It was recently announced that Mastercard was buying a minority stake in MTN Mobile Money (MTN MoMo) for an undisclosed fee. This continues Mastercard’s trend of buying stakes in African mobile money companies following 2021’s acquisition of a minority stake in Airtel’s mobile money unit for $100 million. This made me wonder what informs MasterCard’s strategy in Africa and what makes MTN (and Airtel Money) attractive acquisitions…

MasterCard extending its reach in Africa

MTN’s mobile money suite of services initially allowed MTN wallet holders to store funds, send and receive money, make payments and carry out other transactions using their mobile phones. As time progressed, MoMo has evolved to also include insurance and cross-border remittances.

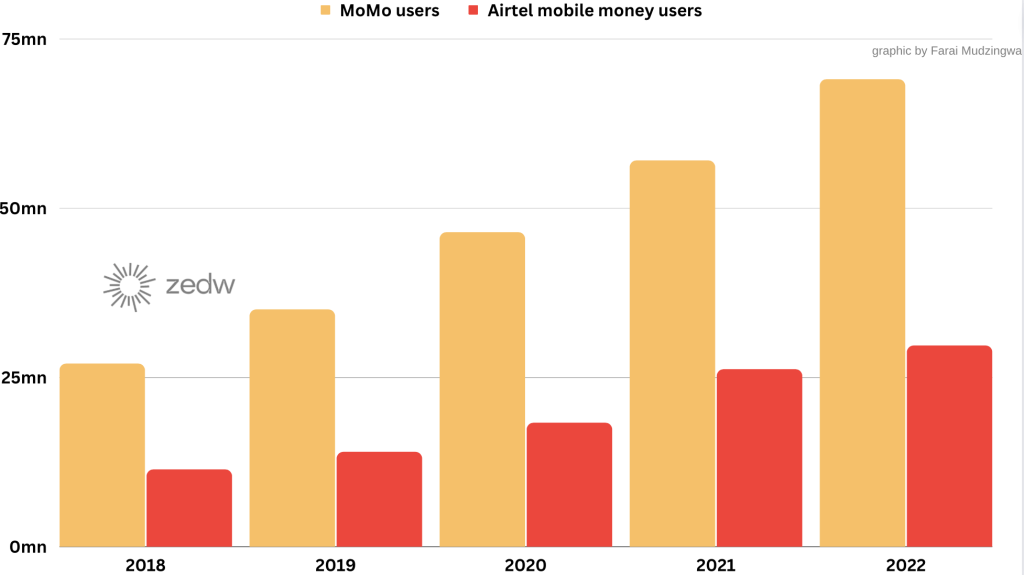

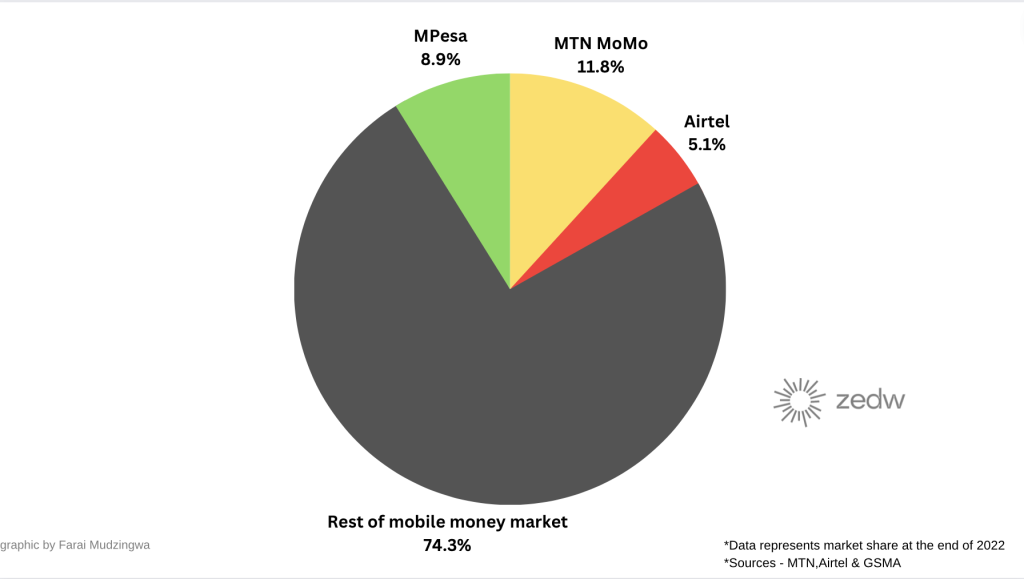

Over the past half-decade, MTN MoMo has grown from 25 million users to 60 million users at the end of 2022 and is present in 16 African countries. MTN’s Fintech division is a significant financial service provider in Africa with a mobile money market share of 11.8% (est.) as of 2022. Combine this with Airtel’s user base and you realise MasterCard now owns a stake in mobile money players with just under 100 million users combined (98.7 million) and 15-16% of the market share in Africa.

