In late November 2022, Chipper Cash announced they would be acquiring Zambian Fintech service provider Zoona, signalling Chipper Cash’s intention to expand into the SADC region. Laura Kennedy, Chipper’s VP of Corporate Development at the time mentioned that the deal would accelerate the startup’s expansion across the continent and be used in product development.

2023 has been a quieter year on the expansion front for Chipper which gives us time to explore the Zoona acquisition along with what Chipper’s further involvement in the SADC remittance market could look like, the challenges they’ll face on the way and the size of the market they are entering…

Chipper Cash history

Chipper Cash founders, Ham Serunjogi and Maijid Moujaled believed there was a fortune to be made bringing transnational financial services to Africa’s people. Sending money between countries was extremely difficult and banking systems were very underdeveloped. The two met at Grinnell College in Iowa and came up with the idea for a money transfer app there, but wanted to acquire experience working in the tech industry first.

In the spring of 2018, Serunjogi texted Moujaled, who was working as a software engineer in San Francisco, to say it was time to get going… They launched a test version of their app in July 2018, letting customers send money from Uganda to Ghana for free. The cofounders took pitches to more than 50 VC firms until, in November 2018, 500 Startups agreed to invest $150,000.

By mid-2019 Chipper Cash was available in Uganda, Ghana, Kenya and Rwanda. It soon expanded to Nigeria, Africa’s biggest market with more than 200 million people, and by the end of the year, it had 600,000 customers. It also introduced a foreign-exchange markup fee of 2% to 5% to start generating revenue. In 2020, Chipper began to let users buy and sell bitcoin and ether, establishing a second lucrative line of business: trading fees.

Chipper Cash reached a $2.2 billion valuation in late 2021, with investment from firms including Sam Bankman-Fried’s FTX, Ribbit Capital and Bezos Expeditions. Transactions grew from $200 million in the first quarter of 2021 to $1.6 billion 12 months later.

Source: How Chipper Cash Made Banking Easier Across Africa And Became A Billion Dollar Company | Forbes/YouTube

At present Chipper Cash’s offers the following services:

- Payments – Remittance, chipper card, bill payments, airtime

- Investing – Crypto/Stocks

- Business – Network API, Chipper Checkout

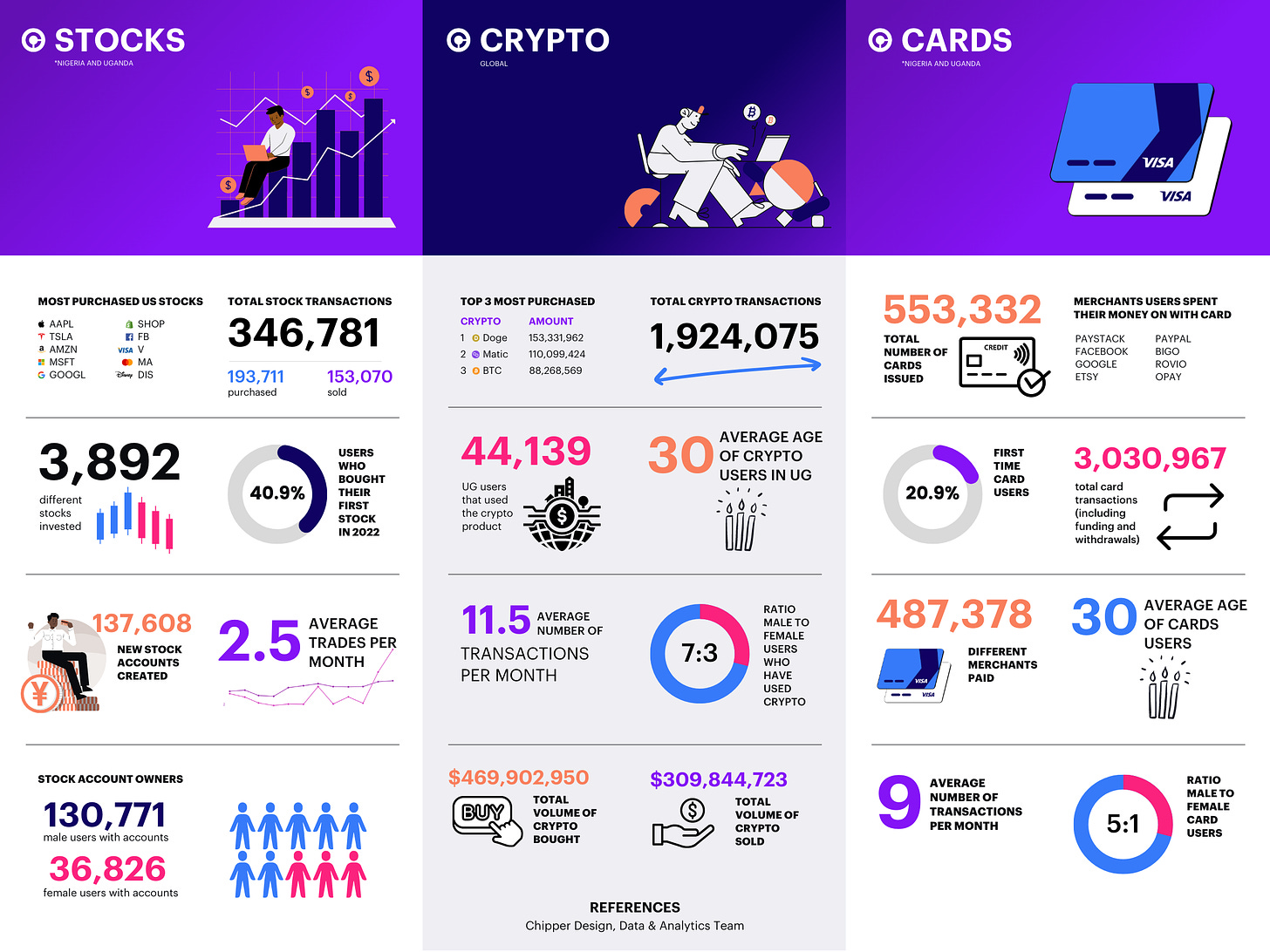

Below is an overview of how the fintech provider performed in 2022:

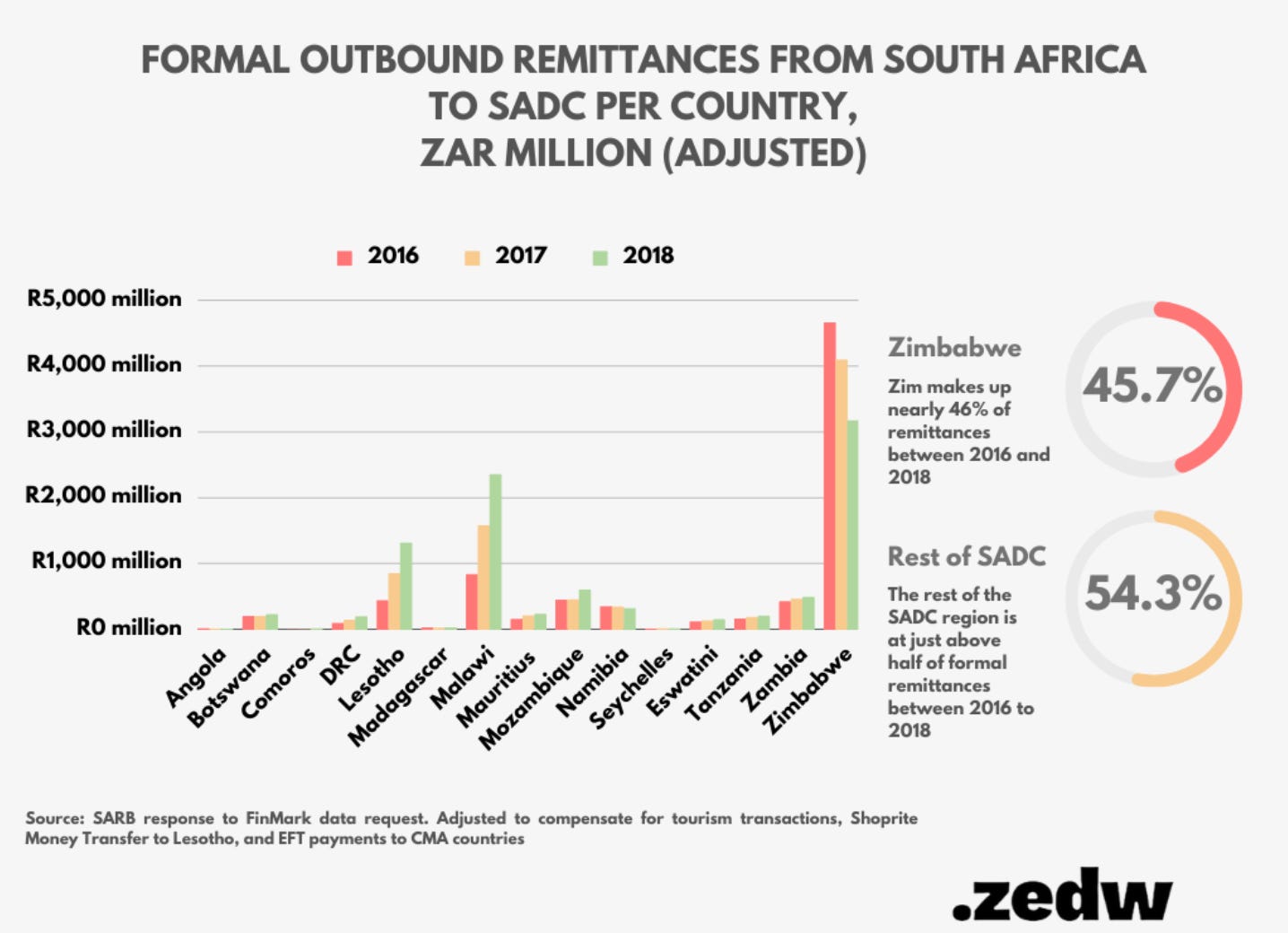

In 2021 Chipper Cash made their first inroads into SADC after moving into South Africa and allowing peer to peer transfers. We’ll explore this move a bit more but it’s important to also take a look at the regional domestic remittance market they entered once they got into South Africa (and then later Zambia)…

Remittance market in SADC

Across SADC’s 16 countries you have in essence, four types of formal remittance service providers (RSPs)

- Banks – financial institutions that are licensed and supervised by central banks or other financial regulators. They can offer remittance services as part of their broader banking activities, either directly or through partnerships with other RSPs.

- Money transfer operators (MTOs): non-bank entities that specialize in providing remittance services, usually through a network of agents or branches. They can be either international or local MTOs, depending on their geographic scope and ownership structure.

- Mobile network operators (MNOs): telecommunications companies that offer mobile money services, which allow customers to store and transfer money using their mobile phones. Some MNOs also offer cross-border remittance services, either directly or through partnerships with other RSPs.

- Other non-bank RSPs: entities that provide remittance services using alternative technologies or platforms, such as online platforms, digital wallets, prepaid cards, cryptocurrencies, or blockchain-based solutions.

