Following our exploration of the evolution of Mobile Money in Zambia we thought we would look at other countries in the region taking the same approach. Our second destination is Malawi, a country that currently has an estimated 20.6 million inhabitants and saw mobile money introduced in the early 2010s.

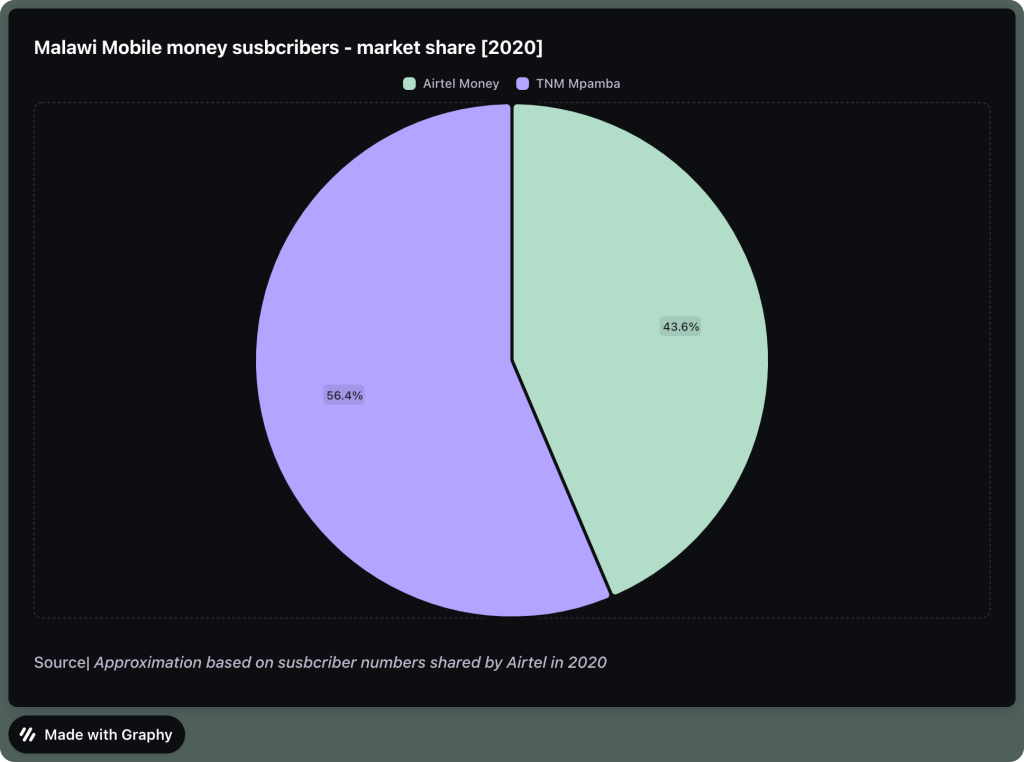

Malawi has two main mobile money service providers: Airtel Money and TNM Mpamba. Airtel Money is a subsidiary of Airtel Malawi, which is part of the Bharti Airtel Group, one of the largest telecommunications companies in the world. TNM Mpamba is a subsidiary of TNM (Telekom Networks Malawi), which is the first and largest mobile network operator in Malawi.

Airtel Money was launched in 2012 and TNM Mpamba was launched in 2013. Both services operate on a similar model, where customers can register for a mobile money account for free at any authorized agent, and then use their phones to perform various transactions. Customers can also link their mobile money accounts to their bank accounts or debit cards for more convenience.

Services offered by mobile money in Malawi?

Mobile money in Malawi offers a range of services, such as:

- Cash-in and cash-out: Customers can deposit or withdraw cash from their mobile money accounts at any agent location.

- Peer-to-peer transfers: Customers can send or receive money from other registered customers using their phone numbers.

- Bill payments: Customers can pay for various bills, such as electricity, water, TV, airtime, school fees, insurance premiums, etc., using their mobile money accounts.

- Merchant payments: Customers can pay for goods and services at participating merchants, such as supermarkets, restaurants, pharmacies, etc., using their mobile money accounts.

