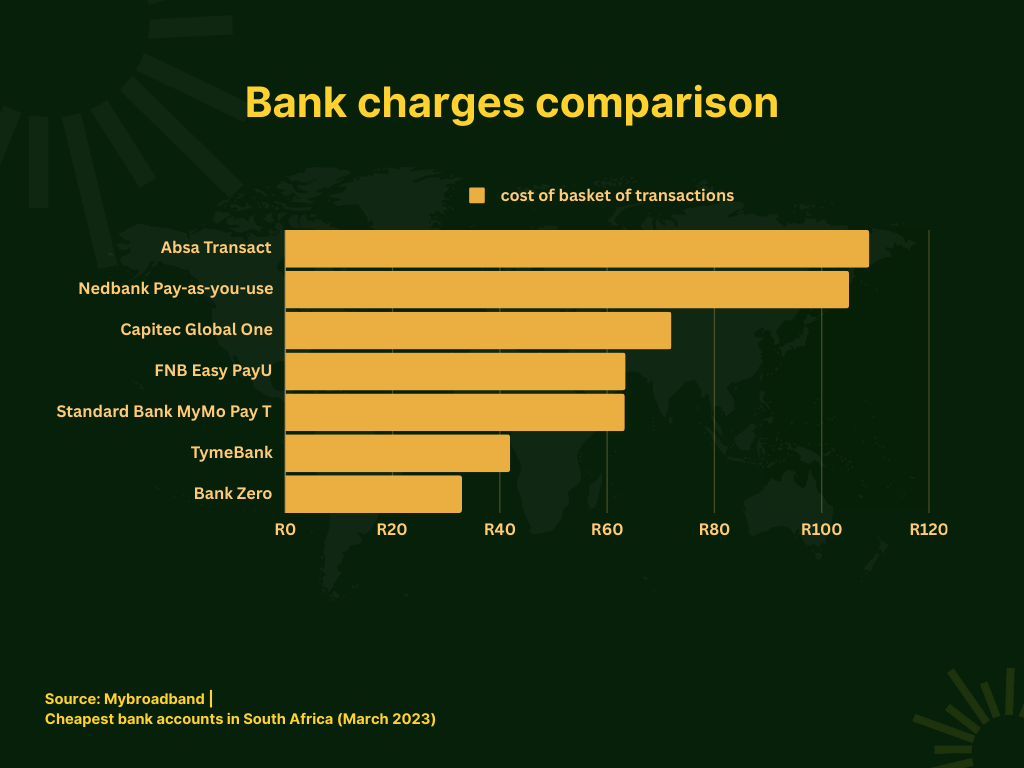

MyBroadband declared TymeBank as the second cheapest bank account in South Africa. The study included a comibination of monthly fees, withdrawals, bank transfers, purchases and notifications. TymeBank landed at a cost of R43/month ($2.28). Tymebank allows clients to send money for R7($0.36) to other South Africans and at no cost to fellow Tyme Bank clients.

Not only doees TymeBank offer competitive fees they go a step ahead and also offer fee transparency courtesy of their fee calculators that allows consumers to break down transaction fees, savings targets and reward bonuses on a per transaction basis. In a world where consumers more often than not complain about hidden banking fees (regardless of which part of the world they are in) such features allow TymeBank to be perceived differently by the customer base. Because the fees are so readily available as well means potential customers are informed with more ease which partly addresses their focus on educating account holders.

Another point of differentiation for TymeBank was their credit card launched in 2022. South Africans earning as low as R3,000 were eligible whilst the industry standard was around R5,000-R10,000 making this more accessible. When this was introduced Tymebank also stated that their target audience was expanding to also include middle and upper-class customers with a view to improve revenue perfomance. By attracting higher income customers, the neobank sought to take a cross-subsidisation approach which typically means that differential pricing dependent on which income bracket you exist in.

Providing some disruptive options in the savings realm has also meant that TymeBank looks attractive across a number of product offerings:

| TymeBank Goal Save | 4%-6% (7%/8%) |

| AfricanBank Access Accumulator | 4.8%-8.25% |

| Capitec Flexible Savings | 2.25%-2.5% |

| Absa TruSave | 0-2.35% |

In this regard they’ve differentiated themselves bySavings account with dynamic interest rates. TymeBank starts off paying 4% interest, increasing to 6% by day 91. That 6% is higher than the industry average of 5.05% in South Africa. Customers who give TymeBank a 10-day notice of intent to withdraw get 7% interest. Finally, users who move their salary to their TymeBank account get 8% interest.