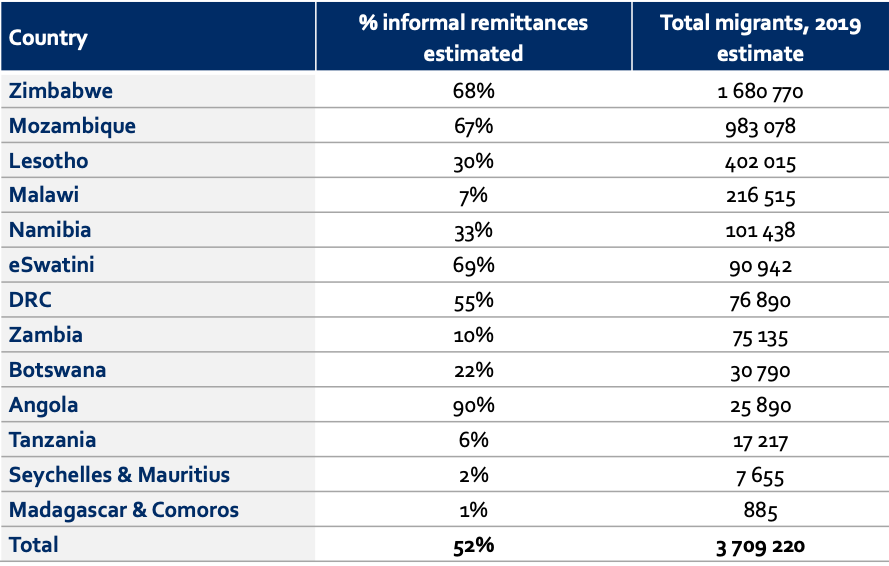

Whilst the formal remittances are important and have been rising in popularity, historically informal remittances have actually dominated the market. A 2021 report by FinMark Trust (FMT) titled South Africa to the Rest of SADC Remittances Market Assessment estimated that in 2019, 52% of remittances made within the region were made informally. The popularity of informal remittances is due to the fact that around 80% of SADC migrants are undocumented and are low-income earners which discourages them from transacting within formal systems.

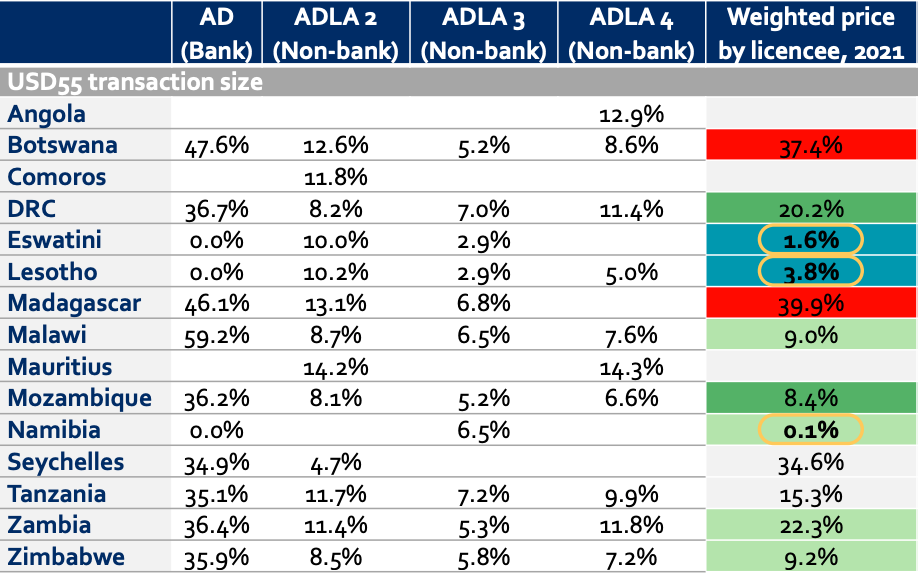

In 2018, the World Bank reported that the average cost of sending US$200 to SADC countries was estimated to be 12.64%, compared to the global average cost of 7.13% – heavily incentivising use of informal channels. (Sending money from South Africa to other SADC countries is even more expensive: the average cost to send US$200 from South Africa to other SADC countries was 17.08 percent with costs ranging from 13.47 percent in the South Africa–Lesotho corridor to 20.49 percent in the South Africa–Angola corridor.)