- Bulk payments: Customers can receive payments from organisations or employers, such as salaries, pensions, social benefits, etc., using their mobile money accounts.

- Savings and loans: Customers can access savings and loan products offered by partner financial institutions or microfinance organisations using their mobile money accounts.

Context

Before going into the evolution of Mobile Money in Malawi – I felt it would be important to share a bit of context comparing Malawi to some of its regional counterparts. To be specific, I used Mozambique, Zambia and Zimbabwe – partly because of proximity and partly because I assumed the countries would be similar, painting a surface level of the state of commerce and development in these countries with a particular focus on Malawi. This didn’t turn out to be true but the metrics measured still give decent context to Malawi’s present state to anyone who has been to any of these countries. I measured the following metrics:

- Percentage of population with cellular mobile connections;

- Percentage of population using the internet;

- Percentage of population earning below/above the poverty line;

- Percentage of population with access to electricity;

The chart generally makes for grim-reading – but the worst part is that Malawi is lagging behind its counterparts on every single metric. This is important context because I it will inform some of the trends we’ll get to talk about in regards to mobile money in Malawi.

Growth in mobile

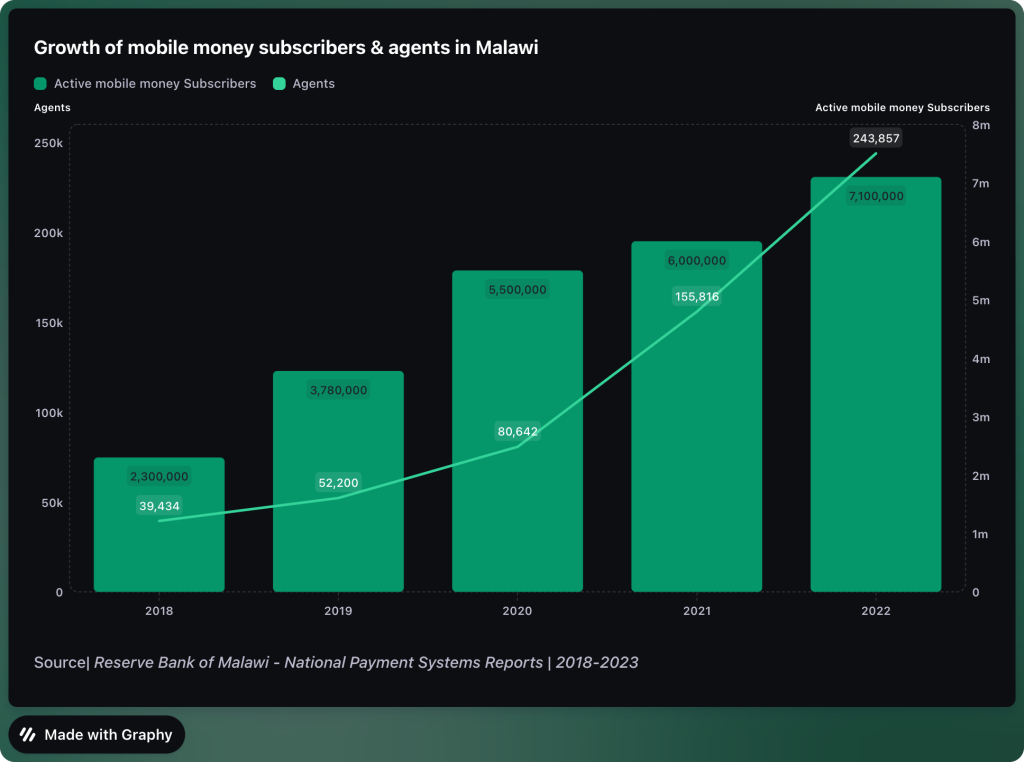

Over the last 5 years subscriber numbers and agent networks have grown steadily. In 2018 Malawi had 2.3 million active subscribers and 39,434 agents. By the end of 2022 that subscribers and agents had grown to 7.1 million and 243,857 respectively.

