Businesses have been inundated with the slogan, “adopt social” along with all the benefits that will come only if they adopt a social-media-native approach. One piece of the puzzle that the social media evangelists tend to leave out is the size of the pie they are pitching. Business owners and (sometimes digital marketers) end up going online without knowing which platforms are best for what, along with the size of the audiences they can expect to find on the social media in their respective countries.

Given this backdrop – dotzedw decided to put together data tracking the most recent performance of 5 social media platforms across the 16 countries in the SADC region. We looked at data from Facebook, Instagram, TikTok, LinkedIn, and Twitter.

*Active Social media users & the most used platform at present

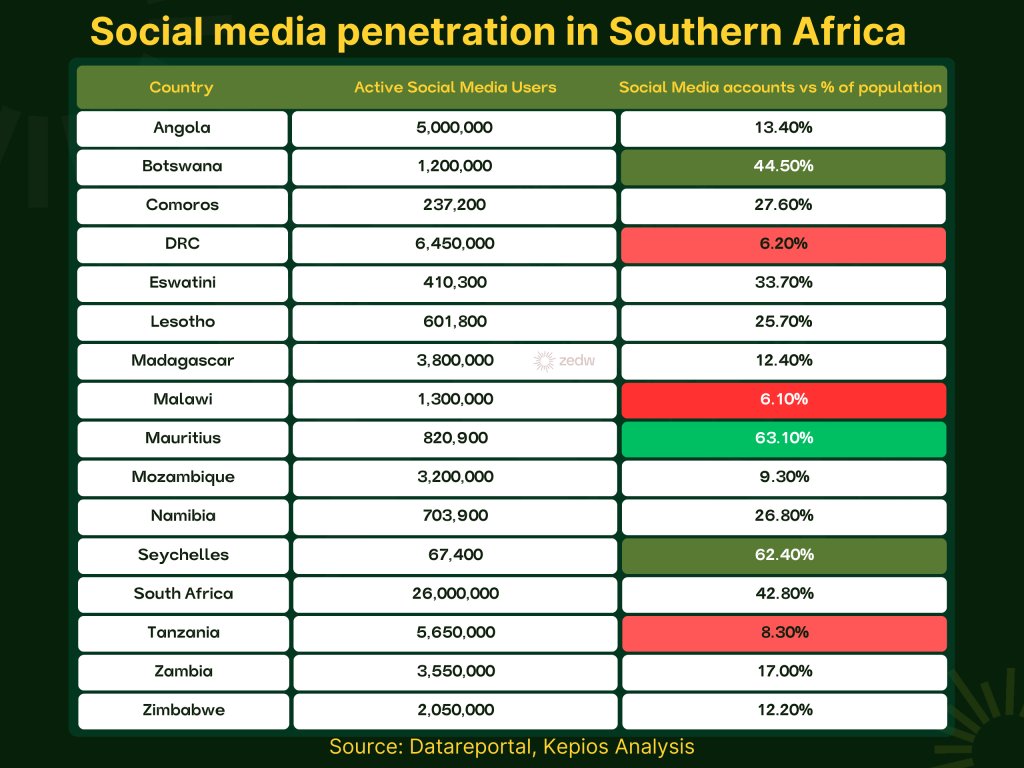

The active social media penetration and user stats in the table below are also interchangeable with Facebook – which is the region’s most popular social media site. Most of the insights in this section will generally apply to Facebook (unless indicated otherwise)

*These stats don’t factor in people of the represented nationalities who are in the diaspora

Within the region social media is still a tool largely accessed by minorities with only two countries (Mauritius and Seychelles) having a social media penetration above 50%. The average social media penetration in the region is still quite low at 25.7%. This is significantly behind the global social media penetration which currently stands at 62.3%

Anyone individual or group operating within this sphere with commercial intent, has to be cognisant of the fact that there’s a broader majority that is missing out on whatever message they are pushing presently.

A redeeming factor is that the social media penetration is higher when you isolate for adult populations:

What this means is that when you isolate for the adult population which more actively participates in commerce, you have a 10% improvement in penetration which is more encouraging for people focused on selling – but it is still a minority.

Between men and women who are you more likely to find on social media?

Naturally, it’s important to understand how gender representation is skewed on social media:

On average within the SADC region, men are more active on social media than their female counterparts – a 10.3% difference between the two genders. Lesotho and Namibia are the only exceptions to this rule – whilst Malawi has the widest imbalance with an estimated 64% of men represented whilst women lag behind at 35%. Within the region the difference gets worse as we zero in on the other social media platforms, as you’ll see later in the article.

Generally though – at the moment it’s more likely that men will interface with whatever content you decide to put up on social media unless you’re in Botswana, Namibia or South Africa the three countries close to a 50-50 split.

Whilst only 25% of the region is on social media presently, that number is growing which means if you get in on the action now – you can expect that pool of users you can share your knowledge or sell services to, to grow:

Ultimately the above data suggests that if your goal is to reach as wide as audience as possible with no concern for other details such as age and profession, Facebook is still the social media platform where you will get the most people.

What’s happening with X?

