The Zambian telecommunications sector has undergone significant development in recent years, with the number of base stations increasing, mobile data usage soaring, and the fixed internet landscape evolving. This article will explore the key players in the sector, as well as the trends that have shaped the industry over the past decade.

Infrastructure Development

The number of base stations in Zambia stands at 11,987 in 2022 with a steady uptick from 10,574 in 2020 This translates to an internet penetration rate of 101.2%, a vast improvement from 73.2% in 2012.

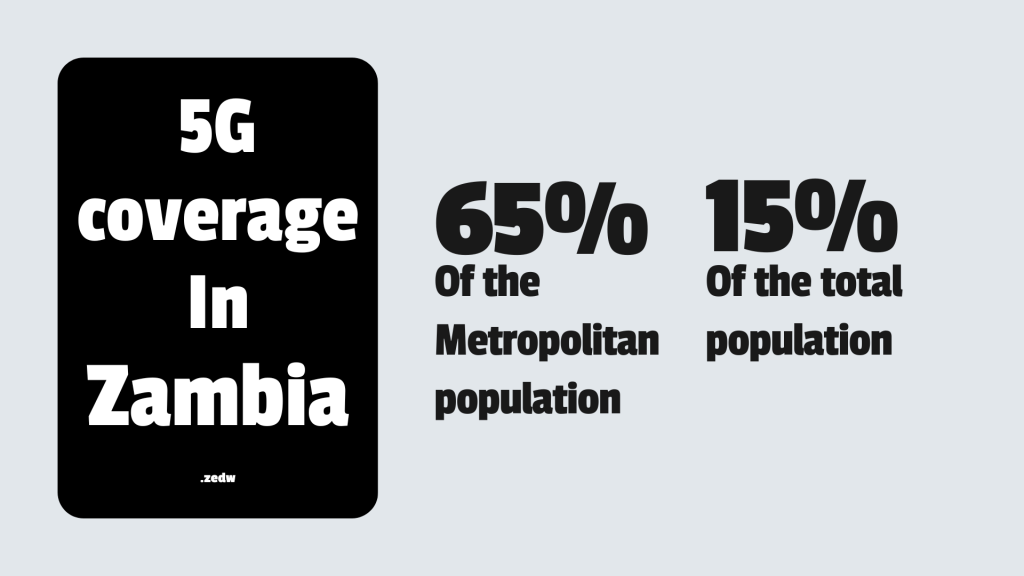

In November of 2022, MTN Zambia launched a 5G network that covers 65% of Zambia’s Metropolitan and urban areas as well as 15% of the Zambian population. In areas that include Lusaka, Kiwe, and Ndola, MTN plans to have 100% 5G coverage by mid-2023.

The Players in the Sector

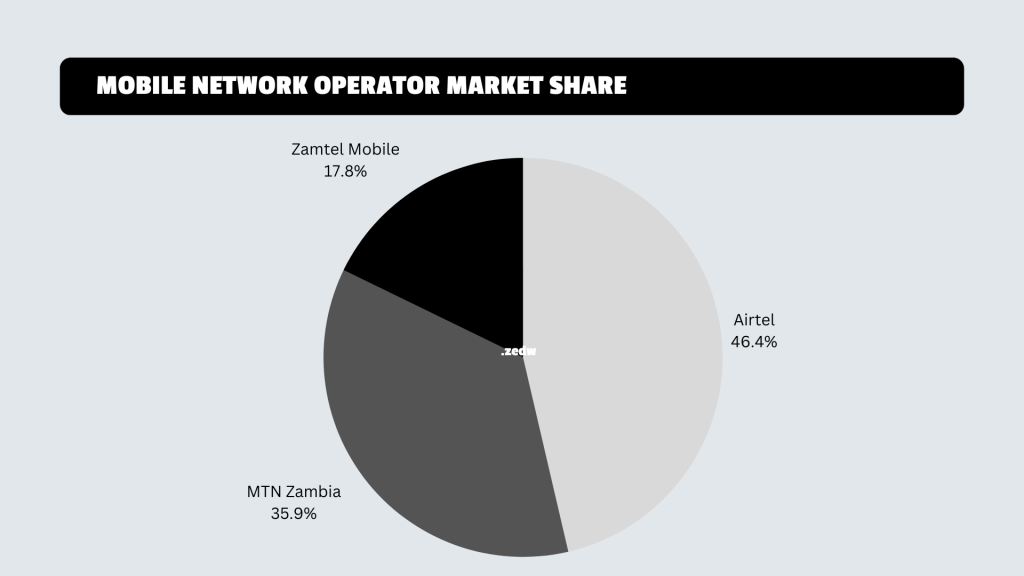

The Zambian telecommunications sector is dominated by three mobile network operators (MNOs): Airtel Zambia, MTN Zambia, and Zamtel Mobile.