That means around 34% of the countries total population is now accessing mobile money. This is a significant gap between bank accounts which are said to be available to around 20% of the population despite being around longer. Mobile money tends to have lower barriers to entry than bank accounts, largely relying on the same infrastructure as mobile networks making it reach more parts of a country along with less KYC requirements than banks.

When we look at usage drivers it seems that ability to buy airtime continues to be the biggest use case application with 46.8% of transactions in Q2 of 2023 dedicated to this. The second most popular use case was sending money which made up only 7.9% of mobile money transaction volume. It’s no surprise that low value payments are more frequent but what did surprise me a bit was how low usage of mobile money was for merchant payments and bill-payments. These two payment categories only made up 2.6% of the value of all mobile money payments – COMBINED! That’s an alarmingly low figure and the Reserve Bank of Malawi (RBM) acknowledges as much:

It is therefore clear from the foregoing that there is a need for service providers to design products that would meet the specific needs of the customers as well as to intensify awareness efforts on the benefits of embracing mobile money for payment of goods and services and other third-party payments. This will ensure increased usage of mobile money services for a wide array of use cases as opposed to using cash and other paper-based payment instruments, which are bulky and prone to theft.

Reserve Bank of Malawi | NPS Report Q2 2023

Cash In/Out captured most of the value (46.8%) of mobile money transactions which makes sense considering than an estimated 80% of Malawi’s population is based in the rural areas. That suggests there is a high likelihood that these are remittance type transactions where people in urban areas are sending money to relatives in the rural areas.

RBM blamed the overall of diversity in mobile money use cases on access:

The retail payments segment however, continues to face challenges such as low participation of women in mobile money services and low awareness and sparse availability of access points in remote areas which affect adoption and usage of electronic payment products and services in the country.

RBM | NPS Report Q4 2021

The issue of access is obviously far-reaching. Whilst it’s easy to chalk it up to having more people use mobile money its clear that Malawi is lagging behind in many regards. The % of their population with access to mobile phones is lagging behind Zambia and Zimbabwe significantly. Simply put more probably needs to be done to put mobile phones in the hands of Malawians.

This extends to poverty as well – with an estimated 89.1% of the population estimated to be earning less than $3.65/day. If the people don’t have money – they can’t spend money. Whilst the RBM tends to suggest that mobile money providers need to innovate and raise awareness to incentivise usage, another argument is that the country needs to lift its people out of poverty as well to see more diverse use cases of mobile money.

That only 15% of the population have access to electricity is a problem as electricity tends to translate to functional mobile infrastructure. It’s safe to assume that the lack of electricity has an adverse effect on mobile money usage as downtime affects consumer confidence in services. The Reserve bank alluded to this inconsistency back in 2019 when discussing adoption of electronic payments:

Intermittent network availability was identified as one of the major factors affecting increased usage of electronic payment channels in the country.