It’s important to remember that MTN has 292 million mobile network subscribers across 22 African countries compared to mobile money’s presence in just 16. If MTN manages to grow their MoMo user base and catches up with the mobile network this would unlock more revenues for MTN and by extension MasterCard.

Beyond the direct revenues which we will take a closer look at, the acquisition also offers distribution opportunities for MasterCard products and services on the continent. Prior to inking the deal, MTN and MasterCard were already familiar as the two partnered to distribute MasterCard virtual cards that were available in all 16 MoMo markets back in 2021. MasterCard’s acquisition of a stake will likely result in MTN being the partner of choice in MTN territories. Interestingly, in 2021 MasterCard reached a similar deal with Airtel meaning those same benefits are being realised. MasterCard will be able to surface new products to 100 million users relying on already established distribution networks instead of building capacity from scratch.

Growing revenue streams

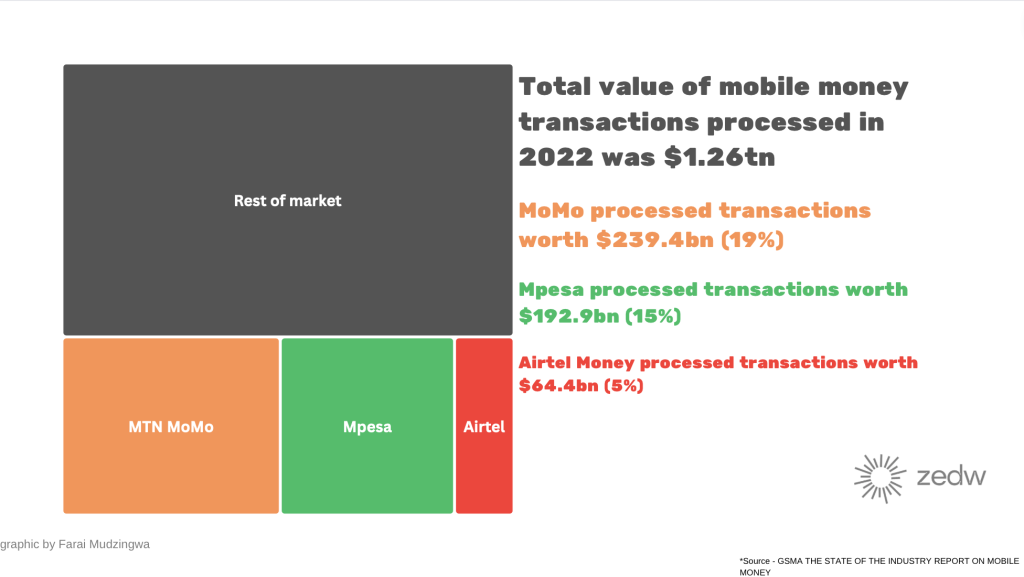

The importance of MTN is further emphasised when you look at the value of transactions processed in the mobile money market. MoMo processed nearly a fifth (19%) of the value of all mobile money transactions. When you combine this with Airtel’s 5% – it means MasterCard now has a stake in two entities that processed nearly a quarter of the mobile money market’s transactional values ($303.8 billion).