Airtel Zambia is the largest MNO in Zambia, with a market share of 46.4%. MTN Zambia is the second-largest MNO, with a market share of 35.9%. Zamtel Mobile is the third-largest MNO, with a market share of 17.8%.

In addition to the MNOs, Fibercom (ZESCO), Liquid Intelligent Technologies, Zamtel, Airtel, and MTN have extensive optic fiber networks across Zambia with an estimated total of 24,102km of fiber networks.

Fibercom retained the most extensive fibre-optic network coverage in the country extending to a total length of over 12,000 km with various international gateways. Liquid Intelligent Technologies owned significant fibre network with a total length of over 8,000 km. MTN and Airtel Zambia continued to collaborate on an underground metropolitan network in Lusaka while ZAMTEL retained its extensive network with access to several international

ZICTA 2022 Annual report

submarine cables.

Mobile Data Usage

Mobile data usage in Zambia has also increased significantly over the past 10 years. In 2012, the average mobile data user in Zambia consumed 100MB of data per month. By 2022, this had increased to 10GB per month. This growth in mobile data usage is being driven by a number of factors, including the increasing availability of smartphones, the growing popularity of online streaming services, and the increasing use of social media.

Fixed Internet Status

Fixed internet penetration in Zambia is still relatively low, at 0.52% of the population. However, small as it is, it was an increase from the 0.36% observed a year prior.

The installed fiber in the country increased from 7,385km to 24,102km, an increase of over 3x within a 10-year period mostly attributed to a host of new players which include MTN, Airtel, and Zamtel.

Fixed internet subscriber numbers have grown over the 10-year period with 15,842 in 2012 versus 86,400 in 2022. Fixed LTE and 5G has been the biggest accelerator of this growth. They are cheaper to set up as opposed to Fiber. Bandwidth consumption stands at 61,000 Terabytes for 2022 which is close to 3x the consumption in 2019.

Postal Inflows and Outs

Postal inflows and outs in Zambia have declined over the past 10 years. This is due to a number of factors, including the increasing use of electronic communication, the decline of the traditional letter-writing culture, and the poor state of the Zambian postal service.

Postal operators in 2012 stood at 9, a figure that has grown to 71 in 2022. Whilst the postal inflows for mail have decreased, an increase in e-commerce has also demanded an increase in courier services.

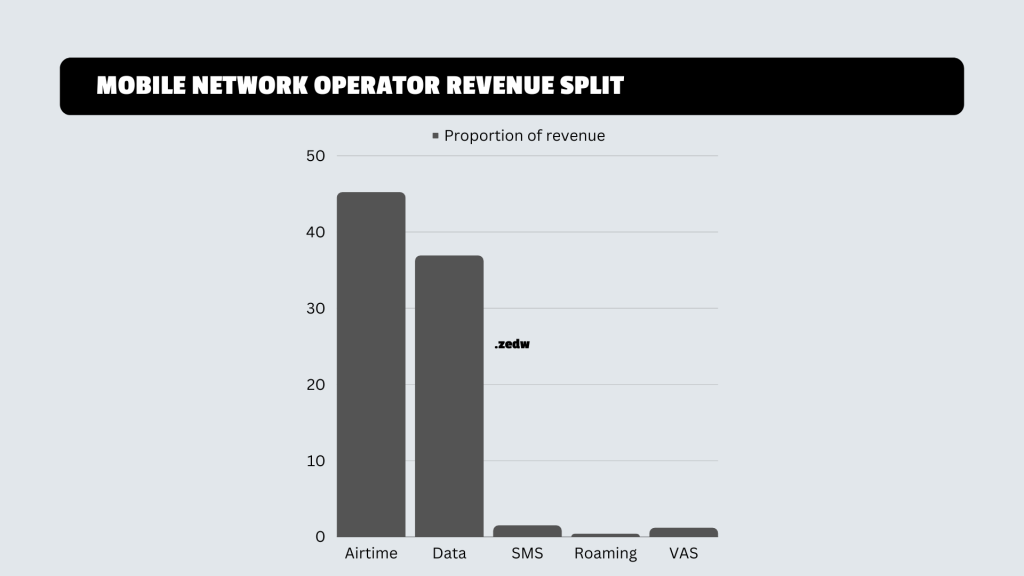

Proportion of Services Earnings for MNOs

The proportion of services earnings for MNOs in Zambia has shifted over time. In 2012, voice services accounted for the majority of MNOs’ earnings. However, by 2022, mobile data services had become the main source of MNOs’ earnings.

Airtime sales accounted for the biggest proportion of operator revenues at 45.2% closely followed by data at 27.5%. Data contributions experienced the biggest rise of any other service at 9.4%.