That’s it on the financial affordability pillar. How does TymeBank “embed this with education and training”? In 2020 the neobank announced a financial literacy educational service to help its “EveryDay account holders navigate their financial lives amidst the COVID-19 outbreak”. The campaign saw account holders receive financial literacy tips, advice, and reminders from TymeBank via SMS. The initiative was also interactive allowing account holders to ask questions and share their experiences for customized learning and support.

There’s always a room…

…and if you spend enough time in a room – you’ll find that there is almost always an elephant… Elephants tend to be noticeable by their nature but once they are in rooms they become inconspicuous. TymeBank is no different…

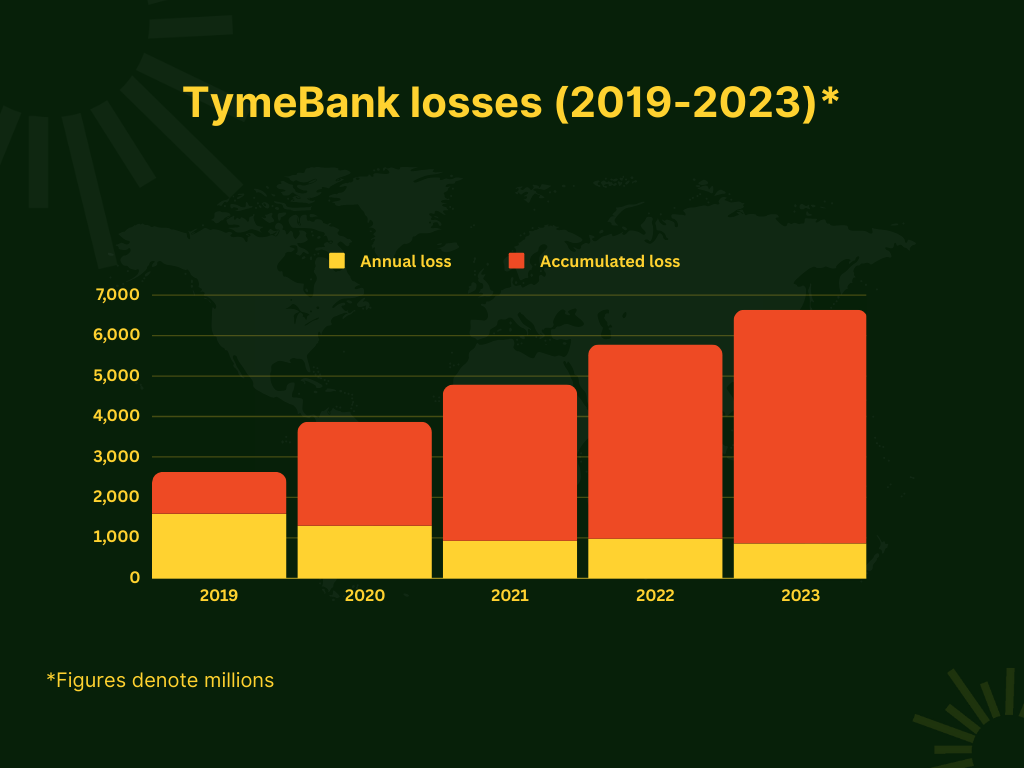

Whilst the reporting on the bank has been full of praise which is justified, an interesting detail that gets omitted about the neobank is that as of June 2023, their accumulated losses sit at R6.636 billion (US$300 million – using current exchange rates). Now all this would be ok if this were a momentary trend but when you look closely, these losses have been there since day one.

Remember we referenced the neobanks intent to cross-subsidise? It appears to me that having different pricing models is one way they intend to plug the leak that currently sees them loosing around R1.3 billion (on average) every year since it’s inception in 2019.

The losses have largely been attributed “group establishment and build costs” implying that the massive growth of TymeBank has so far been fuelled on shaky grounds and it’s unclear how sustainable the current model actually is. From TymeBank’s financial reporting at the midpoint of the year (June) they highlight that the company is safe until October 2024. The reports highlight the continued support from existing shareholders, sourcing of new capital along with scaling and introducing new products into the market as the reasons why they believe with certainty that TymeBank will be fine for the foreseeable future. The auditor of TymeBank’s financial documents -PWC- also suggest that given the information privy to them they are not raising any eyebrows in this regard – which is a good thing.

But until either i) the new capital rears its head, ii) the scaling of TymeBank reaches a point where it starts to reverse this trend or iii) TymeBank starts to offer new products that aren’t loss-leading, there’s room to wonder just how sustainable TymeBank’s model is? This opens up another can of worms?