A fair bit of context here is that banks actually skew the picture because whilst they are way more expensive than their non-bank RSP counterparts (more than 10% lower according to the same World Bank statistics) they are the least used formal remittance channel meaning most consumers don’t get to interface with this extreme end of the charging spectrum. However, in a couple of countries (Botswana, DRC, Madagascar and Seychelles) whose financial systems are dominated by banks or with limited alternatives consumers are affected by this extreme band of charging (see image below).

FinMark Trust’s also published research on the cost of sending money within the region also backs up the World Bank’s view that there is work that needs doing in regards to lowering the cost of sending money.

Ultimately the high costs are a result of a number of demand-and-supply-side factors. We already explored low-income and limited financial inclusion which are some of the demand side factors together with low consumer awareness and limited financial education. That whole pool of missed remittances contributes to RSPs failing to reach economies of scale as formalised transfers are spread across fewer people. On the supply side there are several regulatory and infrastructure bottlenecks limit efficiency.

Regulation of remittance services in SADC

| Country | Commercial Banks | MTOs (independent) | MTOs (with licensed institution) | Non-bank RSPs |

| Lesotho | √ | √ | √ | √ |

| Madagascar | √ | x | √ | √ |

| Malawi | √ | √ | √ | √ |

| Mozambique | √ | x | √ | x |

| Namibia | √ | x | √ | √ |

| South Africa | √ | √ | √ | √ |

| Tanzania | √ | x | √ | x |

| Zambia | √ | √ | √ | √ |

| Zimbabwe | √ | √ | √ | √ |

The legal and regulatory framework for remittance services has considerable influence on the cost, availability, and accessibility of remittance services, as well as on the structure of the remittances market.

The Market for Remittance Services in Southern Africa | World Bank

Regulation of RSPs in SADC has regularly been brought up as adversely affecting the remittance market. Licensing for RSPs has traditionally been viewed as more favourable for banks with many non-bank RSPs in the region still required to partner with banks to offer remittance services. Madagascar is an example of a country with peculiar regulation as their Foreign Exchange Code mandates that cross-border remittance between residents and non-residents can only be made through commercial banks and the national postal service. This means throughout the country there are only 300 locations to access remittance services.

On the more positive side of things, South Africa in 2014 introduced a new category of licensing that allowed RSPs to operate independently. It’s not as widely adopted in the region but other countries (Lesotho,Malawi, Zambia, and Zimbabwe) also have regulation with similar concessions. All this has been to great effect as well:

A number of new and innovative money transfer operators (MTOs) have emerged in the SADC countries where the regulatory framework allows for MTOs to operate independently. The remittances market in the SADC region has largely been dominated by well-established MTOs, such as Western Union and MoneyGram. However, after several countries introduced regulations to allow for independent MTOs, new online- and mobile-based MTOs have emerged. In South Africa, four MTOs have since been licensed as ADLA Category 3 institutions: Exchange4Free, Hello Paisa, Mama Money, and South-East Exchange Company.

The Market for Remittance Services in Southern Africa | World Bank

With that not so brief context – back to Chipper Cash…

Chipper Cash’s entry into SADC

Given the backdrop Chipper Cash announcing its entry into South Africa was exciting, but it was clear there was going to be work to. It was exciting because there was a new player that would undoubtably add to the competition within the region but there were limitations because of the digital-first approach Chipper cash takes.

Chipper Cash requires South Africans using it to link it to their bank accounts. This has a couple of implications – Chipper Cash in South Africa only allows for peer to peer sending within that country and in addition if you’re not banked there’s no play for you here. Because South Africa has continent-leading banking penetration with 84.1% of adults having an account with a financial institution, Chipper Cash’s digital first approach was always going to feel right at home in South Africa so it made sense in that regard.