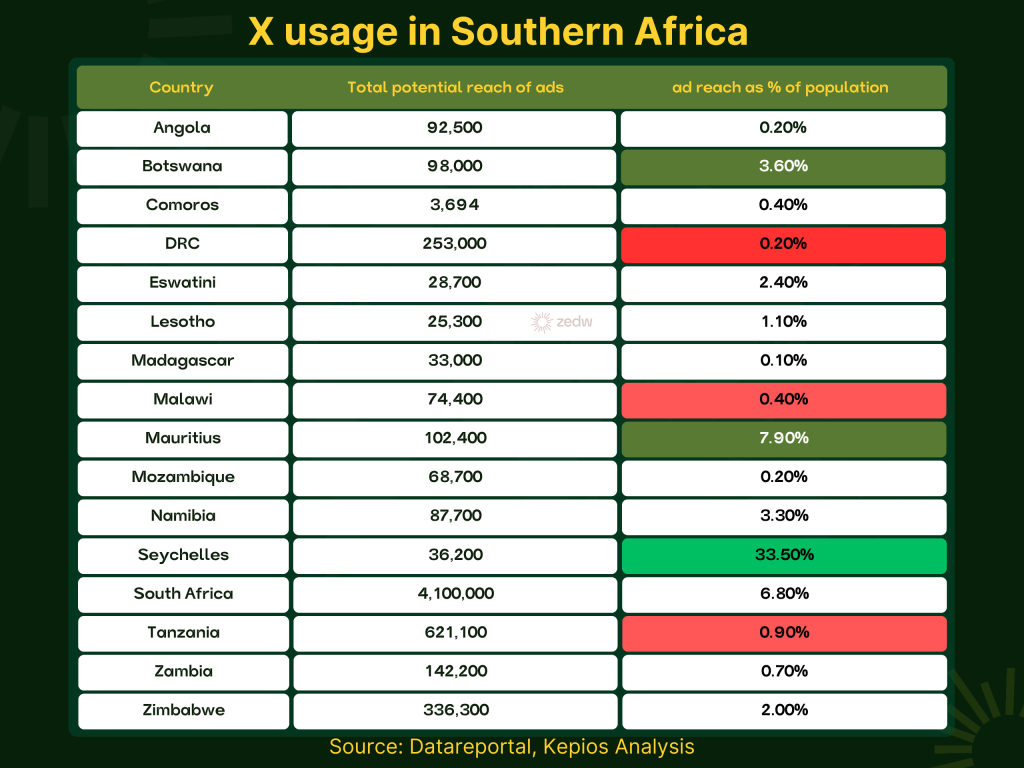

If Facebook is the king of numbers, X (formerly Twitter) is on the opposite side of the fence:

That there’s only one country where the number of X users that are reachable via ads is above 10% is quite surprising. Part of X’s, well documented woes when it comes to attracting advertisers is because the platform has so few people with an estimated global user base of 619mn people – making it the 12th most used social media platform globally.

To make matters worse – users are actually declining on the platform, a trend which is mostly holding true in Southern Africa;

Given the fact that the platform doesn’t look to be growing and was already smaller than most of its competition – it’s easy to see why most businesses don’t utilise Twitter at all when it comes to advertising. It is a bit of a different story for people looking to grow their own brand but overall the outlook on X isn’t that great at the moment.

The last big problem that Twitter will have to address if it wants to start growing its user base and actually become more appealing to businesses is the platform can stop being a boys club. Presently, the gender split on Twitter is tilted so heavily it was quite surprising;

Unless you’re predominantly interested in speaking to a male-only audience, there’s not much that you will find on Twitter. This is something that the platform has to work on if sustainability is key to them.

Social media but for professionals…

The proposition on LinkedIn is relatively simple – if you want to build an audience and the filter you want to use to target people is their profession then LinkedIn gives you the best shot at that.

TikTok – an emerging star?

The recorded data available for TikTok makes it hard to reach any conclusions at the moment for a few reasons. The sample size is relatively small with data available from 5 of the 16 countries. From the above visual its clear that TikTok has already raced ahead of X and LinkedIn when it comes to and it would not be surprising if this is also true in the countries where we don’t have the data. From the visual below, it’s clear that TikTok has raced past X and LinkedIn when it comes to share of users, and it would not be surprising if this is also true in the countries where we don’t have the data.

The problem with TikTok however is its notoriety for being a difficult medium to advertise on as its video-first format tends to mean any form of advertising on the platform requires more creativity and is pricier to execute. The demographics are also skewed heavily towards young and female users – limiting its value to advertisers looking to target broad audiences:

While TikTok’s 1 billion monthly user base sounds like a safe bet for practically any brand or content creator, you may not get the response you were hoping for. Currently, TikTok’s audience skews young and female—53% of all users are between 18–25 years old, and 57% are female.

TikTok advertising: pros and cons \ Backstage

Last but not least – Instagram

Facebook’s subsidiary has low penetration in the market with only two countries (Tanzania and South Africa) having more than a million users reachable via ads. To be fair though the growth trend suggests that this number only stands to get better:

What’s the verdict?

For most of the countries in the region – social media is still used by a minority (25.7%). Most of the SMEs within the region simply won’t have the budgets to advertise via traditional media (i.e newspapers and radio/TV stations) and so social media no matter how small – is the only outlet.

That the number continues to grow means the potential customer bases are growing over time. This growth trend makes it worthwhile to dip toes into the digital marketing waters, as now is a better time than ever to find buyers online in most of these countries… Unless of course your plans were to advertise on X which is the only platform losing followers in the region.