Banks on our continent have largely ignored informal traders. There’s a host of reasons for this but there has always been a sense of wonder regarding how a tech solution for Africa’s informal would work. That’s where Kazang enters… For over a decade now the company has been providing POS machines to informal traders in different African markets allowing them to resell prepaid services and accept card transactions.

How does Kazang work?

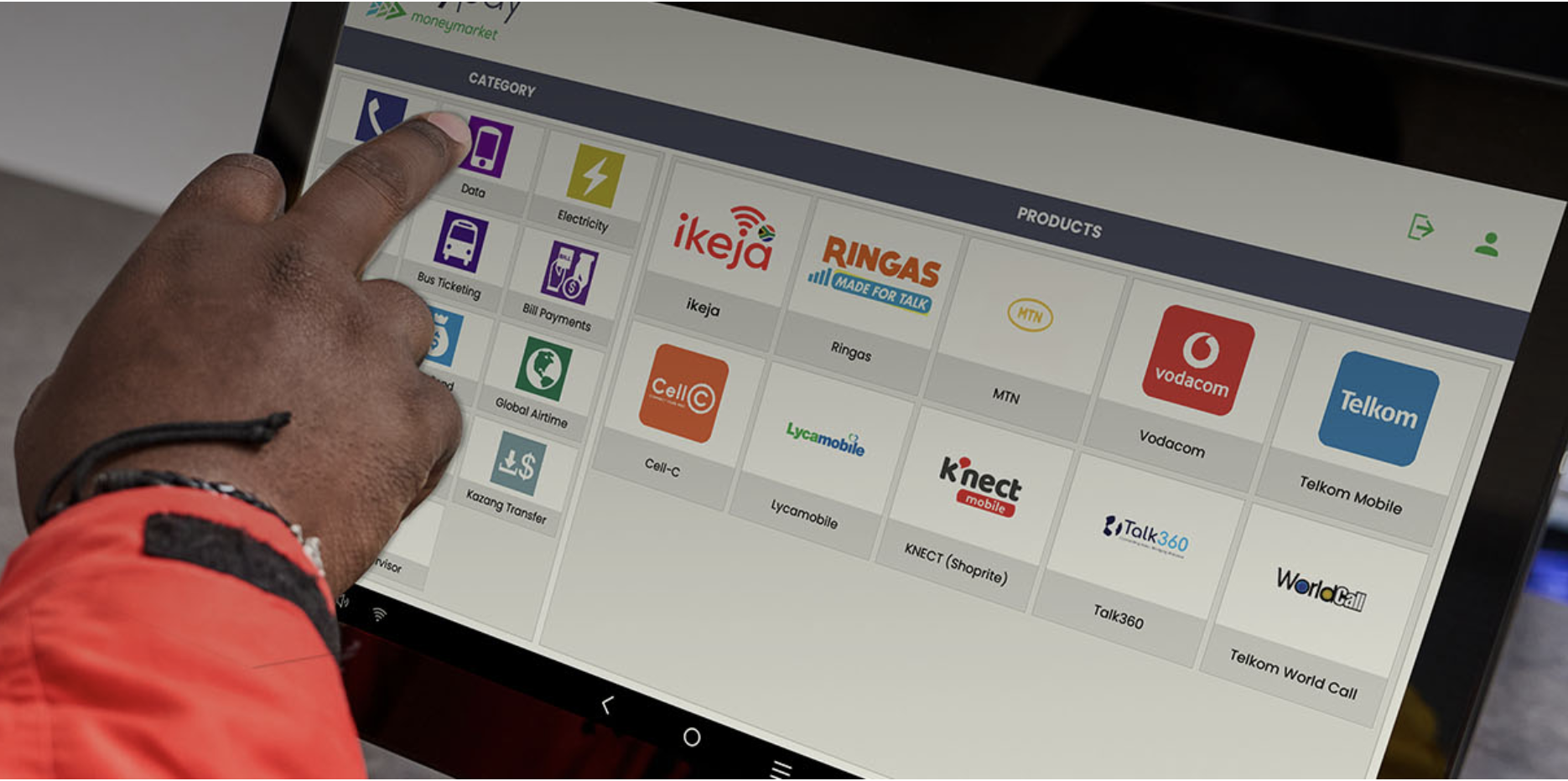

In the most basic of terms Kazang started off allowing spaza shops (informal convenience shop), traders and other entrepreneurs to resell prepaid products (think airtime and utility bills) for a commission split.