When the deal between MTN and MasterCard was announced, MTN CEO Ralph Mupita mentioned MoMo would “use MasterCard’s tech infrastructure to expand its payments & remittance services in Africa”. MTN (and Airtel Money) adopting MasterCard’s processing technology would mean that a percentage of the transaction fees would be coming to the payments giant. If MasterCard were to become the sole payment processor for Airtel Money & MTN MoMo and applied their reported 1.5%-3% processing fees they could capture as much as $4.5-$9.1 billion annually. This is an impressive amount once you consider that MasterCard made $22.3 billion in revenues in 2022.

Mastercard adopting continental knowledge

In 2020, Raghav Prasad, MasterCard’s Division President for Sub-Saharan Africa stated that scaling on the continent required a different approach from how MasterCard has done in Europe and the US. In MTN and Airtel MasterCard have partners on the ground that can inform product development. Going forward MasterCard can now access MTN and Airtel’s understanding of Africans to increase chances of rolling out successful products.

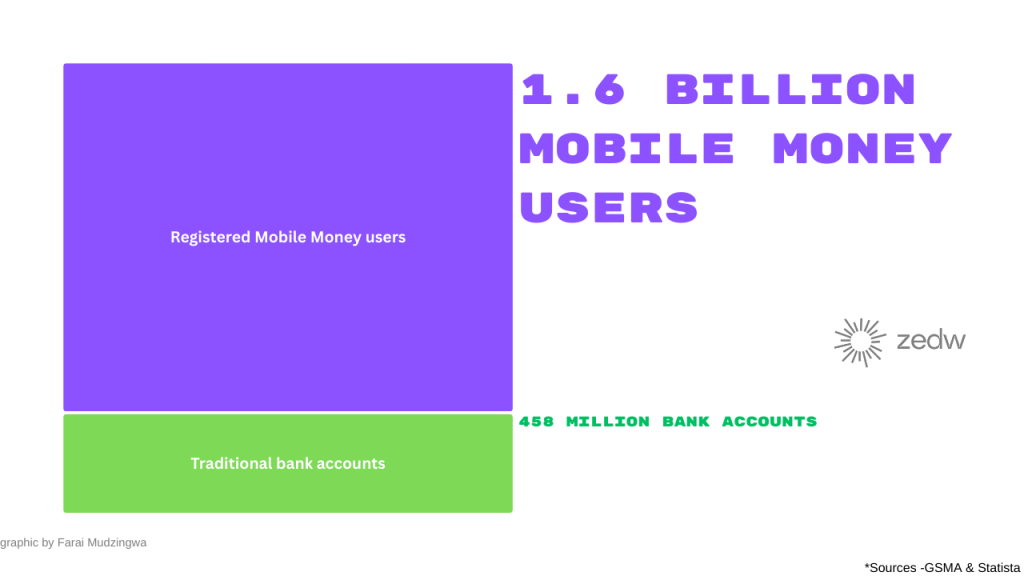

“Why not do all this on their own?”, is something you may be wondering. MasterCard chose to partner and chose mobile money over banks because of the technologies far-reaching impact in Africa:

“The number of people with mobile wallets is an order of magnitude above those with bank accounts”

Raghav Prasad, MasterCard’s Division President for Sub-Saharan Africa

Before the Airtel and MTN acquisition, MasterCard executives previously mentioned that their biggest competitor in Africa was cash and not other financial institutions. This thought process is clearly what informed the deals that have followed since with mobile money being one of the bright sparks that have shown glimpses of how a cashless economy might manifest on the continent.

Additional context

There are other interesting points to consider with this acquisition. Having mentioned that MasterCard will gain access to more knowledge on African customers – it’s also likely that MTN will also have a few things to learn. Thus far the bulk of mobile money’s use cases have taken the nature of person-to-person transactions. Going forward, MTN will have additional access to knowledge around person-to-merchant transactions which are the forte of MasterCard.

MoMo (& AirTel Money) might also be able to get preferential pricing to access MasterCard’s payment rails. This could potentially see MasterCard charge them lower payment processing fees for existing services (e.g the Virtual MasterCard) in order to gain market share on the continent.

All things considered, the acquisition by MasterCard seems to align pretty well with what the financial giant has previously stated as its goals on the continent. MasterCard initially acquired a smaller player in the mobile money market when they bought into Airtel in 2021. Acquiring the largest player in the mobile money market two years later suggests that the first deal has only reinforced their faith in the expansion opportunity…

Cover image credit – Pixabay/Pexels