RBM | NPS December 2019

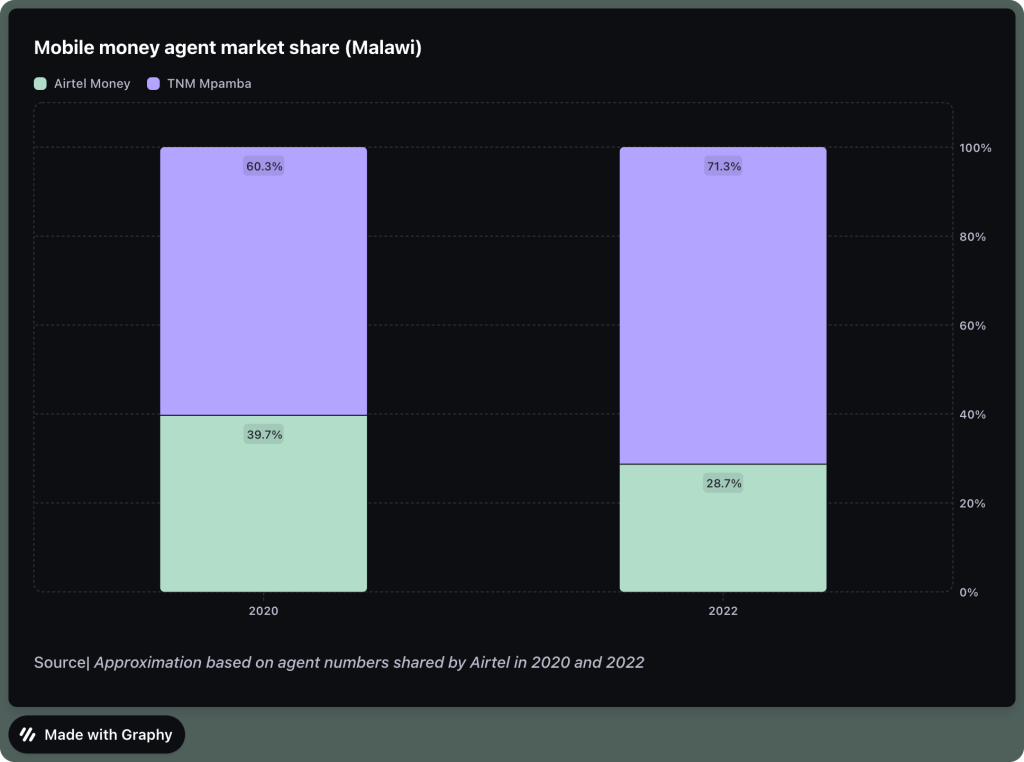

Agent networks

Agents continue to provide vital, in-person access to mobile money services. Over the past decade, the number of active agents has grown more than 10 times. As of 2021, there were 5.6 million agents globally and the 25 largest agent networks grew by more than 25 per cent on average from 2020 to 2021. Through these agents, customers cashed in and digitised a total of $261 billion.

GSMA | State of the industry Report 2020 – Mobile Money

Another big driver of mobile money growth are the agents whose growth rate has outpaced that of subscribers. In the last 5 years Malawi’s mobile money agent network has grown by 618%.

This is a net-positive since a vibrant agent network tends to correlate with growth on the subscriber side. Agents are critical to the growth of the mobile money as they perform crucial tasks like on-boarding and customer education meaning there is usually a correlation between agent growth and mobile money subscribers.

A triumph card of mobile money is that agent networks tend to also have more reach than banks in Sub-saharan Africa and this is true in Malawi. Malawi’s leading bank has 114 ATMs across the country – which is merely 0.05% of the number of access points that mobile money providers have.

The superior reach of agent networks is inline with trends across most parts of the continent with data from GSMA suggesting the density of the agent network reached a continental average of 228 active agents per 100,000 adults which was around 7x the reach of ATMs and 20x that of bank branches respectively.

There are some worrying trends regarding the agent networks and a big part of that is to do with the lopsided distribution of the agents.

Nevertheless, the distribution of agents poses a challenge as most of them are located in urban and semi-urban areas, leaving rural areas with fewer agents despite having a larger population (approximately 80 percent of the total population). Only 23.2 percent (66,050) of all agents are in rural areas, while the rest are in urban and semi-urban areas

RBM | NPS Report

As far back as 2016 – RBM noted that they and mobile money providers were “implementing measures targeting the rural masses to ensure meaningful uptake of mobile payments.” Without alluding to what these measures – it’s hard to actually track how effective they were. The distribution of agents seems to suggest most activity is still urban facing.

More recently, mobile money agents in the country have felt that the commissions are too low and have outlined protest plans. Tensions have been brewing since the service providers reduced the commission in September of 2022 and informed agents that they would not be reversing the decision. The agents have scheduled their protest for the 14th of November.

Outlook

There is room for mobile money to continue growing in Malawi when you consider active mobile money subscribers only make up around 60% of cellular connections. The recent unrest in the agent networks is something to watch though as it could slow down growth and activity. In 2020, Zimbabwe’s Reserve Bank banned mobile money agent lines briefly and mobile money usage and growth actually started reversing.

Featured Image by Godfrey Phiri | Pexels