Are other Neobanks profitable?

One way to rationalise these losses is that TymeBank has to catch up with established banking institutions to even have a chance of survival. Beyond this, a question that follows after discovering the financial situation that TymeBank finds itself in is how others in this industry are faring. My first port of call was a report published in 2022 by consultancy group Simon-Kutcher. The report explores the future of neobanking and their outlook was quite grim:

Our latest analysis found that only two out of 25 *advanced-stage Neobanks have reached operational breakeven. Extrapolating these results across the industry and considering that over half the players are not yet three years old, we predict that less than 5% of the world’s 400 Neobanks have turned profitable so far.

The Future of Neobanking: How can Neobanks unlock profitable growth?

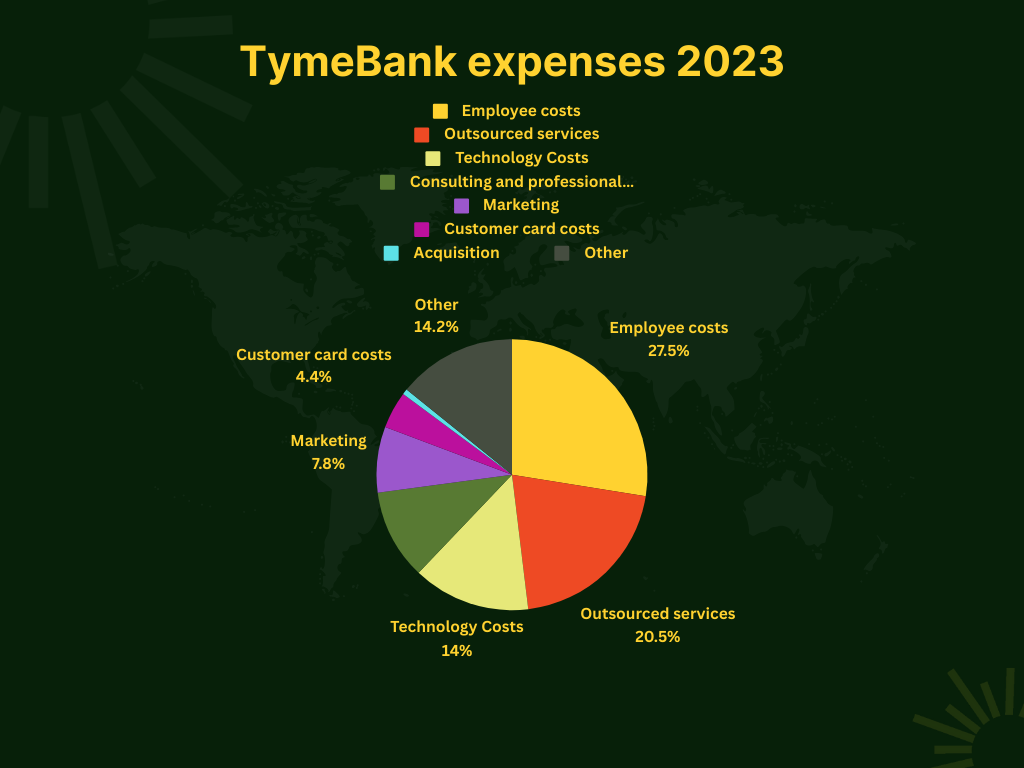

This same report argued that where neobanks were doing well was in acquiring customers at a low cost by utilising budget channels such as social media and banking on word of mouth. This seems to check out in the case of TymeBank where Marketing and Acquisition expenses came to 8.5% of the company’s total expenses (R119,441,000+R9,880,000).

Neobanks are said to be struggling on the income side of things due to low revenue per client figures. This is a particularly hard problem to solve because these low revenues are a consequence of having an attractive service and to change on that front would imply that the service ceases to be as competitive against regular banking counterparts.

Given that profitability of neobanks is currently elusive it would be disingenuous for me to type and suggest what I think they should do to improve their fortunes. Wiser and more experienced people than me are having a hard time executing that in the real world. What I will say is that over the next few years it will be interesting to observe where TymeBank and a host of other neobanks like ChipperCash and Opay go from here. If they become profitable – it will be a historic case study that explores how they managed to reverse their losses. If they are unable to reverse that slide we will have a historic case study exploring how digital banks managed to gain millions of subscribers but still lost it all because of unsustainable unit economics…

I’m crossing my fingers that TymeBank is successful but whether or not that’s the case, I hope I will be around to cover whatever outcome the neobank that’s shooting for the stars manages to reach when all is said and done…