In order to be able to resell these prepaid services interested parties have to acquire Kazang POS devices or an application where all the magic occurs. If acquiring POS machines traders have two options:

- outright purchases which allows them to earn a high % profit split from day one or:

- they get the machine for free and have a lower profit split with Kazang until they pay off the cost of the POS device.

Kazang currently has presence in 4 markets, offering the following services:

| Products/Services | South Africa | Namibia | Botswana | Zambia |

| Airtime/Data | ✅ | ✅ | ✅ | ✅ |

| Water/Electricity bills | ✅ | ✅ | ✅ | ✅ |

| Wi-Fi vouchers | ✅ | |||

| Gaming (betting) | ✅ | ✅ | ✅ | |

| Local money transfers | ✅ | |||

| DStv payments | ✅ | |||

| International airtime | ✅ | |||

| International electricity | ✅ | ✅ | ||

| Bill payments | ✅ | ✅ | ✅ | |

| International money transfers | ✅ | ✅ | ✅ | |

| Entertainment (gift vouchers) | ✅ | |||

| Cashless payments | ✅ | |||

| Insurance | ✅ | ✅ | ✅ | |

| Mobile Money | ✅ | |||

| Agency banking | ✅ |

What makes Kazang so compelling to informal traders is that they have been traditionally overlooked by banks for a few reasons. Banking institutions feel informal traders do not process enough card transactions to justify the cost of the banks’ card machines. In addition informal traders are not regularised businesses and therefore aren’t compliant to receive most of the services banks offer.

These informal traders are in essence the market Kazang is moving to capture. It’s important to note that this is not an inconsequential market given that informal traders have a big presence in most of Africa. South Africa’s informal economy is estimated to be made up of 3.3 million businesses. Zambia isn’t far off with over a million informal businesses. Once we look at Kazang’s market penetration it becomes clearer why they still actually have a big opportunity to pursue…

Their reach across the region

Kazang metrics in South Africa:

- Since 2012 Kazang has managed to grow rapidly from 12,000 to 75,000 POS devices in South Africa;

- As of July 2023, Card enabled POS devices stood at 44,900 activated devices (98% Y-o-Y growth);

Kazang metrics in Zambia:

- Kazang has 15,000 POS devices in the region use;

- Currently, Kazang generates a monthly turnover of approximately US$1,9 million;

- processes more than 6 million transactions per month

- Kazang Zambia Limited reported US$21 million in revenue in 2020

Kazang is bringing people closer to products and services by making them more accessible, affordable, and convenient. By selling prepaid services at spaza shops and informal traders’ locations, Kazang is reaching customers who may not have access to formal outlets or online platforms. By providing a mobile app that can be used to sell prepaid services from anywhere, Kazang is also making it more convenient for customers who may not have time or transportation to visit physical outlets.

Integration & expansion

Naturally their ability to reach as many people as they do hinges on their integration with widely used services. As far back as 2013 Kazang was already integrating with remittance giant Mukuru. DStv payments for South Africa and Zimbabwe also went live that year. Given that at this time Kazang already had over 12,000 POS machines spread around South Africa it’s no surprise that they could integrate these players.

Beyond direct integration with service providers – Kazang has also grown its influence through acquisitions. Saicom – the parent company of Kazang at the time – acquired Bua Bua’s vending and payphone customer bases. This deal saw Kazang’s vendor base grow by 500 new vendors.

Many of the vendors that we have added through this acquisition are in the northern provinces of the country, specifically Limpopo, Mpumalanga and the northern half of Gauteng. It’s strategic for us to add more retailers in this area of the country where we have not traditionally had a strong footprint.

