Only 6,000 out of the estimated 178,000 Zimbabwe Exemption Permit (ZEP) holders have made an application for a conventional visa for their stay in South Africa. This proportion represents 3.37% of the entire population of the Zimbabwean Diaspora on the Zimbabwe Exemption Permit who work, study and live in SA.

How this all came about because the South African government is seeking to regularise the status of Zimbabweans in SA. By doing this, they want to administer the immigration process for Zimbabweans through the visa system and not some instrument that operates beyond it.

According to reports, there are some who have already resigned themselves to returning back to Zimbabwe. However, the exact number is unknown… Although, from the figures of those who have applied for an alternate visa, at least at this point, it looks like there might be a mad dash to do it last minute or there may be a significant movement of people back to Zimbabwe if they choose not to abscond.

Whatever the case might be, there is the potential for a mass exodus which will affect a thriving industry both in Zimbabwe and in South Africa.

South Africa’s financial system benefitted from the Zimbabwe Exemption Permit holders

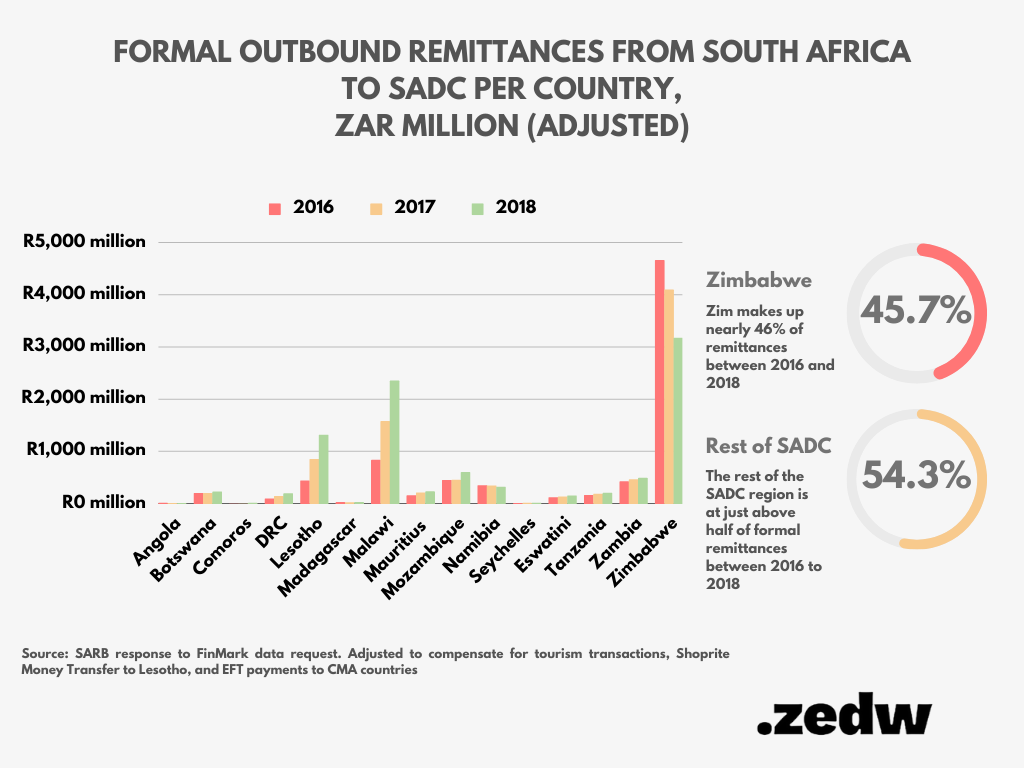

A consequence of the movement of people across Zimbabwean’s southern border to seek opportunity is the boom in the remittance business. Zimbabwe has been the largest send market in SADC from South Africa and that is something we talked about when we dissected that particular money transfer corridor.

MUST READ: The cash cow that is the SA to Zim remittance corridor

Data gathered by the South African Reserve Bank (SARB) between 2016 and 2018 showed that SA to Zim cross-border money transfers accounted for 45.7% (R11 billion of R26 billion transacted to the rest of SADC) of remittances sent from South Africa.

In the event that even half of the 178,000 people return back to Zimbabwe, the remittance business and the companies that rely on it will take a hit. It’s safe to assume that a number of those with the ZEP were individuals who had greater earning potential than those who had not been documented by South Africa’s Ministry of Home Affairs.

This notion is substantiated by the cost of paying for the ZEP in relation to the average earnings of a Zimbabwean in South Africa. The data that backs this up some by way of Prof. Makina who published the Profile of migrant Zimbabweans in South Africa study.

The information is over 16 years old at this point but is one of the few available resources to take a peek into the Zimbabwean Diaspora Community in South Africa.

However, what this data reveals, albeit with a pinch of salt, is that the earning potential of Zimbabweans in South Africa is not at the level that many of them would be able to afford the ZEP, which is saying nothing of many who crossed the border, and continue to do so, without any documentation.

Moreover, this would suggest that many of those who have chosen to return were banked individuals because the Zimbabwe Exemption Permit did allow Zimbabweans to open accounts in SA.

So... some simple maths in this equation is that we will see a depression in remittances through the South African corridor because of the potential subtraction of participants.

The two questions that come up now are, who will feel the perceived exodus more? And how much will remittances through the SA to Zim corridor fall by?

Who will be the losers in the financial sector?

ADLA Licence Holders

Authorized Dealer Limited Access (ADLA) Licence holders, like Mukuru, Access Forex, Hello Paisa and Remittance Service Providers might be the least affected by this change because there are lighter KYC requirements for sending money through them.

Authorised Dealer in the table above refers to Banks.

If we take Mukuru for example, it has three tiers to send money through its system and the lightest only needs a Passport or ID. There is, however, a caveat because the maximum you can send through Mukuru on its "lite" arrangement is R2,000 per month (approx US$118).

This would suggest that they will still be open for business to the litany of Zimbabweans who travel to South Africa every so often. They will also still play a pivotal role for those Zimbabweans who choose to go through the regular visa process and those who were compliant by default.

Bank-linked International Money Transfer Organisations (IMTOs)

This is the player that might be hit the hardest because they essentially rely on the banks to function. They can't compete with ADLA licence holders who now almost have a monopoly on the market.

Entities like Western Union, Money Gram and to some degree World Remit, don't fall under the ADLA category according to RemitScope's Report on South Africa. In saying that, the report noted that the above-mentioned were not substantial players in the SA to Zim corridor.

However, whatever role they played will be further diminished by the fact that ADLAs are far more accessible than they are and those who remain will continue using them.

The banks or Authorised Dealers

The sheer difference in cost to send money through banks across borders and the deals offered by ADLA operators.

So there is no real value proposition for anyone to use them because there are better more competitive options through ADLAs.

How much will remittances fall if permit holders leave en masse?

This is a difficult question to answer because up-to-date data from the South Africa Reserve Bank (SARB) is not easy to find. What we have currently is what was shared with FinMark Trust on the remittance outflows between 2016 and 2018.

However, it would be safe to assume that there will be a noticeable depression in remittances through the SA to Zim corridor if a hundred thousand or more Zimbabweans return. The extent of which will be something we will only learn in time because there are still scores of Zimbabweans who are in the regular Visa system and they will be active because of how central remittances are to taking care of those they left back home.