Another limitation with Chipper Cash’s current approach is that it allows them to participate in SADC’s biggest remittance market but they don’t get to access data on inbound or outbound remittances due to their local limitation:

Not participating in the SA-SADC remittance corridor means Chipper Cash gets to miss out on providing being one of the options used by migrants in South Africa sending money within the region. An estimated 55-70% of migrants in South Africa are believed to be from SADC countries. When we talked about regulation, we discussed how around 2013 there was a shift allowing for RSPs to provide services independently of banks. Chipper Cash took note of this following their launch with execs stating that the peer-to-peer money transfer space in South Africa was ripe for disruption:

Today in South Africa, moving money is still slow and costly, with transactions taking up to 48 hours to get to their destination and costing up to 2% to send. We believe sending money shouldn’t be costly or take days to receive…

Pardon Mujakachi | VP of Partnerships & Strategy, Africa

Chipper Cash’s acknowledges these shortcomings because they stated that this was merely a “starting point”. In fact, Chipper Cash had been indicating that by the end of 2021 they intended to enable inbound and outbound remittances from South Africa, but they haven’t done so yet. Perhaps that’s what informed their next move and what can be considered a truer entry point into SADC – The acquisition of Zambian fintech Zoona in 2022…

What does Zoona bring to the table?

Working together, we can combine our expertise to connect consumers and businesses across the continent, positioning ourselves as the first choice provider for financial services for the people of Africa. Zoona and Chipper share a vision to provide innovative and trusted payment and transfer solutions to customers in Africa. I can’t wait to see what the future holds for us as we look to bring our combined business, products and services to more customers.

Zoona co-Founder & CEO | Brett Magrath

Zoona entered the Zambian financial market in 2009, so they have a decade and a half of experience in the money transfer space in Zambia. Zoona is boots-on-the-ground remittance not digital first. Instead of requiring a mobile wallet Zoona relied upon a network of agents which to be fair continues to be an important point of differentiation in a region where mobile phone access gaps still exist. Being able to tap into all this experience could help Chipper Cash if ever they decide to transition from their digital wallet and banking model to something more traditional or a hybrid between the two.