Martin Wright, Kazang Connect CEO

In 2017, Kazang also acquired a 49% stake in Sandulela Technology a prepaid electricity wholesaler. So their strategy has largely involved acquiring businesses that are already in a line of business they are in or acquiring companies to add on new services or expand on the options available for end consumers.

We’ll extend Kazang’s offering in informal rural and peri-urban areas by providing easy purchase of electricity and we’ll give even more small business owners a new opportunity to extend their businesses by becoming Kazang dealers in the municipal areas where Sandulela has been appointed. At the same time, we’ll be extending the customer base for Sandulela’s electricity providers.

Martin Wright

Interestingly, Kazang also used being acquired to expand their service offerings. Following acquisition by Lesaka in 2022, Kazang VAS was merged with the existing EasyPay bill payment solution to create EasyPay Money Market. This acquisition has been highlighted as what has allowed the company to offer services like gift vouchers or gaming tickets (i.e betting).

Outlook

In the mid-2010s it became apparent that relying on prepaid airtime as the driving force of the business would be problematic. This is because mobile network operators started making it much easier for consumers to buy airtime from mobile phones via mobile money:

The current business model utilised by Kazang has allowed it to grow a network of thousands of agents but has also made it quite reliant on mobile network operators, since most payments are airtime purchases. In a sense, Kazang is being pushed into new business lines as mobile network operators migrate their airtime top-up systems from third-party agents, like Kazang, to customers themselves, who are encouraged to top-up through their mobile money wallets.

Case Study on Kazang Zambia (2018)

Whilst the quote above may have been true in 2018, it seems Kazang has been mindful of this threat and has since diversified their services (as indicated by the table outlining services above). Spenn Technology which owns 60% of Kazang Zambia indicated the importance of remittances when talking about Kazang:

Kazang significantly increases our presence on the streets of Zambia, adding more than 10,000 agents and hardware terminals throughout the country. As a result, SPENN will become the biggest cash in and cash out distributer in Zambia. By integrating services, SPENN users will be able to deposit and withdraw money from any of the Kazang agents in Zambia, and we will also be able to integrate SPENN on the point-of-sales machines.

Jens Glaso, CEO of SPENN Technology

It’s natural that remittances are a potential key focus for Kazang in all the territories they operate in. Between 2016 to 2018, R26 billion worth of cross-border remittances were sent from South Africa to the SADC region. This is a huge market that Kazang will probably be fighting for going forward.

Beyond remittances, gaming (betting) is another high potential market that is growing in Africa. In South Africa alone, gambling revenues grew by 34% to R34 billion. According to a report by RandM, betting in Africa is expected to grow at a compund rate of 12% annually between 2020 and 2025 and reach $40 billion in revenue. That’s another huge and growing market that Kazang is already offering to customers.

This potential for growth is what led to acquisition of the Connect group (which owned Kazang) by Lesaka. They said as much in their 2022 investor report:

The acquisition of Connect significantly advances Lesaka’s vision and is truly transformational for the Company. The acquisition

adds significant scale to our legacy B2B offering, bringing 44,000 micro, small and medium enterprises into the Merchant business

segment. We expect the complementary product offerings to create significant growth opportunities by enabling us to address the

needs of approximately 1.4 million informal and approximately 700,000 formal micro, small and medium enterprises in South Africa.Connect has significant opportunities for continued growth within its current addressable market, estimated at more than ZAR

Lesaka 2022 Annual Report

100 billion ($6.6 billion), in merchant financial services for MSMEs in South Africa. Further, this addressable market has strong

secular growth due to MSMEs shifting from manual to digitized cash management and from physical cash to digital payment methods

The acquisition of Connect Group by Lesaka managed to turn the company around growing revenues from around R3 billion to R9 billion (with Kazang being highlighted as instrumental to this success. Ultimately though, the Kazang story is testament to the fact that you don’t have to go outside and build everything yourself from scratch. Companies can extend their reach by integrating with existing players, acquiring others or even being acquired…