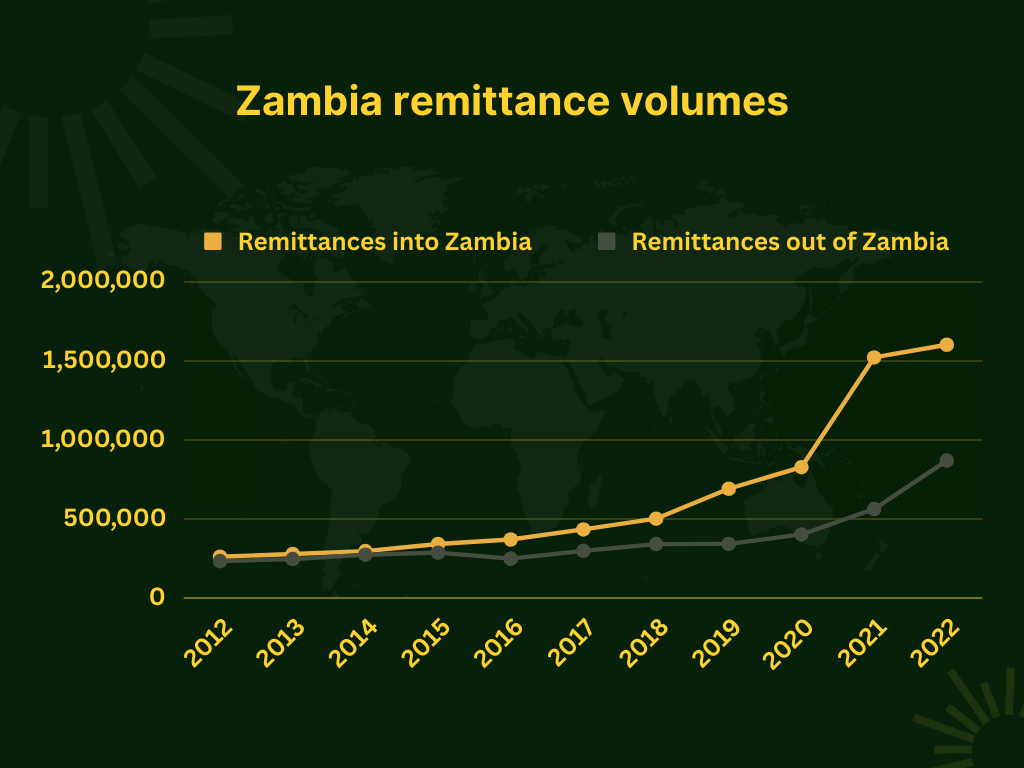

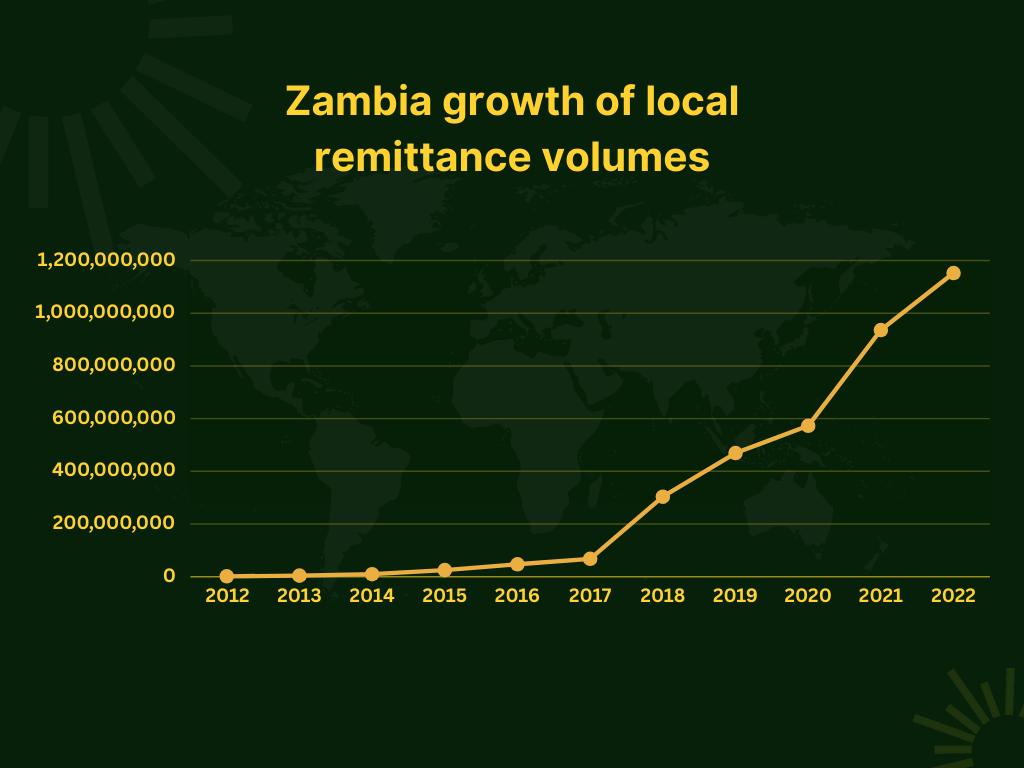

More broadly Zambia’s remittance market has been growing steadily over the last decade and will give any participant in that country important access to data from a number of other countries within the region since Zoona already has a presence in South Africa, Malawi and Mozambique as well (6 of the top 10 countries sending money into Zambia are within the SADC region).

It will be interesting to see whether Chipper Cash decides to continue expanding into the SADC region via mergers and acquisitions or if the startup will decide to build out their own hybrid – a combination of both digital wallets and the more physical elements we are presently used to going forward. I can see a reality where they expand their digital first offering in South Africa under the Chipper Cash brand but then use acquisitions to expand their presence in the rest of the region that requires a different approach from Chipper currently offers.